I’m a big fat granny-hating sellout, which probably explains why I think a deal to make Social Security solvent would be a good idea. But Dick Durbin is a liberal hero, and guess what? He wants to make a deal too:

I believe we need a new bipartisan commission to recommend a plan to keep Social Security solvent for the next 75 years. The commission should have a reasonable amount of time — eight months to a year — to present a plan to Congress. Congress should vote on the commission’s plan and any other bipartisan plan that makes Social Security solvent for 75 years. Whatever plans wins the most votes — beyond the 60 votes you need to pass anything of significance in the Senate — is the plan that ought to move forward.

Fine. But it’s worth answering a few questions I’ve gotten about this. First question: I’ve suggested that a successful deal would take Social Security off the table for decades. But didn’t the Greenspan Commission think they’d taken Social Security off the table forever back in 1983? Now it’s popped back up. What’s the deal?

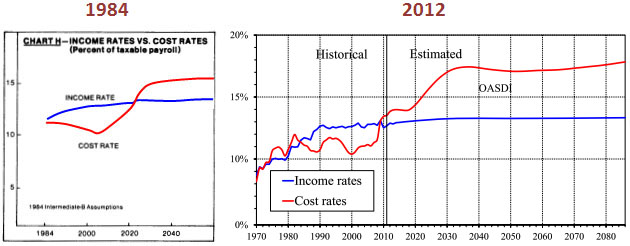

Answer: That was never their intent. The commission’s plan was to make Social Security solvent over 75 years by building up a surplus through 2020 and then using the surplus to pay off the retiring baby boomers through 2060. After the surplus had been used up, however, they knew perfectly well that Social Security would be insolvent again. In fact, on an ongoing basis, their estimate of Social Security’s shortfall is pretty similar to our current estimate, as the charts below show:

Thirty years have passed since the Greenspan Commission’s report, and our job now is to finish their unfinished business by figuring out how to make Social Security solvent after the surplus is exhausted. If we do this without trust fund gimmickry, it really will make the system fully funded more or less permanently.

Second question: Why bother with this now? At worst, the trust fund surplus will run out around 2040 or so. Why not wait and see how things work out?

Actually, I’m fine with that. Another ten years won’t do any harm, and we’ll have a better picture of where the economy is headed by then. Still, if we start earlier, it allows us to phase in changes more slowly, and I think there really is a benefit to this. It makes the impact on both current workers and current retirees smaller, and it allows everyone to plan better.

Third question: Why are people like me talking about a compromise approach that includes both tax increases and benefit cuts? Social Security isn’t a very generous program to begin with. If it needs fixing, it should be done solely through tax increases.

That’s a reasonable view, but I don’t think it’s a realistic one. I believe Social Security should be broadly financed, so I don’t favor closing its shortfall with a whopping big tax increase on the rich. And benefits are scheduled to increase over the years, so what we’re talking about here is a smaller increase, not a cut in absolute terms. A blended approach—say, two dollars of revenue increases for each dollar of benefit cuts—that gradually increased payments to low earners, reduced payments to higher earners, and increased taxes broadly, would be pretty tolerable if it were phased in over 20 or 30 years.

Fourth question: Isn’t this just pie in the sky? Yes, it absolutely is. Even squishy sellouts like me are only in favor of a deal that includes both small revenue increases as well as small cuts in future benefit growth. However, there’s approximately zero chance of Republicans agreeing to any revenue increases, which means no deal is really on the horizon.

And let’s make this more specific. Right now, there’s a proposal on the table to change Social Security’s inflation indexing formula in a way that would slow the growth of future benefits. This is a defensible idea (though see Dean Baker for a dissenting view), but under no circumstances should it ever be passed on a standalone basis. It should only be passed, if at all, if it’s accompanied by a revenue increase that’s at least as large.

That said, a compromise deal would shore up a key program of the liberal project and put an end to scary stories about how Social Security won’t be around for today’s younger workers. I’m in favor of young people having confidence in liberal programs, and that’s why I think a deal would be good for us lefties. The only problem is finding enough Republicans who agree.