My favorite indicator of out-of-whack housing prices has always been the price-to-rent ratio. The rationale behind keeping an eye on it is pretty simple: rent is basically the return you get from investing in a home, so if the price of buying a home goes way up but the rent doesn’t, it means the return on investment from housing is declining. However, the only reason to make an investment with a low return is because you’re betting that the value of the home itself will keep rising, and at some point that simply makes no sense. Why should the value of a home keep rising if it remains a low return investment? Basically, you’re betting on a bubble.

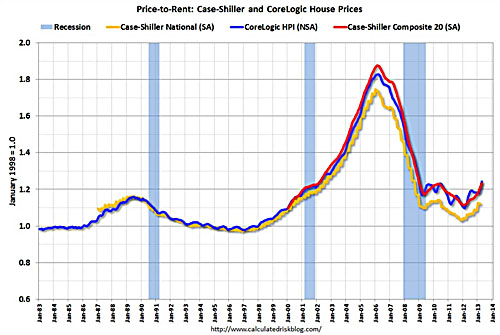

The chart below, from Calculated Risk, shows the price-to-rent ratio (indexed to 1998 = 1.0) for the past few decades. Obviously things got way out of control from 2002 through 2006, and by 2012 it looked as though average house prices had retreated to reasonable levels. However, for the past 18 months the price-to-rent ratio has been rising fairly sharply. It’s too early to say that we’re in any kind of danger zone yet, but it’s worth staying vigilant. Given the weakness of the recovery and the weakness of income growth, it’s hard to think of too many good reasons that home values should be outpacing rents by very much.