BATS, based in Kansas City, is the third-largest stock exchange in the country. This morning they went public, offering shares in BATS to the public for the first time. Naturally, shares in BATS were traded on BATS itself.

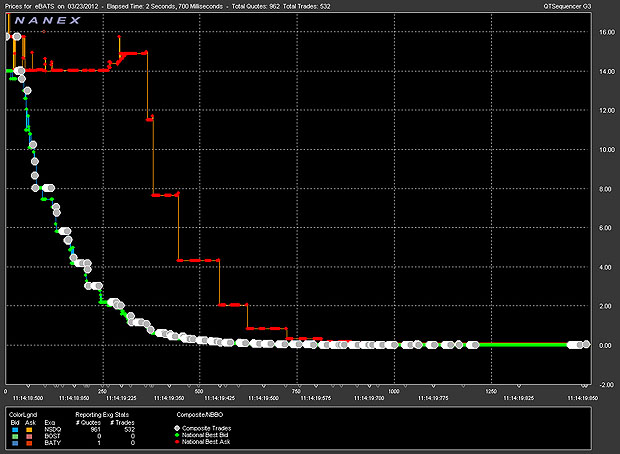

So what happened? At 10:45 AM trading opened and was halted immediately because of a software glitch. At 11:14:18 trading resumed. At 11:14:19:850 — that is, less than two seconds later — the stock had crashed to one-hundredth of a cent. That is not a typo. Via Zero Hedge, here’s a chart showing the first two seconds of trading:

From the Wall Street Journal’s report:

The day’s events may rekindle questions about the reliability of the stock-market’s plumbing, questions that came into sharp focus almost two years ago when the broader market plunged hundreds of points within minutes in what came to be known as the “flash crash.”

….BATS, which stands for Better Alternative Trading System, was launched in 2005 by Dave Cummings, a pioneer in high-frequency trading, to compete with more traditional markets such as the NYSE and Nasdaq. It was designed for speed and gained favor with sophisticated trading firms, in part because it rarely had technical glitches.

Take your pick: (a) This is just a software glitch. It could happen to anyone. (b) This is what happens when the financial market is controlled by computer algorithms, not human beings. It may be “just a glitch,” but it’s a telling one. Next time it could end up being more than just an embarrassing moment.