Update, September 25, 2017: A US district court judge has sentenced Carlos Rafael to 46 months in prison, the Gloucester Daily Times reports. The judge said he needed more time to determine the legality of Rafael’s planned forfeiture of 13 of his vessels.

Update, April 3, 2017: As part of his guilty plea filed on March 30, Carlos Rafael agreed to give up 13 of his vessels.

Update, March 15, 2017: Carlos Rafael’s trial has been postponed until March 30, 2017.

The fake Russians met the Codfather on June 3, 2015, at an inconspicuous warehouse on South Front Street in New Bedford, Massachusetts. The Codfather’s lair is a green and white building with a peaked roof, fishing gear strewn across a fenced-in backyard, and the words “Carlos Seafood” stamped above the door. The distant gray line of the Atlantic Ocean is visible behind a towering garbage heap. In the 19th century, New Bedford’s sons voyaged aboard triple-masted ships in pursuit of sperm whales; now they chase cod, haddock, and scallops. Every year, more than $350 million worth of seafood passes through this waterfront, a significant slice of which is controlled by the Codfather, the most powerful fisherman in America’s most valuable seafood port.

“The Codfather” is the local media’s nickname for Carlos Rafael, a stocky mogul with drooping jowls, a smooth pate, and a backstory co-scripted by Horatio Alger and Machiavelli. He was born in the Azores, a chain of Portuguese islands scattered in the Atlantic. As a teenager in 1968, he emigrated to New Bedford, where he later took a job in a fish-processing plant. (More than a third of New Bedford’s residents have Portuguese ancestors; many can trace their heritage back to the days when Yankee whalers picked up crew members from the Azores during trans-Atlantic voyages.) Rafael rose to foreman at a seafood distribution facility and later founded his own company. He bought his first boat in 1981, and then another and another, until he owned more than 40 vessels, many christened with Hellenic names—the Athena, the Poseidon, the Hera. Local newspapers hung on his pronouncements, dubbing him the “Waterfront Wizard” and the “Oracle of the Ocean.”

The Codfather also ran afoul of the law. In the 1980s he was sentenced to six months in prison for tax evasion, and in 1994 he was indicted—and acquitted—for price-fixing. In 2011, federal agents confiscated an 881-pound tuna that had been illegally netted aboard his Apollo. “I am a pirate,” he once told regulators. “It’s your job to catch me.” Law-abiding rivals resented him and grudgingly admired him. “He has no compunction about telling you how he’s screwing you,” says one ex-fisherman.

By 2015, though, Rafael was 63 years old, with assets worth tens of millions of dollars, and he was ready to cash out. According to court documents, that January he let slip that he was selling his boats and dealership; five months later, three men appeared at his warehouse to negotiate. It was an unsavory trio: two members of a Russian crime syndicate and their broker. That was fine by Rafael, who swiftly divulged his business’ fraudulent underpinnings. Carlos Seafood, he said, was worth $175 million—more than eight times what he’d claimed to the IRS. To prove it, Rafael reached under his desk and procured an envelope labeled “Cash.” Each year, he boasted, he sold thousands of pounds of under-the-table fish to a New York dealer named Michael, who gave Rafael a “bag of jingles”—cash—for the contraband. “You’ll never find a better laundromat than this motherfucker,” the Codfather bragged.

Rafael’s fraud, which he termed “the dance,” was a triumph of vertical integration. The National Oceanic and Atmospheric Administration (NOAA) requires fishing boats to report the species and weight of their catch, among other information, each time they return from sea. Seafood dealers, meanwhile, have to submit their own reports detailing what they purchase from incoming vessels, which NOAA uses to verify fishermen’s accounts. Rafael, though, was exploiting a gaping loophole: Because he owned both boats and a dealership, he could instruct his captains to misreport their catch, and then he could falsify the dealer reports to corroborate the lie. A corrupt sheriff’s deputy named Antonio Freitas allegedly helped him smuggle the cash to Portugal through Boston’s Logan International Airport. (Freitas now faces charges for his role in the operation.)

As the Codfather described his fraud to his new acquaintances with glee, he seemed to catch occasional glimpses of his own carelessness. “You could be the IRS in here. This could be a clusterfuck. So I’m trusting you,” he said. Then again, he rationalized, the IRS wouldn’t be clever enough to use Russians as rats. “Fuck me,” he said. “That would be some bad luck!”

Indeed. The man posing as the Russians’ broker was Ronald Mullett, an undercover IRS agent. Over the next eight months, Mullett’s team built its case, repeatedly meeting with Rafael and the mysterious Michael in New York City. (According to the affidavit, that was Michael Perretti, a Fulton Fish Market dealer once busted for peddling bass illegally taken from polluted waters—though he hasn’t been charged for his connection to Rafael.) On February 26, 2016, federal agents arrested Rafael in a raid on his South Front Street warehouse, and in May he was indicted on 27 counts of fraud and other charges covering more than 800,000 pounds of fish. It appeared that the Codfather’s kingdom had come crashing down.

From Point Judith, Rhode Island, to Penobscot, Maine, Mullett’s affidavit received Zapruderlike scrutiny from industry observers. How could the Codfather have masterminded such a massive, undetected scam under the waterfront’s collective nose? New Bedfordians speculated about Rafael’s political connections, while environmentalists blamed neutered enforcement. To many fishermen, though, the crime’s roots ran even deeper, to a system that benefited empire builders like Rafael at the expense of small boats. Like farming, banking, and a host of other industries, commercial fishing has always been subject to consolidation and concentration, the accumulation of power and capital in the hands of a few at the expense of many. In some places, regulations have forestalled the process; in others, they’ve accelerated it. New England falls in the latter category: In 1996, about 1,200 boats harvested groundfish—that’s cod, haddock, flounder, and a suite of other white, flaky bottom-dwellers—from Connecticut to Maine. By 2013, that number had dwindled to 327. “Most of the boats just rusted to the dock, like looking at a graveyard,” says Jim Kendall, a seafood consultant and ex-fisherman. “More than anyone else, Carlos was big enough to survive.”

For centuries, unchecked overfishing had devastated the schools of cod that once teemed in the northwest Atlantic, and various rules had failed to stem the crisis. So in 2009, desperate officials voted to instate a new form of regulation, called catch shares. Under catch-share systems, biologists determine the “total allowable catch,” an inviolable limit to how many pounds of, say, flounder can be extracted annually from New England waters. Managers then divvy up slices of that pie to local fishermen, who are typically free to catch their slice—or sell it or rent it out to competitors—whenever they see fit. (Think cap and trade for fish.) When each fisherman owns a stake, the rationale goes, he has an incentive to conserve: The more fish in the sea, the bigger the pie and its slices.

Catch shares can make a notoriously risky industry safer and more profitable by letting fishermen capture their share when markets and weather conditions are most favorable. After catch shares came to the West Coast sablefish industry, captains cut down on fishing during perilously windy days. Research by Tim Essington, a marine scientist at the University of Washington, suggests that while the system doesn’t always create bigger fish stocks, it produces more stable populations and catch rates. “By ending the race to fish, that may allow our monitoring and science to keep up,” Essington says.

Today, catch shares cover about two-thirds of the fish caught in US waters, from red snapper in the Gulf of Mexico to king crab, the industry immortalized by Deadliest Catch, in Alaska. Catch-share programs have proliferated overseas, too, in developed countries like Australia, New Zealand, and Iceland and increasingly in developing ones such as Belize and Peru.

Yet for all the problems catch shares solve, the conversion of once-open fisheries to de facto private property creates plenty of new ones. Small-scale fishermen who receive tiny slices often have no choice but to sell out to larger competitors, who accumulate fishing power like agribusinesses devouring family farms. In some cases, “armchair fishermen” have funded their retirement by leasing out their quotas, turning lesser fishermen into sharecroppers who pay exorbitant rents for the right to work. “I know Alaskan fishermen who’ve moved to Arizona to play golf, and all they do is manage their catch-share portfolio,” says Seth Macinko, a professor of fisheries law and management at the University of Rhode Island and a former commercial fisherman. In the Gulf of Mexico, just 55 “sea lords” own the rights to three-quarters of the red snapper, while nearly 500 fishermen compete for the scraps. After part of the Atlantic clam industry switched to catch shares, a single company gobbled up 27 percent of the pie.

That consolidation isn’t all bad—after all, the presence of too many boats is often what caused overfishing in the first place. Still, most catch-share programs have rules to prevent concentration. No halibut fisherman in southeast Alaska, for instance, can own more than 0.5 percent of the pie. Other fisheries reserve slices for local communities. Still others require boat owners to go to sea with their vessels, preventing armchair fishermen from stockpiling shares.

But when the New England Fishery Management Council voted for catch shares in June 2009, such safeguards weren’t part of the plan. The program already promised to be a headache—it proposed to organize fishermen into groups, called sectors, that would split their cumulative groundfish shares among members. Sectors whose members had caught more in the past would receive larger slices, an arrangement that malcontents called “rewarding the pigs.”

The council had to sort out the details in a hurry: The 2007 reauthorization of the Magnuson-Stevens Act, a sort of maritime Farm Bill, mandated that all American fisheries establish catch limits by the end of 2011, and the Obama administration, a big catch-share booster, offered $16 million to help New England nail down a system. Setting accumulation limits would gum up the works: How many pounds of fish should one boat owner be allowed to acquire, how could the system prevent families from sidestepping the rules, and how should it handle fishermen whose holdings exceeded the bar? “Any kind of catch-share program should’ve come with meaningful consolidation caps, but the council punted that ball,” says David Goethel, a New Hampshire fisherman who sat on the council. “They had so much pressure to get this program done.”

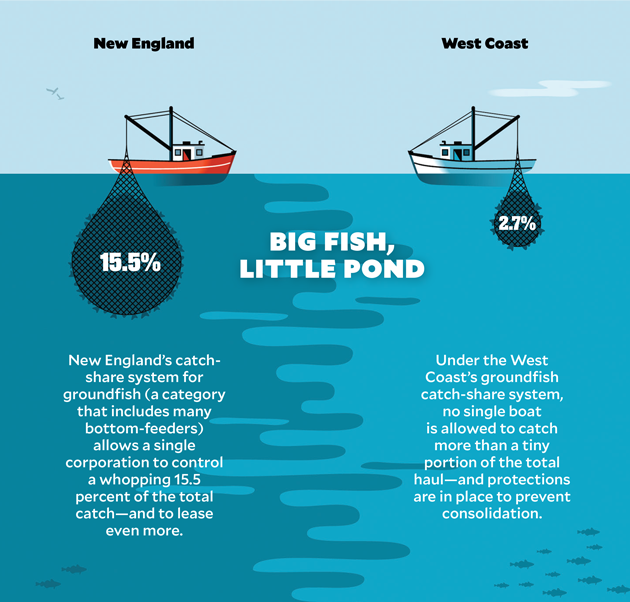

Other catch-share programs have taken pains to dilute fishing power: When the West Coast groundfish industry, long dominated by a giant company called Pacific Seafood Group, transitioned to catch shares in 2010, no boat was allowed to hold more than 2.7 percent of the total catch. After the program began, fishermen who exceeded that limit had to divest by 2015. But in insular New England, similar controls would have required busting up the Northeast’s most powerful fishing enterprise: Carlos Seafood Inc., the Codfather’s company. “He didn’t influence the process in an outward way,” says Goethel, the council’s sole dissenting vote. “But his corporation loomed over everything.”

When New England instituted its catch-share system, the Codfather was the big winner. Rafael’s initial slice was more than 12 million pounds, about 9 percent of New England’s total. Many small fishermen soon sold or leased him even more—some were eager to cash out, while others hadn’t received enough groundfish to make a living. By 2013, three years after the program began, the Codfather was raking in more than a full quarter of New England’s groundfish revenue. When a reporter from Vice visited the South Front Street warehouse that year, he found that Rafael had adorned his office with pictures of Tony Montana, the cocaine kingpin from Scarface. His aggrieved small-boat competitors, the Codfather said, were “mosquitoes on the balls of an elephant.”

And anyway, the new system, along with the disappearance of cod, took many of those small competitors out of the equation. In 2010, the first year of catch shares, more than 440 boats were catching groundfish in New England; by 2013, about 120 of those vessels had left the game. Although stringent catch limits aimed at rehabilitating cod stocks downsized the entire industry, small boats dropped out at around twice the rate of larger ones, according to federal reports. The poster child for disaster was Sector 10, a cluster of small-scale fishermen scattered along the coast south of Boston who received only a tiny slice of the pie. The collective’s groundfish revenue fell by more than half during the program’s first year. Some guys switched to other species, like lobster and squid, that weren’t subject to quotas; others dropped out. Some lost their homes. “Now there are some days when I’m the only boat out there fishing,” says Ed Barrett, a fisherman based in Marshfield, Massachusetts, and Sector 10’s former president. “It’s like, where the fuck is everyone?”

To be clear, the catch-share system didn’t create inequity—Rafael began swatting the mosquitoes decades before it came into play. But it drove the gap into “hyperspeed,” Barrett says. And while the Codfather’s scheme may well have predated catch shares—Rafael told Mullett he’d been conducting the dance for 30 years—consolidation can expand the scope of existing fraud, by dragging once-independent fishermen, and fishing access, into the orbit of a deep-pocketed cheater. In 2014, American Seafoods Company, the biggest player in Alaskan pollock, paid $1.75 million for skewing its scales to fool the feds. “Any industry is susceptible to corruption, and the lack of [controls against consolidation] is the Achilles heel of the groundfish quota system,” wrote the magazine National Fisherman after Rafael’s arrest.

And the program’s structure produced a new incentive to cheat. As you’d expect, fishermen are allowed to catch more of comparatively common species than rare ones. That can quickly become a problem: You might own a big slice of the haddock pie, but if your net happens to catch flounder, you must either stop fishing or rent more flounder quota from your peers. Rafael simply mislabeled the other kinds of groundfish as haddock, an abundant species for which he owned millions of pounds. “This is the shit we painted all week,” he told the IRS, pointing to his cooked ledgers. “See? Seven hundred…We call these haddock.”

New England’s lax enforcement created still more opportunity. While all West Coast groundfish boats carry government-paid observers whenever they leave port, just 14 percent of groundfish trips in New England are similarly monitored. The Nature Conservancy and others are experimenting with onboard electronic monitoring systems—cameras with GPS and sensors—that would supplant human overseers, but they’re years from implementation. And while the catch-share program originally called for dockside agents to prevent fraud, NOAA curtailed its efforts in 2010 after an inspector general report rebuked the agency for overzealous policing. The lack of enforcement frustrates Joshua Wiersma, the Northeast fisheries manager for the Environmental Defense Fund. “Unless we have effective monitoring, the odds that something like Carlos is going to happen again are pretty good,” he says.

In fact, something like Carlos is already happening again—and it’s still Carlos. In August 2016, with Rafael out of prison on a $1 million bond, his Lady Patricia was boarded by the Coast Guard for illegal fishing, according to an incident report. He’s also continued to acquire vessels. Because the Codfather has stashed control of his boats within a warren of companies all listed at the same address, it’s difficult to know exactly what he owns—but in June, his wife, Conceicao, purchased a new boat under the auspices of yet another company. The company’s name seemed to raise a middle finger at critics: Nemesis LLC.

Carlos Rafael’s arrest has, by most measures, upended New England’s fishing industry. To account for years of unreported catch, NOAA will likely recalibrate its population estimates, which could lead to further cuts to quotas. “The biggest victims are the fishermen themselves, the honest operations that are trying to make a living,” says Peter Shelley, the Massachusetts senior counsel at the Conservation Law Foundation. But if there’s a silver lining, it’s that Rafael’s arrest offers a giant reset button for a beleaguered fishery, an opportunity to redistribute the catch in a more equitable way.

On a steel-gray November morning, I drove down South Front Street, not far from the Codfather’s green warehouse, to meet a fisherman with a different approach to business.

I found Armando Estudante by his 120-foot boat, the Endurance. Estudante is a bowling ball of a man, with hands and wrists swollen by years of labor and a brushy gray mustache dangling over his upper lip. He moved to Massachusetts from Portugal in 1978 and purchased his first boat in the early ’80s.

These days, the Endurance fishes for scallops, shellfish that are managed by a different system. Estudante still owns a groundfish quota, but he leases it to other fishermen, often at below-market rates. “To have someone profit by staying at home while someone else goes fishing, to me, is a disgrace,” he said. “You remove the incentive for new blood to come into the fishery. That’s what you’re seeing here in the Northeast—who the fuck wants to go fishing? Because you have to pay rent to people that don’t go.”

Far better, Estudante said, to have a “boots on deck” rule that forces boat owners to run their own vessels. You don’t have to look far for an example, he added. Maine’s lobster industry is governed by such a provision and is famously self-regulating and sustainable. “It’s not such a radical idea,” Estudante insisted.

For some fishermen, though, transferable catch shares evoke Winston Churchill’s quip about democracy: They’re the worst form of fisheries management, except for everything else that’s been tried. Making the existing system more equitable—as some regions already have done—has long been the crusade of the Northwest Atlantic Marine Alliance, a Gloucester, Massachusetts-based group that advocates on behalf of small-scale fishermen and local seafood. NAMA’s efforts are spearheaded by Brett Tolley, a lanky, bearded descendant of four generations of Cape Cod fishermen. Tolley has spent years campaigning for systemic reforms that, among other measures to protect small boats, would include consolidation limits. In October 2015, he organized a protest in which dozens of irate fishermen stormed out of a meeting of the New England Fishery Management Council. But when the council finally published the long-awaited safeguards last year, it capped ownership at 15.5 percent of the total quota—far higher than many other fisheries, and too high to rein in even the Codfather. And while the new rules limit the amount of quota that fishermen can own, there’s no constraint on how many pounds they can rent from their peers. “To us, that’s a complete failure to deal with the problem,” Tolley says.

For all the angst that catch shares have caused, New England’s fishermen have bigger concerns. Cod, the fish that launched a thousand boats, hover at catastrophically low levels—5 percent of the target in the Gulf of Maine, and climate change is thwarting their recovery. Off-brand species like dogfish and black sea bass have flourished in New England’s warm new world, but they’ve struggled to find a niche in markets saturated with farmed salmon, shrimp, and tilapia. Resourceful small-scale fishermen have begun vending their catch through community-supported fisheries, launching co-ops, and peddling their wares directly to restaurants—approaches that have lighter environmental impacts than industrial fishing. Yet none of this has slowed the industry’s erosion. A Trump administration proposal to slash NOAA’s budget by 17 percent—including a 5 percent cut to its subdivision, the National Marine Fisheries Service—could make fishermen’s lives more difficult by impairing the agency’s ability to provide satellite weather forecasts and reliable fish population assessments. “You see small pockets of fishing boats here and there that make great backgrounds for postcards, but this business is collapsing, piece by piece,” says Scott Lang, New Bedford’s former mayor.

Although Rafael faced up to 25 years in prison and $500,000 in fines if convicted, no one expected the case to reach trial—and, sure enough, Rafael will plead guilty before a federal judge in Boston on Thursday, March 16. Yet many New England fishermen are less concerned with the Codfather’s fate than with the fate of his property. According to the indictment, Rafael may be forced to surrender the boats he used to commit his fraud—and the fishing permit and quota attached to each vessel. The disbursement of those forfeited assets will be contentious. Jon Mitchell, New Bedford’s mayor, has lobbied NOAA to keep the Codfather’s shares in his home port, arguing that innocent fishermen’s “livelihoods depend on the continuation of the business,” according to a local newspaper. In other places, environmental groups have swooped in to snatch up fishing shares and remove them from circulation.

Neither option sits particularly well with Brett Tolley, who advocates making the Codfather’s property available to the fishermen who have been most disadvantaged by regulations—small boats, for instance, or young people who weren’t grandfathered into the catch-share system. There’s precedent for such a “permit bank” concept: The Penobscot East Resource Center, an organization devoted to the rehabilitation of Maine’s flagging fisheries, owns two permits and leases out access to fishermen. Several states run banks, too. From the ashes of the Codfather’s empire could rise a more equitable distribution of the catch. “How do we protect fleet diversity? How do we prevent excessive consolidation? How do we ensure multiple generations of fishermen get access?” Tolley demands. “All communities have a stake in how this turns out.”

Hear journalist Ben Goldfarb talk about what it was like to report the story of the Codfather on the Mother Jones food politics podcast, Bite:

This article was produced in collaboration with FERN, the Food and Environment Reporting Network.