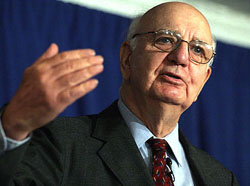

LEVERAGE….Paul Volcker’s Group of 30 has produced a report piled high with recommendations for regulating the banking system, including a suggestion that the size of banks be limited so that there’s no longer any such thing as “too big to fail.”  Matt Yglesias likes that idea, but I’m pretty lukewarm about it myself since it’s not clear to me that bailing out a hundred small banks is any better than bailing out a dozen big ones. Systemic failure is systemic failure, after all.

Matt Yglesias likes that idea, but I’m pretty lukewarm about it myself since it’s not clear to me that bailing out a hundred small banks is any better than bailing out a dozen big ones. Systemic failure is systemic failure, after all.

But I’ll stay agnostic on that for the time being. Recommendation 8b, however, ought to be getting more attention:

Given the recurring importance of excessive leverage as a contributing factor to financial disruptions, and the increasingly complex ways in which leverage can be employed on and off balance sheets, prudential regulators and central banks should collaborate with international agencies in an effort to define leverage and then collect and report data on the degree of leverage and maturity and liquidity mismatches in various national systems and markets.

The rest of the report provides plenty of grist for conversation, but I honestly think that if regulators could figure out some reasonably robust way of defining and limiting leverage and limiting it everywhere (i.e., in the shadow banking system as well as the regular banking system), I’d trade that for all the rest of the rules combined. Put it together with this one, and you’ve got the skeleton of a serious regulatory overhaul:

Large, systemically important banking institutions should be restricted in undertaking proprietary activities that present particularly high risks and serious conflicts of interest. Sponsorship and management of commingled private pools of capital (that is, hedge and private equity funds in which the banking institutions own capital is commingled with client funds) should ordinarily be prohibited and large proprietary trading should be limited by strict capital and liquidity requirements. Participation in packaging and sale of collective debt instruments should require the retention of a meaningful part of the credit risk.

Banks should be banks, not casinos. Now all we have to do is figure out how to implement these recommendations and then get Congress and the entire rest of the world to agree to phase them in. Should be a piece of cake.