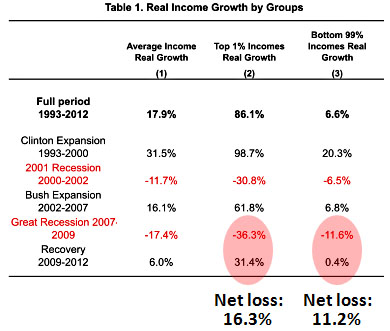

Via Matt Yglesias, I see that Emmanuel Saez released some new income inequality figures a few days ago, and the headline result is predictable: the super rich are doing really well! Since 2009, incomes of the top 1% have grown by 31 percent, while the  incomes of the other 99% have been flat.

incomes of the other 99% have been flat.

Now, I imagine that apologists for the rich are going to point out that their recent winnings still don’t make up for their losses during the Great Recession. And that’s true. As the annotated chart on the right shows, since the 2007 peak the rich have suffered an average income loss of 16.3 percent. The rest of us have done better: our incomes are down only 11.2 percent.

But this is meaningless. For starters, an 11.2 percent drop for someone making 15 bucks an hour is a helluva lot more painful than a 16.3 percent drop for a millionaire.

More importantly, economic expansions are always where the action is for the rich. When you combine their gains from expansions with their losses from the subsequent recessions, they always do better than the non-rich. They did 25 percentage points better during the Clinton era and 9 points better during the Bush era. When the next recession hits, their net gains will, once again, almost certainly be higher than the rest of us. If you look at complete economic cycles—as you should—the rich have pulled ahead in every single one since 1980. Right now, there’s no reason to think that the next time will be any different.