In my summary post yesterday about Texas job growth, I mentioned that one big factor in Texas’s relative economic success during the recession was its strictly regulated housing market. Texas has long had strong mortgage regulations, and these regulations restricted the growth of both home mortgages as well as home equity loans during the go-go years of the aughts. As a result, Texas didn’t have much of a housing bubble and Texans, as a whole, didn’t go very deeply into debt.

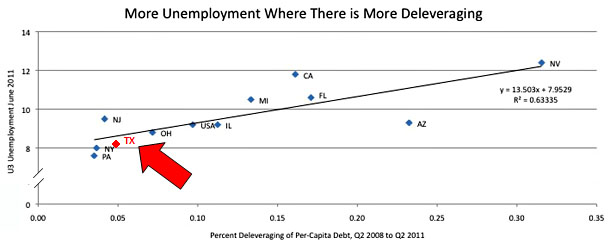

But how big a role did this play? Debt overhang is a big factor in our protracted economic downturn: when overleveraged consumers cut back on spending, this reduces demand for goods and services and gives businesses no reason to expand production. So economic growth stagnates and unemployment stays high. Today, Mike Konczal updates his look at deleveraging across the country, and the chart below quantifies this story of deleveraging and unemployment. Texas didn’t have a housing boom thanks to its strict mortgage regulation, its debt overhang has therefore stayed low, and its unemployment rate, far from being exceptional, is right where you’d expect it to be.

This isn’t the whole Texas story, but it’s a big part of it. The 2008 financial collapse was primarily a story of a housing bubble caused by mortgage lenders run amok, and Texas mostly avoided that. This means it’s also avoided the worst of the unemployment crisis. No miracle. Just common sense financial regulation. Mike has more details at the link.

What’s ironic about this is that most of the things that have helped Texas during the recession aren’t really exportable to the rest of the country. Not every state can be in the Sun Belt, not every state can have lots of open land and low housing prices, not every state can have a thriving energy sector, and a regulatory race to the bottom doesn’t do the country as a whole any good. But one thing that is exportable is tighter government regulation of the mortgage market. It works! Even though Texas is a fast-growing, warm-weather state, it avoided most of the housing madness. But that’s the one thing you’ll probably never hear from Rick Perry. Too bad.