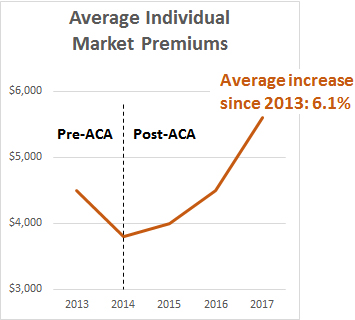

I’ve mentioned before that Obamacare premiums started out too low in their first year, which explains (a) why so many insurers have had trouble making money in the exchanges, and (b) why premiums increased so much this year. But maybe a chart will make this clearer.

I’ve mentioned before that Obamacare premiums started out too low in their first year, which explains (a) why so many insurers have had trouble making money in the exchanges, and (b) why premiums increased so much this year. But maybe a chart will make this clearer.

This is based on data from Health Affairs last year, updated with the big increase in premiums this year. What it shows fairly clearly is that the cost of individual premiums dropped in 2014 when the Obamacare exchanges started up—even though Obamacare policies generally provided better coverage. When you factor in the big increase for next year, average premiums will have risen from $4,500 to $5,600 since 2013.

That’s an annual increase of 6.1 percent, about the same as the average annual increase in employer plans over the past decade.

The usual caveats apply. These are averages: some people do better, some do worse. And for people who qualify for Obamacare subsidies, the actual increase in the amount they have to pay is very small. Overall, though, the point here is clear: if premiums had just risen at a steady 6 percent per year, nobody would be bent out of shape. The reason this is hitting so hard is because insurance companies screwed up their projections when Obamacare started up and now they have to make up for it.