Leidesdorff Street, a shadowy corridor stretching just three blocks, is hardly the hub of San Francisco’s downtown Financial District. Yet for a few hours on Wednesday morning, a lively climate change protest swept through the alley, turning it into the front line in the fight for divestment—a movement to force big banks and financial institutions to withdraw their ties to fossil fuel companies.

The convergence, which drew more than a hundred people and blocked traffic for much of the day, was facilitated by a coalition of local organizations, including Idle No More SF Bay and Diablo Rising Tide, as part of the week of action ignited by the Global Climate Strike on September 20. Wednesday’s protests targeted banks and finance companies along Montgomery Street, which activists dubbed “Wall Street West.”

Around 7:00 a.m. on a balmy morning in a city known for its chill, ten protesters, most of them affiliated with local chapters of the environmental advocacy group 350.org, planted themselves in front of the side entrance to Wells Fargo’s corporate headquarters, barring employees from entering. Three dozen police officers converged, flaunting batons and two paddy-wagons, as Wells Fargo staffers clicked away at smartphones at one end of the alley. Nearby, protesters also blocked entrances to Bank of America, Chase, and Citibank locations. Muralists coated four blocks of asphalt on Montgomery Street in colorful patterns, with messages like “Return to the Old Ways” and “Invest in Life.”

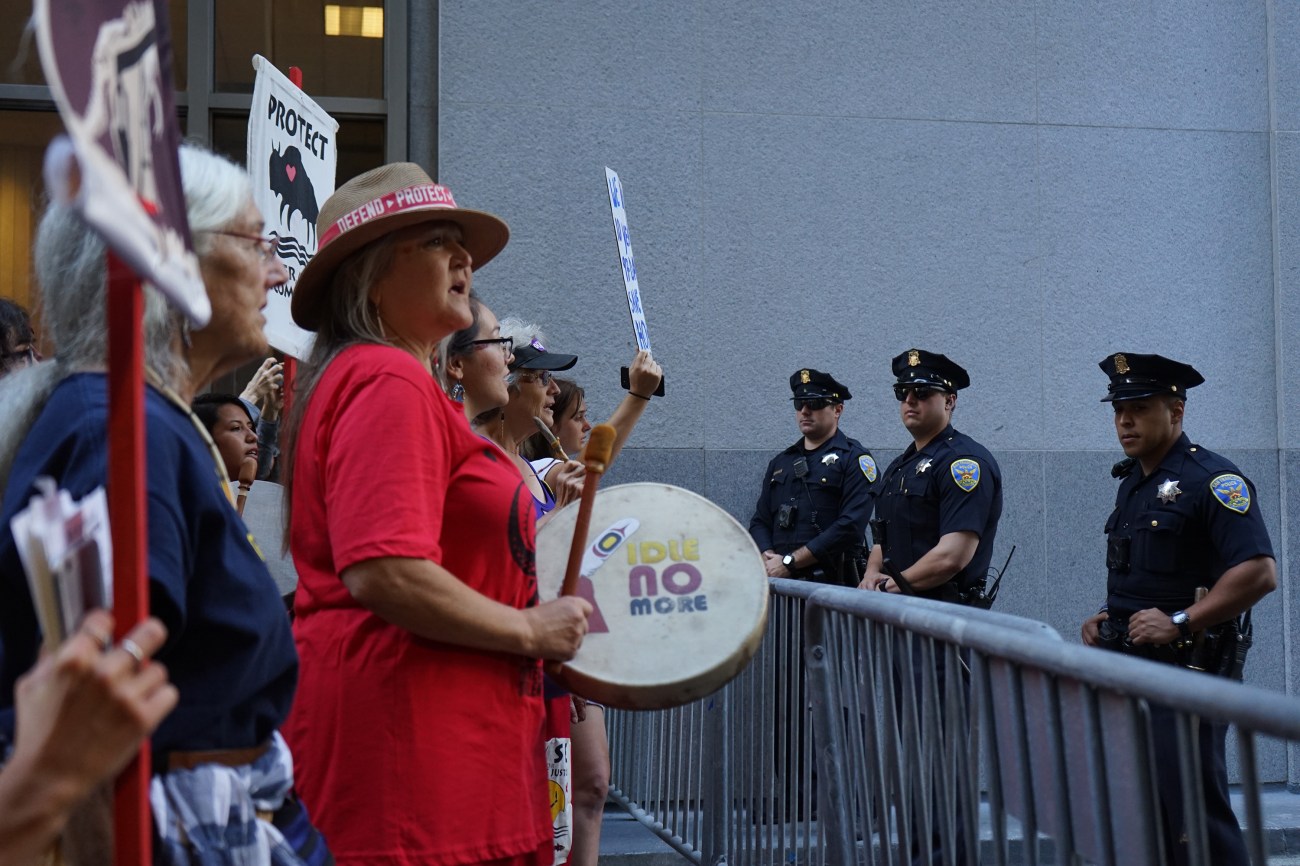

Pennie Opal Plant of Idle No More SF Bay leads songs and prayer outside of Wells Fargo.

Delilah Friedler/Mother Jones

In recent years, those working to slow and reverse carbon dioxide-induced warming have set their sights on companies that bankroll the oil and gas industries, asking them to nix such investments. In a recent New Yorker op-ed, Bill McKibben argued that “Money Is the Oxygen on Which the Fire of Global Warming Burns,” calling divestment efforts an “additional lever to pull” that “could be exercised in a matter of months or even hours” while Washington dithers on climate. A 2013 Oxford study called the “fossil free” movement the fastest growing divestment campaign in history. Just this month, the University of California pledged to remove fossil fuels from its $83 billion portfolio, adding to what 350.org researchers calculate as a total of $11 trillion divested so far by institutions like banks, pension funds, insurance companies, and charitable foundations around the world. The vast majority was divested in just the last five years.

The San Francisco protestors targeted banks that have thus far resisted the movement. According to Rainforest Action Network’s annual report, JP Morgan Chase, Wells Fargo, Citi, and Bank of America together invested more than $200 billion in fossil fuels in 2018, with little to no slowdown in recent years. Wells Fargo has nearly doubled its fossil fuel financing since the end of 2015, when the Paris Agreement was signed with the goal of drastically reducing global emissions. This money funds projects like the Dakota Access Pipeline, which today pumps over half a million barrels of oil per day from North Dakota to Illinois. The project inspired #DefundDAPL, an Indigenous-led divestment movement that began in 2016.

A group of activists with the Rainforest Action Network spilled mock oil outside a Chase Bank location.

Delilah Friedler/Mother Jones

“We know that money is power, and we want to stop the power that is destroying the planet right now,” said Jennifer Listug, a protestor with one arm locked in a PVC pipe that joined her to two other blockaders outside of a Chase bank on Wednesday. “Our request is very simple and it’s immediate. We’re talking right now: no more fossil fuel expansion. Zero.”

Jackie Barshak, who worked with others from Extinction Rebellion, a global climate resistance movement, to block a Wells Fargo loading dock, said their protest was an act of civil disobedience. “The most civil way we can get our message to [the banks] is to shut them down, no business as usual today,” she told Mother Jones. “We are not allowing any employees or patrons to enter, and we’re asking people to move their money out of Wells Fargo and invest it in credit unions and other sustainable projects.” Other protestors called for the banks themselves to invest in renewable energy. In 2018, the Carbon Disclosure Project found that oil and gas companies put only 1.3 percent of their capital expenditures toward investing in low-carbon alternatives.

Jackie Fielder, an Indigenous organizer who founded the San Francisco Defund DAPL Coalition, was on site to offer a large-scale solution: public banking for city budgets. “Basically all major cities—Los Angeles, New York, San Francisco—hold their money in private banks, because they believe Wall Street banks are ‘safe,’ despite the fact that these banks are using this money in contrast to the best interests of taxpayers,” she said. Since 2017, Fielder and the SF Public Bank Coalition have worked to move the city’s $12 billion budget out of Wall Street banks, an effort that she says is “crucial to showing big banks and the powers that be that we can create our own alternatives.”

Calling themselves “the Red Rebels,” a flock of robed demonstrators with Extinction Rebellion stepped slowly through the streets.

Delilah Friedler/Mother Jones

The public banking movement got a major boost this month, when the California legislature passed AB 857, a bill that creates a pathway for cities to launch their own public banks. (Previously, the state only issued licenses for private banks and credit unions.) If signed by the governor, this law could help California cities divest their massive budgets from fossil fuel-supporting banks and reinvest in projects more in line with local values, such as affordable housing.

In a statement following Wednesday’s protests, Wells Fargo said: “We recognize the growing concerns about climate change and environmental sustainability, and we’re working to find solutions. Wells Fargo is committed to accelerating the transition to a low-carbon economy.” The company has pledged to invest $200 billion by 2030 in sustainable business and projects, and so far it says it has provided $23 billion to sustainable finance, 63 percent of which went toward “low-carbon solutions” including renewable energy and clean technologies.

On Leidesdorff Street, the cops gave several warnings before closing in and arresting seven protestors. The support crowd chanted “climate heroes, we honor you” as the arrestees were led into vans. By lunchtime, Wells Fargo’s corporate headquarters was back in business. But the industry had lost another client. Doug Nielson, who came out to protest Wells Fargo because the bank is reportedly the top funder of fracking, told Mother Jones that he was ready to move his money to a public bank. “I don’t want to say from where,” he said, “but I am in the process of divesting.”

Murals painted by a coalition of activists stretched across four blocks in San Francisco’s Financial District.

Delilah Friedler/Mother Jones