Someday I’ll finally be able to say that there’s nothing left that credit/debit card companies can do that would surprise me. But today is not that day. As I read through Tuesday’s front page article on the Visa debit card network in the New York Times, I found myself so gobsmacked that I wasn’t even outraged. Instead, I kept laughing at the sheer audacity of the whole thing. It is truly unbelievable.

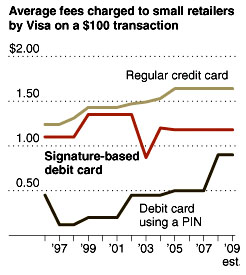

It’s a little complicated to summarize the piece in a few words,1 but it turns out that there’s a big difference between using a debit card that you authorize via a PIN and using a debit card that you authorize with a signature. Back in the early days of debit cards, the small networks that operated ATMs used PINs to authorize debit cards and charged merchants no fees for their use. In fact, sometimes merchants even received a small rebate because, after all, it costs banks less to process a debit card transaction than a check.

That changed after Visa entered the debit market. In the 1990s, Visa promoted a debit card that let consumers access their checking account on the same network that processed its credit cards, which required a signature.

To persuade the banks to issue more of its debit cards, Visa charged merchants for these transactions and passed the money to the issuing banks. By 1999, Visa was setting fees of $1.35 on a $100 purchase, while Maestro and other regional PIN networks charged less than a dime, Federal Reserve data shows. Visa says the fee was justified because signature debit was so much more useful than PIN debit; at the time, roughly 15 percent of merchants had keypads for entering a PIN.

Merchants said they had no choice but to continue taking the debit cards, despite the higher fees, because Visa’s rules required them to honor its debit cards if they chose to accept Visa’s credit cards.

Visa’s explanation for its high fees is pretty fanciful, but whatever. Everyone has keypads now, and a lawsuit eventually put an end to Visa’s “accept all cards” policy. What’s more, Visa’s transaction  volume has gone way up, and electronic payment networks boast the ultimate in economies of scale. So not only is Visa now charging a dime per transaction like the other guys, they’re probably only charging a few pennies. Right?

volume has gone way up, and electronic payment networks boast the ultimate in economies of scale. So not only is Visa now charging a dime per transaction like the other guys, they’re probably only charging a few pennies. Right?

While some merchants said they thought the lawsuit would pave the way to a new era of competition, a curious thing happened instead: while Visa temporarily lowered its fees for signature debit, it raised the price on PIN debit transactions and passed the funds on to card-issuing banks, and its competitors soon followed.

The current class-action lawsuit joined by Mr. Goldstone contends that Visa’s PIN debit network, called Interlink, is offering banks higher fees as an incentive to issue debit cards that are exclusively routed over this network. Interlink, which has raised its PIN debit fees for small merchants to 90 cents for each $100 transaction, from 20 cents in 2002, is often the most expensive, especially for small merchants, Fed data shows.

One large retailer, who requested anonymity to preserve its relationship with Visa, provided data that showed Interlink’s share of PIN purchases rose to 47 percent in 2009, from 20 percent in 2002, even as its fees steadily increased ahead of most other networks — to 49 cents per $100 transaction in 2009, from 38 cents in 2006.

And what is Visa’s excuse for its astronomical fees? They are, says Elizabeth Buse, Visa’s global head of product, “not a cost-based calculation, but a value-based calculation.” Roger that.

1In other words, you should click the link and read the whole thing. Really.