Pumpjacks in New Mexico.Charlie Riedel/AP

This story was originally published by the Guardian and is reproduced here as part of the Climate Desk collaboration.

American private equity tycoons are profiteering from the global climate crisis by investing in fossil fuels that are driving greenhouse gas emissions, a new investigation reveals.

Oil and gas pipelines, coal plants and offshore drilling sites linked to Indigenous land violations, toxic leaks and deadly air pollution are among the dirty energy projects financed by some of the country’s largest private equity firms, according to an investigation by the corporate accountability nonprofits LittleSis and the Private Equity Stakeholder Project (Pesp).

Private equity refers to an opaque form of financing away from public markets in which funds and investors buy and restructure companies including startups, troubled businesses, and real estate. Globally, the industry manages more than $7 trillion for wealthy individuals and institutional investors such as mutuals, hedge funds, endowments and pensions, investing in every sector from retail chains and healthcare to prisons and weapons.

Some of that money finances fossil fuel projects that release greenhouse gases that cause global heating. Higher atmospheric and ocean temperatures are directly linked to the rise in catastrophic weather events like drought, extreme temperatures and hurricanes.

Yet unlike banks and other publicly listed companies, private equity firms are exempt from most financial disclosure rules, making it extremely difficult to track their assets. It means people like firefighters and teachers whose pension funds are invested in private equity funds have little way of knowing if their retirement nest egg is financing coal plants, oil wells, or solar farms.

The Private Equity’s Dirty Dozen report, shared exclusively with the Guardian, provides a snapshot of the industry’s involvement in some of the country’s most controversial fossil fuel investments, as well as the deep political and cultural ties of its wealthy executives. The investigation found:

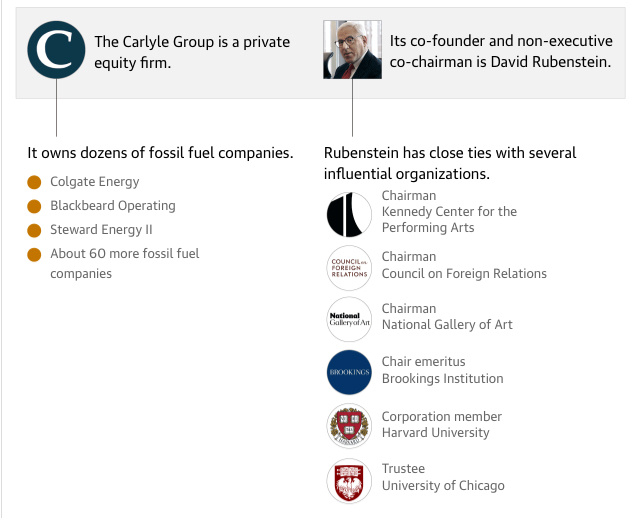

- The Carlyle Group, one of the world’s largest private equity firms, owns dozens of oil and gas companies including a stake in NGP Energy Capital, which boasts its own major portfolio mostly focused on fracking and drilling in states like Texas, Wyoming, and Colorado. Carlyle, which recently announced a target of net zero emissions by 2050, also partners with Hilcorp Energy—a major methane emitter with a track record of offshore spills in Alaska and the Gulf of Mexico—on at least $4 billion in equity and debt deals. (Methane is more than 25 times as potent as carbon dioxide at trapping heat in the atmosphere, and accounts for about a quarter of today’s global heating.)

The Carlyle Group’s Network of Influence

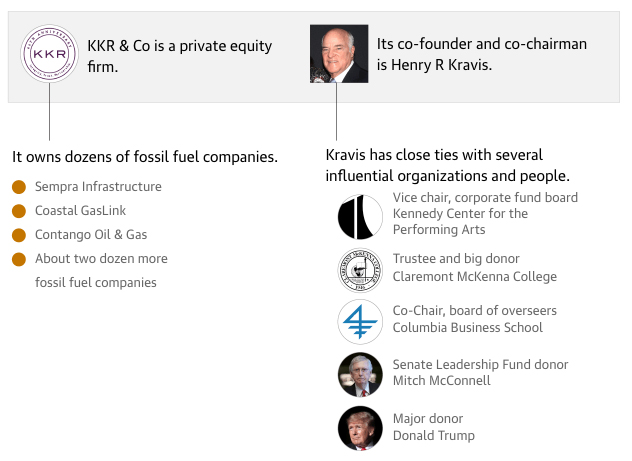

- Kohlberg Kravis Roberts & Co (KKR) has a controlling stake in the Coastal Gaslink pipeline in Canada, a 400-mile, multibillion-dollar infrastructure project through unceded Indigenous territories that will transport fracked gas to a Pacific coast port for export to Asia. Police have deployed to evict protests and blockades organized by the hereditary chiefs of the Wet’suwet’en Nation. Co-founder Henry Kravis is a major Republican donor, donating $1 million to Trump’s 2017 inauguration fund.

KKR’s Network of Influence

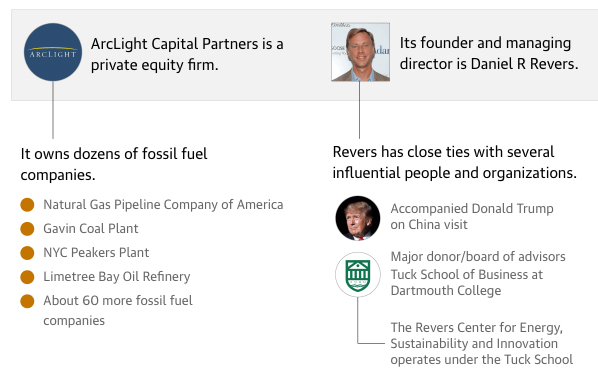

- Daniel Revers is the managing partner & founder of ArcLight Capital Partners, a top energy-focused private equity firm, who accompanied Trump to China in 2017—reportedly to help recruit investors for an environmentally disastrous refinery in the US Virgin Islands. Last year the EPA enacted emergency powers to shut down the Limetree Bay oil refinery after multiple toxic leaks led to school closures and adverse health impacts on majority black communities. This was followed by a DoJ complaint alleging the refinery posed an imminent threat to public health and the environment, before Limetree filed for bankruptcy.

ArcLight Capital’s Network of Influence

- Richard Kayne is a major Republican donor and co-founder of Kayne Anderson Capital Advisors, the largest investor in energy pipelines in America. Kayne held a stake in the fifth largest oil pipeline developer in the world, the Plains All American Pipeline, when it was fined $60 million for spilling 140,000 gallons of crude oil into the Pacific and the California coast in 2015—the state’s worst oil leak in 25 years. (The company sold its stock in 2021 but still has a seat on the board.)

The findings have renewed calls for greater transparency in the booming private equity industry, so that communities bearing the brunt of toxic emissions and extreme weather can track the money behind the misery.

“By plowing money into dirty coal plants, offshore drilling and deforestation, private equity threatens to undermine our hard work to tackle the climate crisis and advance environmental justice,” said Elizabeth Warren, former presidential candidate and member of the Senate committee on banking. “It’s just another page from private equity’s standard playbook: boost short-term profits at the expense of the long-term wellbeing of communities.”

Alyssa Giachino, Pesp’s climate director and co-author of the report, said: “While communities have shouldered the harms from fossil fuel investments, private equity firms have built vast wealth. Many firms have adopted rhetoric around sustainability, but have yet to provide transparency on their holdings and impacts.”

A KKR spokesperson said the company “wholeheartedly disagreed” with the report’s assertions. “Not only do we believe in—and our actions support—the need for a sustainable energy transition, we also believe in the value and importance of transparency, as evidenced by an extensive library of public disclosures including our Climate Action Report and Sustainability Accounting Standards Board Report [among others].”

Private equity firms have spawned an elite group of super-rich power brokers with deep ties in politics, the arts, sports, and education sectors.

In recent years, banks have come under growing criticism for bankrolling fossil fuel projects, while secrecy surrounding private equity has shielded the industry from the same scrutiny. Yet in 2020, state-owned institutions like public pension and sovereign wealth funds invested 22 percent of the trillions in their portfolios in private equity where—unlike the stock markets—only the wealthy and institutional investors have direct access to this capital.

The nature of these investments, let alone their impacts, are notoriously tough to track, though according to financial data analysts PitchBook, there has been at least $1.1 trillion in private equity energy deals globally since 2010.

It’s no secret that the oil and gas industry spends big on politics, contributing more than $700 million through individual, PAC and outside donations since 2000, according to Open Secrets. More than 80 percent of the campaign contributions have benefited Republican coffers.

But the financial sector is far and away the largest source of campaign contributions to federal candidates and parties. Stephen Schwarzman, chief executive and founder of Blackstone Group and the world’s 34th richest man according to Forbes, is a major Republican donor who has personally contributed to Donald Trump, Mitch McConnell, and former Georgia senator Kelly Loeffler—who supported overturning the 2020 presidential result. (Schwarzman has recognized Biden’s victory and condemned the January 6 insurrection.)