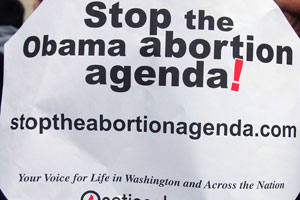

Flickr/<a href="http://www.flickr.com/photos/dogra/224874995/sizes/z/in/photostream/">dogra</a> (<a href="http://www.creativecommons.org">Creative Commons</a>).

Politico notes that House Republicans plan to follow up on health care reform repeal with a “more targeted attack”: the “No Taxpayer Funding for Abortion Act”, which Reps. Joe Pitts (R-Penn.), Chris Smith (R-N.J.), and Daniel Lipinski (D-Ill.) reintroduced this morning.

Politico says the bill aims “to prevent federal funding for abortion procedures” by codifying the Hyde Amendment, the restriction that has been attached to Health and Human Services appropriations every year since 1976, which prevents the use of federal funds to pay for abortions in programs like Medicaid. But almost every outside observer believes the bill (or at least the version of it that was introduced last Congress—I’m assuming there will not be significant changes) would do far more than that. Abortion rights advocates even say that the legislation could lead to the end of private insurance coverage for abortion. As I reported in a story last month:

Susan Cohen, the director of governmental affairs for the pro-abortion-rights Guttmacher Foundation, argued in a policy brief this fall that “the Smith bill would go…into uncharted territory” by preventing employers from taking a tax deduction for offering an insurance plan that covered abortion. (Like most other benefits, health insurance costs are generally tax-deductible for employers.) Analysts at NARAL Pro-Choice America and Planned Parenthood, the leading abortion rights advocacy groups, agree. According to abortion-rights advocates, Smith’s bill would create a huge incentive for employers to only offer health insurance that doesn’t cover abortion. Insurers would respond to what their customers wanted, and the percentage of health plans offering abortion coverage—currently 86 percent—would undoubtedly plummet.

While experts agree that Smith’s bill would have some impact on tax policies, not everyone buys the abortion-rights groups’ analysis. Timothy Jost, an expert in health law at Washington and Lee University Law School, says he agrees with the abortion-rights groups that the tax provisions in the Smith bill would mean that self-employed people and people with health savings accounts (HSAs) wouldn’t be able to treat abortions as medical expenses. But he doesn’t agree that the bill would prevent employers from deducting the costs of insurance plans that include abortion coverage. Nevertheless, Jost believes that “going after the tax subsidies that affect abortion” would represent a “substantial victory for the pro-life movement in America.”

Read the whole thing.