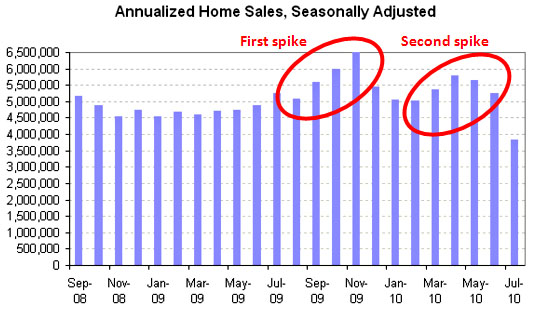

Hey, how about that first-time homebuyer tax credit? It was originally scheduled to expire at the end of 2009, and home sales spiked as people rushed to get their loans approved in time. Then the program was extended, and after a brief lull sales rose again, this time spiking in June as people rushed to get their loans approved before the program went away for good. So what happened in July? The chart below, modified slightly from one created by Daniel Indiviglio, shows the results:

That’s a stunning 27% decline in July. There’s no telling whether that’s a short-term effect or if home sales will stay low for a while. The most optimistic appraisal is that it’s a short-term impact because of the intoxicating effect the tax credit seems to have had on people. Megan McArdle, who just bought a house, reports that she and her husband “were astonished by the effect that the tax credit seemed to be having on people. Prices were climbing rapidly, as people got into bidding wars that raised the price by more than 8%. Inventory vanished rapidly; the average days on the market for a new property that wasn’t ridiculously overpriced, half-finished, or occupied by tenants who wouldn’t let the place be shown, was 1-4 days.”

That’s been my sense too, which is remarkable since $8,000 shouldn’t be that big an incentive to buy something as expensive as a house. But then again, maybe that’s the Southern Californian in me talking. $8,000 isn’t a huge incentive if you’re buying a $500,000 house in Los Angeles or Orange County, but it’s probably a much bigger deal if you’re buying a $150,000 house in Little Rock.

In any case, we better hope this is just a short-term effect from housing sales getting artificially pulled in a month or two to take advantage of the tax credit. If it’s not — if the tax credit really was propping up the market — then we’re in for yet more economic pain. Slow housing sales drive lower house prices, and lower house prices have an outsize effect on consumer spending and on economic growth in general. Buckle your seat belts.