<a href="http://www.flickr.com/photos/imamhartoyo/8306555760/sizes/z/in/photolist-dE2gCC-dE21ZA-beP4C2-4eKFMz-FviPy-eq8ZZz-eq98d8-eq9hyt-eq9cXP-eq99Mv-er5wkL-eq9bet-eq95fX-er5hgW-er5m3j-eq992n-er5ueW-er5mPu-eq9fte-eq93Cp-2K8Ko-xQqp7-vZbAP-3KpJC-vuiNz-hfmSF-3Kte9-6rCoTd-69NReD-69NPM6-fFg8xn-4G5jsi-4DN3oH-beP3de-dReWMR-dReWZH-5eGg56-5eLE8f-5eGeVK-5eGfFH-5eGfqX-5eGfwx-5eLD3s-5eLCXo-5eLDmb-c3Yprb-gsdpZZ-aRCPJK-69NSez-69NTir-69SZr5/">Imam Hartoyo</a>/Flickr

After spending years trying and failing to win a global climate treaty, environmental activists have finally changed tactics. Instead of pouring all their efforts into passing doomed legislation, they’re picking big symbolic battles with the fossil fuel industry.

The campaign to derail the Keystone XL pipeline from Canada’s tar sands is just the start. On the West Coast, environmentalists have mounted a similar attack on the coal industry, which wants to reverse its steep national decline by exporting millions of tons coal to China. Green groups believe they can prevent the shipments (and keep the coal in the ground) by stopping the construction of huge new coal export terminals at ports in Oregon and Washington. “Based on our back-of-the-envelope calculation, the burning of this exported coal could have a larger climate impact than all of the oil pumped through the Keystone pipeline,” says Kimberly Larson, a spokeswoman for the Power Past Coal campaign, a coalition of more than 100 environmental and community groups that oppose the coal terminals.

Here’s what you need to know about the biggest climate change fight that you’ve probably never heard of:

Why are American environmentalists focusing on coal exports when we burn so much coal right here?

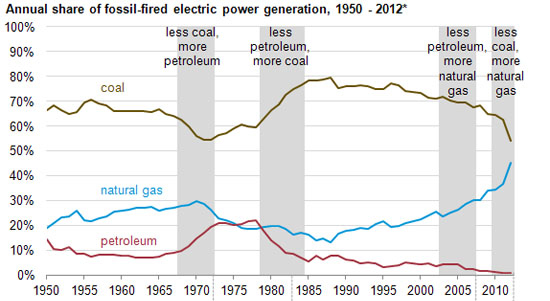

To be sure, lots of coal-fired power plants still operate in the United States, but they’re quickly being squeezed out of business by new federal standards for mercury, arsenic, and other toxins, which will take effect in 2016. Any new coal-fired plants must meet strict carbon emission standards—a virtual impossibility given the high cost of so-called “clean coal” technologies. And at any rate, the Environmental Protection Agency may actually be the least of Big Coal’s worries. As a result of the fracking boom in Texas, the Midwest, and Pennsylvania, the price of natural gas in the United States has fallen to below that of coal, and it is on track to overtake its dirtier cousin as the nation’s leading source of power generation:

So how much coal do we export?

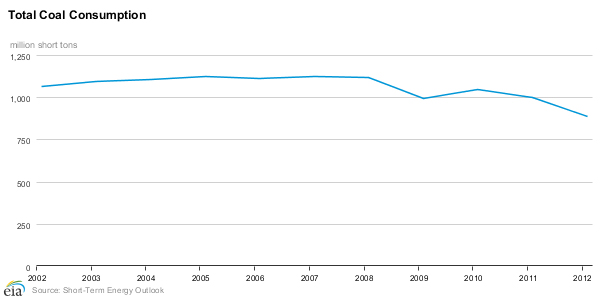

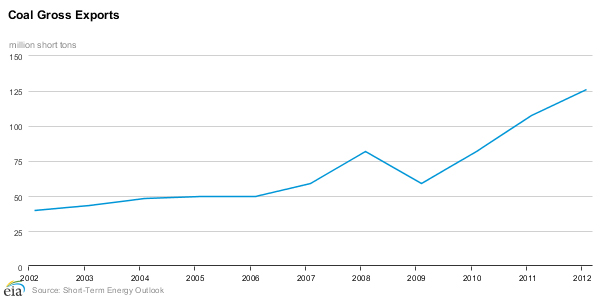

Last year, the United States exported 125 million short tons of coal. While that’s just a fraction of the 890 million tons that we consumed domestically, the exports are on a steep trajectory. Behold.

Who buys our coal?

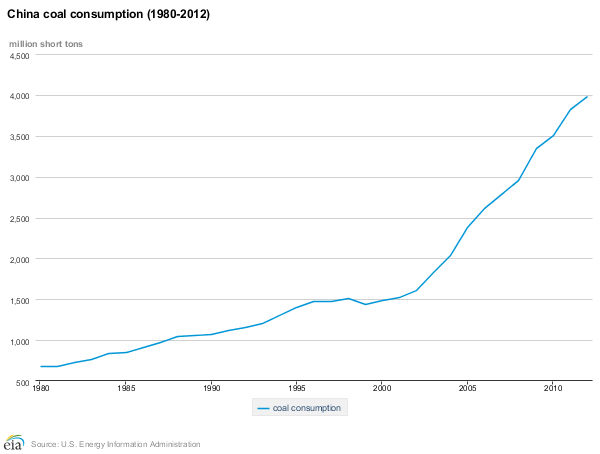

Canada, Mexico, and lots of European countries buy American coal, but our biggest single customer is China, which last year purchased 7.8 million tons from us. The People’s Republic already accounts for almost half of the world’s coal consumption, and demand continues to skyrocket for cheap coal-fired electricity to power its growing industrial parks and mega-cities:

But doesn’t China have its own?

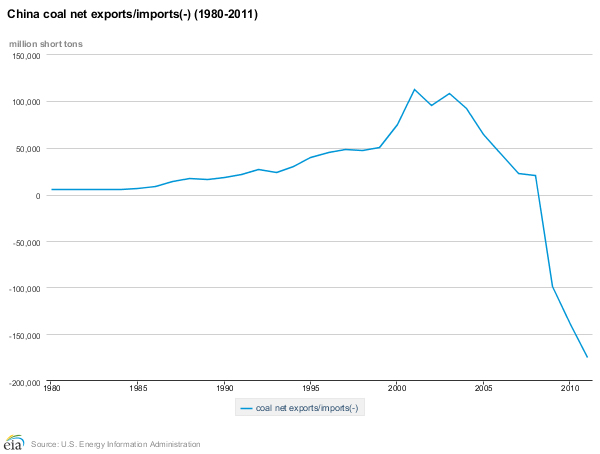

To be sure, China mines a lot of coal at home—more than any other country, in fact. But it’s not enough to meet its needs anymore. Around 2009, it switched from being a net coal exporter to a huge net importer. (See graph below.) Of course, China also uses electricity generated from natural gas, but it can’t get enough of it to slake its thirst for cheap power. Transporting natural gas requires pipelines or specialized tankers, making it much more difficult and expensive to import than coal.

What’s stopping US coal companies from exporting everything they’ve got to China?

Distance and transportation bottlenecks, basically. Last year, America’s leading coal-exporting state, West Virginia, shipped 27 percent of its coal overseas. A lot of that was metallurgical-grade coal bound for steel foundries in China. Yet West Virginia faces stiff competition in China from Australia, the largest producer of metallurgical coal, which benefits from much lower shipping costs. “It’s going to be a tough time for coal, and it’s going to be a tough time for West Virginia,” Michael Zervos, the CEO of United Coal, told the Charleston Daily Mail in July.

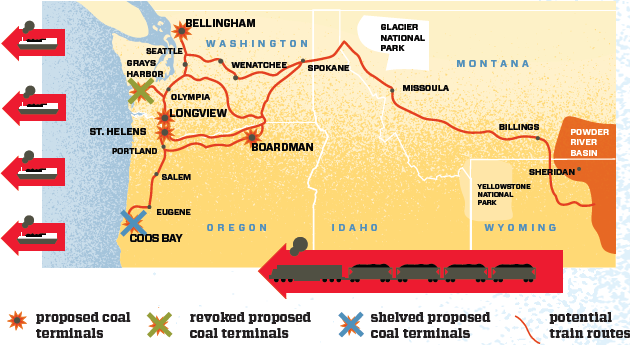

In order to compete in China, the US coal industry is reorienting itself toward the West Coast. The nation’s two largest coal companies, Peabody Energy and Arch Coal, want to strip-mine vast reserves in Wyoming and Montana’s Powder River Basin, then ship the coal by rail to ports in Oregon and Washington, where it would be loaded on cargo ships bound for China. But the ports lack the capacity to move that amount of coal cargo. In 2011, just 7 million of the nation’s 107 million tons of coal exports left the country via Pacific Ocean ports. The coal companies want to change that by building the following new export terminals:

How much coal could be exported from these terminals?

Up to 123 million tons—an amount equivalent to all US coal exports last year.

How is the coal industry selling its plans to the public?

As huge economic stimulus projects. For example, boosters of the proposed $700 million Gateway Pacific Terminal in Bellingham, Washington, predict that the terminal will generate $140 million in annual economic activity, create an estimated 4,400 jobs during construction, and support 1,250 permanent positions at the docks and in associated professions.

The industry also argues that the environmental impacts of the terminals are overblown—and some experts agree. Sending American coal abroad will increase coal prices at home, hastening our transition to cleaner energy sources, argues Stanford economist Frank Wolak. China will burn coal no matter what; it doesn’t have any other low-cost options, he adds. So if somebody is going to sell coal to China, Wolak contends, it might as well be a country like the United States that can produce electricity from cleaner sources.

What do environmental groups think about the potential impacts?

Environmental groups aren’t buying Womack’s theory. “Not long ago, US demand for electricity was seen as totally inelastic, rising in lockstep with gross domestic production, but that is no longer true,” points out Ralph Cavanaugh, codirector of the Natural Resources Defense Council’s energy program. Cavanaugh believes that keeping US coal off the global market indeed will push China towards cleaner options, such as boosting energy efficiency.

And climate change isn’t the only global impact of China’s coal habit. Sulfur, carbon, and other coal-related air pollutants travel from China across the Pacific, where they’re regularly picked up by air monitors in California, Oregon, and Washington. Emissions from coal plants also have led to a global rise in mercury contamination in fish.

The coal terminals and the trains that supply them are raising environmental justice concerns in surrounding towns. The heaviest and slowest trains in the railway industry, coal trains require more engine power than conventional trains. Their diesel and coal dust emissions will cause higher rates of heart and lung disease, cancer, and childhood developmental problems in communities near the tracks, activists argue.

And coal transport raises new safety concerns for the railroads. Coal and coal dust often falls out of train cars onto the tracks, where it can increase the risk of derailments. The slow-moving trains will create delays for emergency vehicles.

Green groups have been particularly concerned about the impacts of coal shipments on the Northwest’s sensitive marine habitats. A coalition of groups led by the Sierra Club has filed a federal lawsuit against BNSF Railway, a major shipper of Powder River Basin coal, accusing it of violating the Clean Water Act by letting coal spill from its trains into waterways. A report on the marine impacts of the Gateway Pacific Terminal in Bellingham notes that it would ship 974 loads of coal a year on vessels twice the size of oil tankers. An existing coal export terminal in Delta, British Columbia, releases more than 1.5 million pounds of coal dust each year—an amount that could be a potential “nail in the coffin” for a dwindling variety of Pacific herring that lives near the Gateway Pacific Terminal, according to a report by Power Past Coal.

Where can I find a list of the terminals, who is backing each, and their status?

Glad you asked…

1. Gateway Pacific Terminal

Location: Bellingham, Washington

Annual coal shipments: 53 million tons

Proposed by: Peabody Coal, SSA Marine, Goldman Sachs

Status: Initial environmental impact hearings completed. Now under environmental review by county, state, and national authorities. Cherry Point has become a major point of contention in a race for Whatcom County Commissioner.

2. Gray’s Harbor

Location: Hoquiam, Washington

Annual coal shipments: 5 million tons

Proposed by: RailAmerica

Status: Plans abandoned in August 2012

3. Millennium Bulk Terminals

Location: Longview, Wash.

Annual coal shipments: 49 million tons

Proposed by: Millennium Bulk Logistics, a subsidiary of Australian coal company Ambre Energy

Status: State and local authorities are conducting hearings to solicit feedback on what types of environmental impacts to consider.

4. Morrow Pacific

Location: Boardman, Oregon

Annual coal shipments: 7-9 million tons by barge down the Columbia River

Proposed by: Ambre Energy

Status: On November 1, Oregon’s Department of State Lands will approve or deny a permit for the terminal. The proposal would double barge traffic on the Columbia.

5. St. Helens

Location: St. Helens, Oregon

Annual coal shipments: 30 million tons

Proposed by: Kinder Morgan

Status: Kinder Morgan pulled plans for the terminal this past summer.

6. Coos Bay

Location: Coos Bay, Oregon

Annual coal shipments: 9 million tons

Proposed by: California-based Metro Ports

Status: Shelved. In April, Metro Ports allowed its lease on the proposed terminal’s real estate to expire.

How have state and federal authorities responded to the coal terminal proposals?

So far, the Washington Department of Ecology appears to be subjecting the ports to much broader and more detailed environmental scrutiny than other regulatory authorities. Its environmental review of the Gateway Pacific project will include impacts not just at the port, but along the entire route of the coal trains—as well as the climatological effects of burning the coal overseas.

Last month, the US Army Corps of Engineers announced that it was parting ways with Washington on a joint environmental review of the coal port. The Corps will now conduct a separate review that will only consider the terminal’s effects on the surrounding community and marine habitat, but not the emissions that will result from burning the coal in Asia. The move drew protests from environmental groups.

In Oregon, where environmental laws are generally narrower and less strict than in Washington State, authorities are subjecting the Port Morrow terminal to an environmental “assessment” rather than a full environmental impact statement. They have not announced plans to consider the project’s international environmental footprint.

Who will make the ultimate decision?

Given the controversy surrounding these projects, it’s reasonable to expect that any final decisions will be made by the guys at the top: Oregon Gov. John Kitzhaber and Washington Gov. Jay Inslee. But another wild card in Washington is the publicly elected commissioner of public lands, Peter Goldmark, who can unilaterally reject the terminals because they’ll be located on property overseen by his Department of Natural Resources. Goldmark is a rancher from the eastern Washington hamlet of Okanogan who also happens to hold a Ph.D. in neurobiology from Harvard. He declined an interview request from Mother Jones.

If the Washington and Oregon ports get blocked, what’s to prevent US coal companies from shipping it out of Canada?

Right now, the coal companies are trying to construct four coal terminals in British Columbia, but BC environmental activists are fighting back just as fiercely as their comrades in the States. In the unlikely event that all four terminals are approved, they will add just 31 million tons of annual coal export capacity—a fraction of what the industry wants to build here in America.

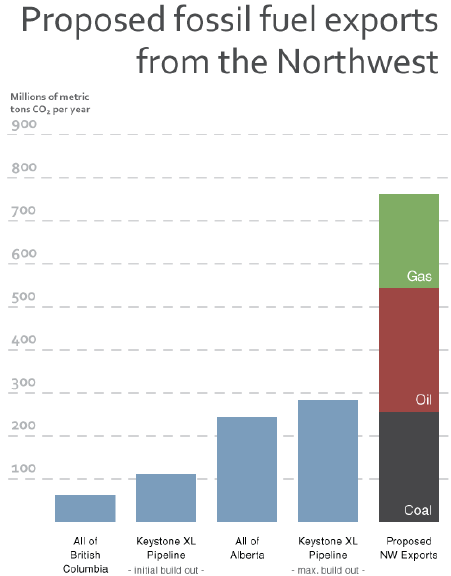

How much greenhouse gas could coal shipped from West Coast ports release into the environment?

Here’s an analysis from the Sightline Institute, which also includes the proposed terminals in Canada:

(The red and green bars mostly refer to Canadian gas and oil pipelines that would carry hydrocarbons from the tar sands.)

How dependent are the coal port plans on global coal prices?

Very. China’s slowing economic growth and efforts to diversify its sources of electric power have combined to cause a glut in the global coal supply. The window for Big Coal’s export plans may be closing on its own, but it could reopen if China’s economy improves.

What do people in the Northwest think about the coal ports?

A poll completed last month by the opinion research firm FM3 found that narrow majorities of voters in Washington (51 percent) and Oregon (54 percent) oppose the export terminals. Opposition has grown by double digits since last year, and those who oppose the ports feel much more strongly about the issue than those who support them.