Dave Weigel complains today that too many rich people have no idea how income taxes work. They’ve heard that Obama wants to raise tax rates on people who make more than $250,000, so they’re working on ways to keep their income right at $249,000. After all, if they go over the threshold, they’d suddenly have to pay the higher rate, and it would be a net loss.

This isn’t true, of course. Obama is only proposing to raise tax rates on income over $250,000, so if your income goes up to $251,000, you only pay the higher rate on the extra $1,000. The tax bill on your first $250,000 stays exactly the same.

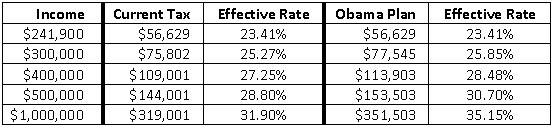

But that’s hard to explain, and we’re all about solutions here, not petty griping. So I have the answer: an EZ-to-Read table that compares total taxes paid under the old Bush rates and the proposed Obama rates. It starts at $241,900 because that’s $250,000 minus the standard deduction, and it’s for married couples filing jointly.

Example: under the current Bush tax rates, a couple making $300,000 pays $75,802, or 25.27% of their total income. Under Obama’s plan, the rate goes up on the amount over $241,900, so they pay a whopping $2,000 more, or 25.85% of total income. Millionaires will pay $32,000 more. Raw data here. Share this with all your rich friends!