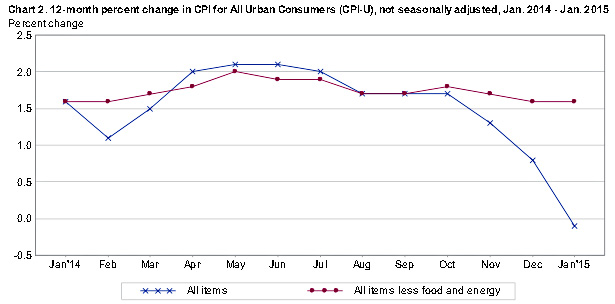

The BLS released its January inflation report today, and guess what? Hyperinflation continues to be kept at bay. In fact, the CPI didn’t just stay at a low level in January, it was actually negative. Compared to a month ago, prices dropped 0.7 percent. Compared to a year ago, prices dropped 0.1 percent (blue line in chart below):

This will cause Paul Krugman to dance another victory jig, but the number the Fed really cares about is core inflation, which excludes food and energy (red line in the chart). This is because food and energy tend to be volatile, which makes them unreliable guides to the long-term trajectory of inflation. The core rate is a better predictor of that. But the news is good here too: Core inflation remained low and stable, increasing only 1.6 percent compared to a year ago.

According to the BLS, gasoline was “overwhelmingly” the cause of the sharp decline in the overall CPI, and it’s unlikely that this will continue. Gasoline prices have probably fallen about as much as they can, and over the next year will remain stable or perhaps rise a bit. But there’s no telling for sure because energy prices are volatile. That’s the whole point of focusing on core inflation.

In any case, as you can see, core inflation has remained below the Fed’s 2 percent target for quite a while. Two years, in fact. This is why Krugman and many others are urging the Fed to hold off on raising interest rates. The labor market still has some slack, and there’s simply no sign of inflation on the horizon—and when there is, there will be plenty of time to act. After all, if the Fed can tolerate two years of inflation below their target, they can tolerate a year or two of inflation above their target. What’s more, there’s no risk here. The Fed knows perfectly well how to get inflation down if and when it gets above target for a sustained period.

In other news, wages are up a bit:

Real average hourly earnings for production and nonsupervisory employees rose 1.3 percent from December to January, seasonally adjusted. This result stems from a 0.3 percent increase in average hourly earnings combined with a 0.9 percent decrease in the Consumer Price Index for Urban Wage Earners and Clerical Workers.

That’s nice, but note that it’s mainly an artifact of negative inflation. If you think of core inflation as the better measure of long-term price levels, wages are up only slightly. That’s better than nothing, of course, but still nowhere near a sign of dangerous tightness in the labor market.

Bottom line: Inflation continues to be well controlled. There’s no need to give up on loose monetary policy yet. Let’s wait until the labor market looks like it’s really picking up again.