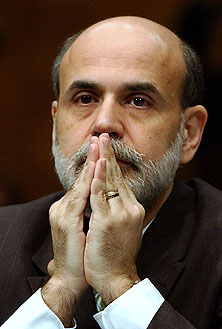

What do we have to look forward to from Ben Bernanke’s second term as chairman of the Fed? The New York Times asked a bunch of economists for their predictions. Here’s Mark Thoma:

What do we have to look forward to from Ben Bernanke’s second term as chairman of the Fed? The New York Times asked a bunch of economists for their predictions. Here’s Mark Thoma:

My worry is that as time passes, we’ll forget how bad things were and the desire to impose necessary new regulation will fade. Here’s where I think Mr. Bernanke’s experience will be crucial. He was there at every step in the development of the Fed’s response to the crisis and he will not soon forget the problems he faced (nor repeat his mistakes), making it more likely that he’ll be a forceful and passionate advocate for new regulation before Congress. [Italics mine.]

Boy, do I hope this is true. But it strikes me as woefully wishful thinking. One of the reasons I opposed reappointing Bernanke is that I’d like to have someone running the Fed who’s serious about reregulating the financial industry, both at a macro and a consumer level. With Bernanke, though, we’re taking a flyer. We’re hoping that the crisis of the last two years has fundamentally changed his view of market self-regulation, and that he’ll apply the same suppleness and creativity he showed dealing with the meltdown to dealing with post-crisis regulatory issues. And maybe he will. But people rarely change lifelong worldviews even after they’ve lived through a catastrophe, and Bernanke has done nothing to make us think he’s an exception. Contra Mark, my guess is that when it comes to actual, concrete legislation and rulemaking, he’ll revert to the same Ben Bernanke he’s always been. When that happens, we’ll have missed our only chance for years to really reform our financial system.

And here’s former Fed economist Vincent Reinhart with another prediction:

The White House will likely learn that a Fed chaired by Ben Bernanke will follow a policy uncomfortably tight as the 2012 election looms into sight. [Italics mine.] Bernanke has espoused a commitment to low inflation over his entire career. He also is a democratic and consultative chairman, so the voices of monetary conservatives among Fed officials will be heard loudly and frequently.

Now this one I believe. That’s what Fed chairmen usually do to Democratic presidents, after all.