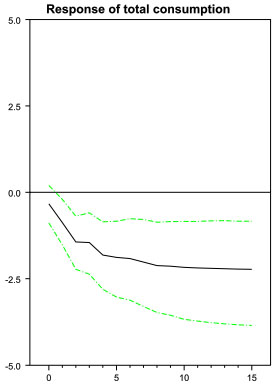

James Hamilton has argued in the past that the spike in oil prices in 2007-08 can almost explain the ensuing recession all by itself. I doubt this is really the whole story, but I think it’s been an underrated argument — and I think the historical impact of oil shocks in general has been underrated too. Today, Ryan Avent points to a 2009 paper by Hamilton where he quantifies things, and the chart on the right comes from that paper.  It shows, roughly speaking, what happens to consumer expenditures when oil prices go up enough to reduce consumer income by 1%. The model Hamilton uses suggests a maximum response of 1.7%, but in reality it’s bigger than that:

It shows, roughly speaking, what happens to consumer expenditures when oil prices go up enough to reduce consumer income by 1%. The model Hamilton uses suggests a maximum response of 1.7%, but in reality it’s bigger than that:

Following a decline that eventually would have reduced consumers’ ability to purchase non-energy items by 1.7%, we observe that on average consumers in fact eventually cut their spending by 2.2%. Why should consumption spending fall by even more than the predicted upper bound?

….One way that Edelstein and Kilian sought to explain these anomalies is by breaking down the responses in terms of the various components of consumption….The magnitude of the ?rst two responses is in line with the simple expenditure-share e?ects, while the response of expenditures on durable goods is ?ve times as big.

The ?rst panel of Figure 16 looks in particular at the motor vehicles component of durables….Here the response is immediate and quite huge, with for example a 20% increase in energy prices in an environment with an energy expenditure share of 5% resulting in a 10% decrease in spending on motor vehicles. That there would be a direct link between such spending and energy prices is quite plausible.

To simplify then: oil prices go up, people stop buying cars, and that has a huge knock-on effect on the rest of the economy. Something to keep in mind before you buy stock in GM or Chrysler during the current period of (relatively) low oil prices. Those low prices might not last forever, after all.