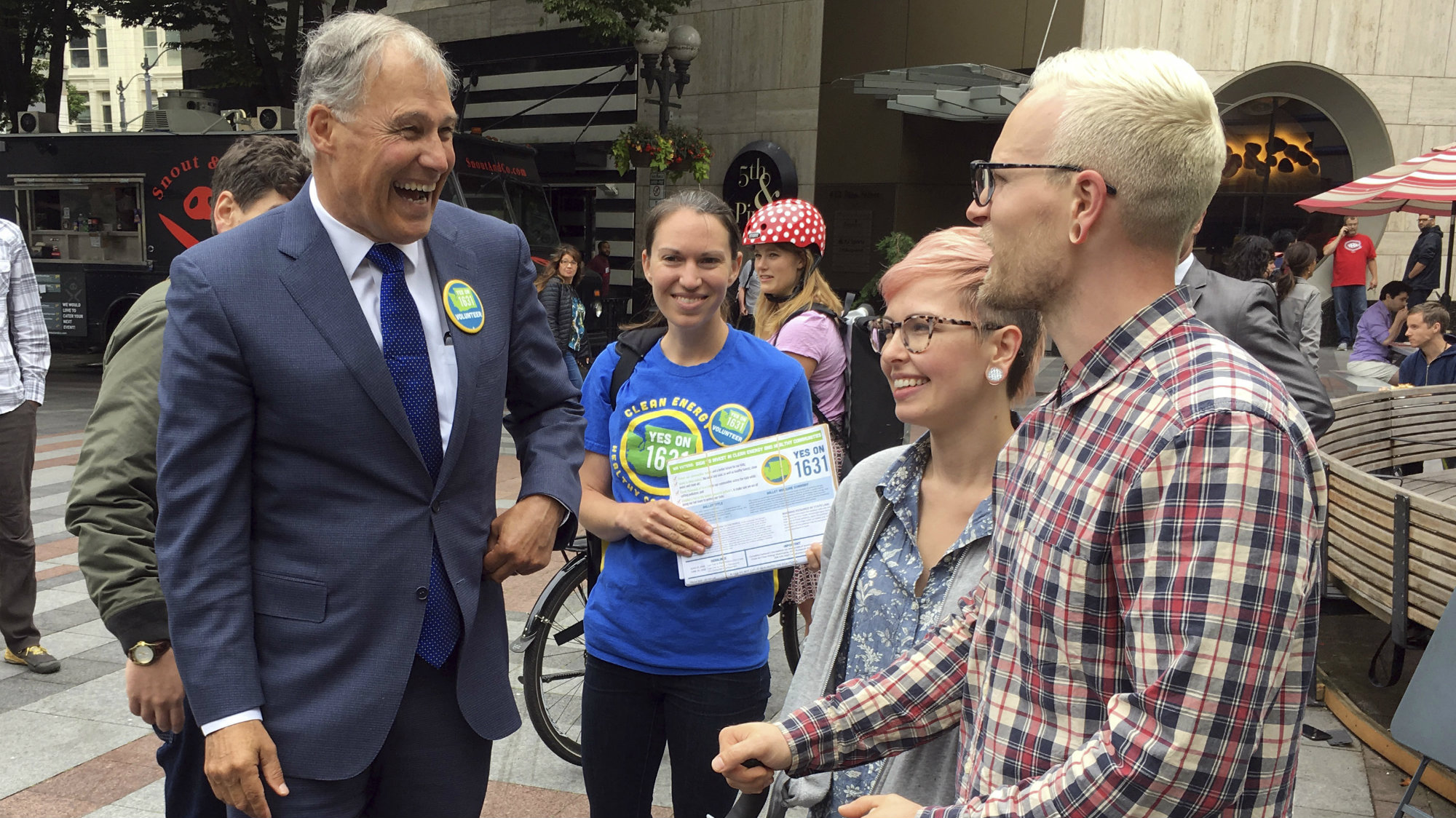

Supporters of a Washington state ballot initiative that would charge a fee on carbon emissions from fossil fuels rally in October. Ted S. Warren/Associated Press

This story was originally published by High Country News. It appears here as part of the Climate Desk collaboration.

Early on election night, as a drizzly dusk settled over Seattle, I made my way to the Arctic Club, a hotel decorated with explorers’ maps and a fake polar bear—a fitting place to await the results on Washington’s carbon tax initiative. Upstairs, in a dimly lit ballroom, community organizers and other supporters of the ballot measure had already gathered. Recent polls suggested a close call on the measure, officially called Initiative 1631, a local, political effort to address the global challenge of climate change.

This was the state’s second attempt to tax carbon emissions, and in the months leading up to the vote, an unusually wide swath of Washington society had turned out in support. A coalition of environmental groups, labor unions, racial and economic justice advocates, health workers and leaders from nearly two dozen tribal nations had designed the tax proposal, and their supporters, in a mix of work-wear, fleece and the occasional suit, filled the airless room. If people were nervous, it didn’t show. A few campaigners sat hunched over computers in the back corner, but mostly, it seemed, people were there to socialize. The line for the bar stretched the length of the room, and a bank of television screens on the far wall drew barely a glance as the evening progressed.

At 8:15 p.m., the buzz of conversation spiked, becoming a roar. “We did it,” a young woman standing next to me said. I checked the televisions: A few counties were leaning toward approving the measure. The room began to perk up. Daisy-chains of young supporters, linked arm-in-arm, wound through the crowd, their shirts proclaiming “Yes on 1631.” “This energy!” a man standing nearby exclaimed, surveying the clusters of people shouting enthusiastically about the results. “People who weren’t sure if they were going to win—that’s the best.”

The celebrations lasted a few minutes. Then a strange hush swept the room, rippling outward from the televisions. People pulled out their phones to refresh elections pages. A second wave of results had come in, and the tide had turned. By 9 p.m., Initiative 1631 was dead.

A few speakers got up to laud the hard work of campaign staff, and the room, which hadn’t quite lost its party feel, echoed with the murmur of people dissecting a loss that hadn’t sunk in. Then the speeches ended, and people began to leave, making their way to the city’s gloomier bars or pedaling home in the dark. As the room emptied, I stood there refreshing my own phone, wondering what had just happened, and what it might mean.

The failure of Washington’s carbon tax proved a dim coda to the state’s long fight to control rising temperatures and reverse their effects on its most vulnerable communities. Its demise raised big questions about humanity’s ability to address climate change. Yet its failure had seemed improbable. After all, in the months leading up to the vote, climate change made its mark on much of Washington life. Over the summer, a ragged line of wildfires scorched the Northwest, curling from British Columbia through eastern Washington and down to Oregon. Wheat fields and forests burned and towns throughout the region were choked with wildfire smoke. In Seattle, people halted their daily runs and commuters wore masks to work, as an orange murk hid the hills of the suburbs and clung to the Space Needle. In August, a mother orca lost her calf, then carried its body on her nose for 17 days, a painful reminder of species loss and habitat degradation. In the fall, many of the state’s largest salmon and steelhead fisheries closed, from the Yakima to the Columbia River, thanks to warming rivers and oceans. Just a few weeks after the election, the National Climate Assessment confirmed that all that was likely just an ominous portent of things to come: Climate change threatens the region’s infrastructure with landslides, rising seas and aberrant weather, while its most vulnerable communities face deteriorating air and water quality.

Given these reminders, now would have seemed a prime time for Initiative 1631. For years, economists have said that a carbon tax—which essentially builds an economic incentive to curtail emissions of carbon dioxide—is one of the most efficient ways to combat climate change. Initiative 1631 proposed to do this by putting a fee ($15 per metric ton) on carbon emissions from the largest polluters, then slowly increasing that fee, with the revenue going toward programs that reduce greenhouse gases and pollution and their effects. Washington voters, in other words, were given a specific action to undertake while they lived out the specific consequences of climate change.

It made sense here, in a green-leaning state where calls to climate action ring louder than in, say, coal-dependent Wyoming. Throughout the Intermountain West, the oil and gas industry provides a lot of jobs and wields a lot of influence, and a significant number of voters support mining and fossil fuel extraction. But in the Northwest, that’s not the case. In Washington, hydroelectric dams, not fossil fuels, have long provided the state’s energy. In 2017, the state received just over 20 percent of its energy from coal or natural gas, and its only coal power plant is on track to close. That reality has helped green Washington’s politics and identity, especially in the western part of the state. Seattle made a commitment in 2002 to eliminate the city’s carbon emissions from electricity, one of the first American cities to do so, and voters passed renewable energy standards in 2006. The state put a limit on emissions in 2008. But Initiative 1631 failed, and Washington must now confront a darker version of itself, in the kind of identity crisis that comes only in defeat.

Along the beach in Edmonds, Washington, a coal train passes behind Nives Dolšak and Aseem Prakash, professors at the Center for Environmental Politics at the University of Washington.

Karen Ducey for High Country News

In the past decade, the Northwest has seen a slew of wins in fights against carbon-emitting infrastructure—and a slew of losses on climate policy. KC Golden is a longtime climate campaigner and, until recently, a senior policy advisor at Climate Solutions, which helped craft Initiative 1631. Now almost 60, Golden claimed his first climate victory in the 1980s, when his group Northwest Energy Coalition was part of regional energy efficiency efforts. In those days, Golden was fighting the “greenhouse effect,” an early name for the warming effects of carbon dioxide, and he won support by pointing to both reduced energy costs and environmental benefits. By 2008, Golden had helped craft local and state commitments to clean energy, and climate activists stepped back, thinking their local fight was mostly over and the federal government would pick up the slack. President Barack Obama’s White House seemed committed, along with much of the world, to reducing emissions of greenhouse gases through regulations and other incentives, with states like Washington, Oregon and California poised to help lead the way.

By 2010, the decline of the US coal market had become obvious, and the fossil fuel industry began to eye the West Coast for access to Asian markets. “They were holed up in the mountains with their coal, and they were trying to figure out where to go,” Golden said. The West Coast offered the quickest way from coal country to China, and so began a wave of proposals for trains to haul the coal and for coastal terminals from Oakland, California, to Bellingham, Washington, to export it. The natural gas industry also began to swell, proposing a dozen separate refineries and terminals with their attendant pipelines and trains in Oregon and Washington.

Had every project been built, “it would certainly make us one of the top fossil fuel transport hubs anywhere in the world,” said Eric de Place, a programs director at the Sightline Institute, a nonprofit think tank focused on regional sustainability. In addition to concerns about air pollution and the safety of coal trains and gas pipelines, the proposals threatened the region’s sense that it was a leader on climate change. “So much of the region had already invested in its identity as being on the forefront of clean energy,” Golden said. Climate activists drew what they called a “thin, green line” at the coastal Northwestern states, adopting a term coined by de Place to describe their role as a barricade against a fossil fuel boom.

The fight to block fossil fuel infrastructure drew widespread support in Washington and Oregon. The Keep It In The Ground movement, which opposes any new fossil fuel production, firmly established itself with direct action in “Blockadia,” as activists strapped themselves to a drill rig headed to the Arctic, blocked trains and demonstrated in the streets of Seattle and Portland. The rural communities of Hoquiam and Aberdeen unanimously banned new crude oil storage facilities in their towns. The Lummi Nation successfully killed a proposal for an export terminal for Montana coal outside Bellingham. In 2018, voters in Kalama, Washington, elected Mayor Mike Reuter, who promised to block construction of a plant for methanol, a fossil fuel with a heavy pollution fingerprint. In Oregon, voters elected a blue bloc of representatives, including Golden’s brother Jeff in southern Oregon, who promised to block permits for an LNG export terminal at Jordan Cove.

Why were these so successful, compared to the carbon tax? Since 2013, legislative proposals for either cap-and-trade or carbon taxes have failed three times. A carbon tax failed on the ballot in 2016. In part, the problems with more abstract carbon-pricing proposals, including 1631, were societal and structural. “(Fossil fuel companies) have spent centuries creating a system of dependency,” Aiko Schaefer, one of the architects of 1631 and the director of Front and Centered, a climate advocacy coalition for people of color, said. Reimagining it will require a radical overhaul of societal structures, a process she thinks will take longer than an election cycle or two. “We’re trying to break free and make a fundamental shift in our society.”

And the difficulties with that shift run deep in the human psyche. Terminals, refineries and railways exist in the material realm, de Place said. “If you take a mile-long coal train going through Seattle, it just doesn’t look good,” said de Place. “We’re animals, and we live in a physical world. That physicality did connect up the dots for people.”

People are animals, yes, and political animals at that, forming loyal packs and scrapping over neighborhood HOAs, city councils, Congress and the courts. In the months since the vote, national climate politics have remained mired in feuding over partisan responsibility and inaction. But what killed the carbon tax was not a blind, party-line vote: the measure failed in red and blue strongholds alike. Of the 59 percent of Washingtonians who voted to re-elect Sen. Maria Cantwell, a Democrat who supports aggressive climate action, about a quarter rejected the carbon tax. In the end, the measure passed in just three places: Seattle’s King County, Port Townsend’s Jefferson County and the county that encompasses the San Juan Islands.

The simplest explanation is that people just don’t like taxes, and oil and gas outspent green groups to exploit that dislike. In Washington, fossil fuel companies and lobbyists spent more than $30 million to defeat Initiative 1631, versus $17 million from supporters. The solution, then, would seem to be to convince people they’ll be just as well off before a carbon tax as after—and to match fossil fuel interests’ spending dollar for dollar. But some observers say the challenges with raising taxes to pay for climate action run deeper.

Nives Dolšak and her husband, Aseem Prakash, are both professors, focused on climate change and its human dimensions, at the University of Washington, in Seattle, who spend their days studying climate policy and pushing environmentalists to reflect on their approach. I thought they could tell me what killed the carbon tax, and I spent many rambling hours on the phone with them, discussing the tax’s details, and its flaws. Whichever one I’d call, I’d find them together: They have been married for 19 years and often greeted me in unison in a well-worn routine. Still, they argued about the relative importance of this or that point and right up to election night, they were divided on one key point.

“We disagreed on whether 1631 would pass,” said Dolšak, a serious-seeming woman in her early 50s from Slovenia, speaking with a wry note in her voice. Dolšak thought it was doomed, while Prakash acknowledged ruefully, “I thought it would pass.”

Not that Dolšak enjoyed being right; 1631’s defeat left them both deflated, she said. “It had all the structural factors in its favor,” said Dolšak, from the menacing weather that preceded the vote to the overall support for climate action in the state. “It had no business not passing.”

In the weeks after, as they ate dinner or got ready for work, they’d dissect the results: Is Washington turning conservative? Is any carbon tax doomed to fail? For Dolšak, the less optimistic of the two, the tax’s failure reinforced her sense that sweeping climate action is far from imminent. “When we’re thinking of solutions, I’m thinking in two to four years,” she said. She came to believe it was a failure of Washington’s green self-mythology: “In Washington, we’re excited to support environmental action, as long as we don’t have to pay for it,” she said. “If a carbon tax cannot pass in good economic times, in a pro-environment state like Washington, then action on climate is far more difficult than it used to seem.” Prakash’s longer view gave him a more hopeful perspective, she said, forecasting what might happen thousands of years from now.

“That’s the Hindu in me!” Prakash quipped, meaning the tendency to think not just of this reincarnation, but the next and the one after that. Although he believes people will embrace climate action eventually, in the short term, he conceded, “I think things are going to get worse before they get better.”

Prakash blamed environmentalists and their approach. “The mainstream environmental groups are less willing to hear from the periphery,” he said. They focus on consolidating a liberal base, he said, to their detriment. Many groups, including the Sierra Club and The Nature Conservancy, did not back an earlier carbon tax that was designed to appeal to more conservative voters. That, Prakash said, “was myopic.” (Mo McBroom, director of government relations for The Nature Conservancy’s Washington chapter, noted that 1631 differed from 732, as it “would have provided investments to make our state more resilient to climate change, including reducing risk of forest fire and addressing drought” and drew support from businesses, prominent philanthropists like Bill Gates, and health professionals.)

In the wake of the election, the couple published half a dozen pieces analyzing the failure that drew on their own discussions. “Nives and I have not given up on conversation,” Prakash said. “It comes out as a family compromise.” What they arrived at was simple: The failure of 1631 was about more than a deep-pocketed oil and gas campaign machine; it spoke to climate action’s broader challenges. “We have anecdotal evidence that money doesn’t lead to electoral success,” Prakash said. And the messaging of the “No” on 1631 campaign fed on the rich vein of discontent around accountability for the funds the tax would raise, as well as the worry that voters, rather than large-scale polluters, would end up paying for the cost of climate change.

Still, it wasn’t advertising campaigns or partisanship alone that killed the tax: it got mired in the same murk that has slowed climate action for decades. The climate is too big for us to easily wrap our minds around, and so it proves to be a difficult issue to legislate. This election cycle, Jordan Stevenson was a fellow at the advocacy group Our Climate, which supported Washington’s carbon tax. A 20-year-old woman with square glasses and a knack for getting people to talk, she spent weeks knocking on doors in the Spokane area, on the far eastern side of the state, along with her husband. She also talked to her father, back home in Vancouver. “He said, ‘I’m glad you’re working on this,’ ” she told me. ” ‘I’ll take a look.’ ” But in the end, she’s not sure he even voted. When she spoke to voters in Spokane, not many people there knew what the tax was, let alone what it had to do with the wildfire smoke outside their windows. “It still didn’t seem concrete or tangible to people,” Stevenson said. Voters told her: “The money I pay in taxes, the increase at the gas pump, it will never benefit me.”

Initiative 1631’s demise might have had something to do with moments like this, where the connection between taxing carbon and more immediate fears about one’s health or one’s job becomes obscured. The initiative promised to pool funds for projects, including new bus lines, land conservation grants, and training to transition fossil fuel workers into other jobs. But when people need to choose between their day-to-day concerns and a future pot of money for projects they can’t imagine, the day-to-day wins. Our minds are better suited to immediate threats—like snarling hyenas or flammable trains—and we struggle with the abstract dangers of a changing climate.

“People don’t get worried about problems that aren’t happening today or tomorrow,” Dolšak said. Those climate hawks who believe that extreme weather events, like wildfires and hurricanes, will inspire climate inactivists are overly optimistic, Prakash said. “An extreme weather event doesn’t affect political leanings.” Ongoing, intensifying hurricanes in Florida, for example, have not necessarily driven people to vote for liberal candidates who back climate action, and extreme weather has a relatively small impact on public opinion.

“A lot of environmentalists are approaching conservation and pollution reduction from a normative perspective: We have to reduce pollution and protect the environment,” Dolšak told me. Instead, the question is over the cost required to take action: “How much is society willing to pay to reduce this problem versus another, equally important problem?”

Despite the work of scientists and researchers, whose models are getting better at explaining the chaotic relationships between climate and weather, the truth is that the destructiveness of a particular storm is hard to link straight to a changing climate—what experts call “the attribution problem.” Smoky summer days in Idaho can seem far removed from a tax, or fee, that will somehow reduce carbon emissions, somehow slow climate change, and somehow decrease wildfires. In this way, climate change can boggle the imagination. Unsurprisingly, the carbon tax found wide support among the state’s tribal nations, some of whom face the obvious possibility of displacement due to rising seas, and in Seattle’s communities of color, where air pollution already causes higher-than-average rates of asthma.

In short, the difficulty of addressing climate stems from its very power: Its effects are inextricable from the way we have configured our society. If we have to name 1631’s killer, it might be what geographer Mike Hulme called the “climate of climate change.” Hulme, an expert in climate change theory at the University of Cambridge, argues that our concept of climate is only partly rooted in objective truths about the material world. At least as powerful is the fact that climate fundamentally formed human cultures, contributing to our idea of it as static. It is impossible to separate ourselves from the climate far enough to get a clear look at it, something equally true of many injustices and economic structures. All of these things are wrapped together, but the climate is changing, and so must our analysis of it.

“All aspects of human life are now analyzed or represented in relation to climate: gender, violence, literature, security, architecture, the imagination, football, tourism, spirituality, ethics, and so on,” Hulme wrote. “All human practices and disputes can now be expressed through the language of climate change, which has become a new medium through which human life is lived.”

Given this, the fight over what to do about rising temperatures epitomizes all our other disagreements over what justice—let alone climate justice—might, and should, look like. For example, Stevenson, the canvasser, was first drawn to climate activism through her interest in reproductive health and justice: “There are areas where people’s children are not growing up healthy because they’re breathing in fumes or drinking fossil fuels in their water,” she said. She used that argument to talk to her dad about climate change, invoking his sense of familial values and his worry for his kids and grandkids. The fight for the carbon tax, then, becomes a fight for what the future of our society ought to look like—and on that, we remain deeply conflicted.

Some say the death of the carbon tax was easily foreseen. “The word ‘tax’ is probably the most reviled word,” said Hal Harvey, CEO of the firm Energy Innovation, which helps design renewable energy policies around the globe. “The first lesson is: Don’t lead with your chin.” Harvey, an energy wonk with a cheery, blunt manner, said the state’s climate coalition should have pushed for more immediately achievable ends first, such as fuel efficiency standards modeled on California’s, or tighter building regulations. “If you had to choose between performance standards and a carbon tax, you’d be insane to pick a carbon tax,” said Harvey.

Dolšak tends to agree: She hypothesized that even cap-and-trade, which often amounts to the same thing as a carbon tax, might have passed in the state, given that it sidesteps the word tax and directly limits emissions. A quirk of state law classified 1631 as a fee, evoking a parking ticket for emitting, rather than a cost to everyday consumers, but most voters identified it as a tax.

Economists generally support a carbon tax over regulations or building standards, because it costs all emitters fairly, in proportion to their emissions. A building standard, for example, might require different windows, different insulation, a different design … and by the time you’re done, it’s hard to disentangle what you did from what you might have done otherwise, and even harder to say how much more money per ton of carbon was effective. In practice, however, many key emitters are relatively unaffected by a carbon tax. Those who build new buildings are rarely the ones paying the energy bills, so a tax on emissions is more likely to hit the building’s occupants.

On the other hand, voters—most of whom aren’t economists—tend to prefer energy standards because they put the costs on those most directly responsible for carbon-emitting systems, the real estate developers and car designers. And although the cost of new standards varies between industries, within them, the costs are the same. An engineer at Volvo isn’t likely to compare her efficiency costs to those of double-paned windows in a new high-rise. Rather, she’ll look to her competitor at Peugeot, who is under the same constraints.

Washington may already be learning its lesson. Less than a month after the carbon tax failed, Gov. Jay Inslee, a Democrat who backed it and has suggested that he might run for president on a climate change platform, held a press conference to announce a new green legislative deal. “This is the greatest endeavor of our time,” he told a crowd of reporters at a workspace for energy efficiency innovators in Seattle. “It is a moment of great peril but it is also a moment of great promise.” He unveiled a plan he hopes to put before the state Legislature this year, one that encompasses clean fuel standards, tighter building codes and a shift to 100 percent clean energy.

The time for a carbon tax will come, Harvey said. The warming climate will produce—in fact, it is already producing—challenges that altered consumption habits and more efficient buildings can’t pay for. The costs of relocating communities farther inland from the coasts, for example, won’t be recouped from sales of Teslas. But for now climate activists are stuck with the art of the possible. “The essence of strategy is making choices,” Harvey said. ” ‘Everything’ is not a choice.”

In the weeks after the death of 1631, climate activists took little time to grieve, refusing to declare defeat. This wasn’t the end, they swore; it was just the beginning. “2019 is a year we can make a lot of progress on this,” Nick Abraham, a spokesman for the Yes on 1631 campaign, told me. “We’ve moved the conversation away from, ‘Should we take action?’ to, ‘What should action look like?’ ”

“I want to make sure people don’t take the vote count and say, ‘Pffft,’ and move on,” Schaefer, the head of Front and Centered and one of 1631’s designers, said. “When my kid plays soccer, when he loses a game, I don’t say, ‘Don’t play soccer anymore.’ ”

But if climate hawks want to make progress, they’ll need to grapple with the cause of death for Initiative 1631. Not long ago, I met Golden in a noisy coffee shop a little over a mile away from the site of the election night failure, for a final postmortem. He was in a reflective mood: Climate Solutions was in the midst of moving offices, and they’d unearthed years of news clippings on the long fight for climate action in the state, records of campaigns and failures going back more than a decade. Golden’s mind was on what would come next, including setting aside the fight for a carbon tax, for now. “Carbon pricing is not our quest,” he said, his voice both uptempo and steady. Carbon taxes are just a tool. “Our quest is to deal with climate change.”

Without a course correction, climate activists may well find themselves right back where they started, raising the body count on failed climate initiatives while blithely marching forward. In Canada, for example, Prime Minister Justin Trudeau faced blowback for his carbon tax proposal. And not long after the US midterms, France underwent a major political crisis, brought in part by a fuel tax meant to curb emissions. In the US, advocates are crafting an economic stimulus package—a Green New Deal. And there, at least, they seem to have taken the hint: That package sidesteps a carbon tax entirely.

Over a cup of tea, Golden dissected, and then dissected again, the faults of the tax and the future of climate action. “The fundamentals are there,” he concluded. But the moral urgency, the sense that life after oil is a real possibility, the feeling that anything useful can be done — those aren’t. In Washington, even as winter faltered and delivered a meager snowpack, concerns over climate change had been quickly replaced by more immediate worries: a federal shutdown and a volatile stock exchange. So even if a majority of Americans believe in climate change, that statistic amounts to very little. It’s just another thing to worry about, on a heaping plate of worry.

What, then, should we take away from the death of 1631? The big lesson is that we need to seek the root cause of our worries, clarify our fears and to face them head on. Golden thinks the first step is to regain a sense that our collective actions can actually affect the course of climate change. On our dependence on fossil fuels, “we’re fighting something that’s dying,” Golden told me. “We’re just not on the same timeline as physics.” Climate change is not just an environmental problem or an economic problem, and it can’t be framed that way. It’s a challenge to our moral imagination—and a big one. Putting a policy to that will be as daunting as it is urgent.

We finished our drinks and parted ways. Outside, the winter weather was particularly nasty, with rain that flew sideways and high winds shoving people around the sidewalks. I made my way through the streets, my thoughts scattered, and before I could really think through all I’d just learned, a gust of wind caught me by surprise and nearly slammed me into a building. I stumbled down a flight of stairs looking for somewhere to retreat to, but there was nothing around but bad weather.

This story was funded with reader donations to the High Country News Enterprise Journalism Fund.