Last year, several insurance companies abandoned Obamacare because they were losing money. This year, premiums have spiked 25 percent on the exchanges. As a result, Paul Ryan says insurance markets are “collapsing,” and Republicans are promising to repeal Obamacare practically on Day 1 after Donald Trump takes office.

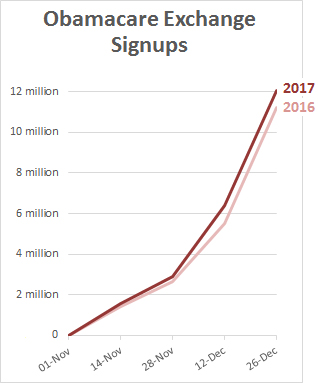

But a funny thing has happened on the way to the collapse: Obamacare is more popular than ever. Charles Gaba is the go-to guy for Obamacare enrollment data, and the simplified chart on the right is based on his more detailed versions here and here. Last year at this time, a little over 11 million people had signed up on the exchanges.  This year, a little over 12 million have signed up. Here’s what this means:

This year, a little over 12 million have signed up. Here’s what this means:

With premiums up 25 percent, a little arithmetic suggests that insurance company revenue from Obamacare will be more than a third higher this year than last year.

Time will tell what this means, but it doesn’t look like a death spiral. The premium hikes are painful, but clearly people find health insurance worth it even at the higher price. What’s more, about 85 percent of Obamacare customers qualify for federal subsidies, and for them premiums are up only slightly—and not even that much if they also shop around.

So: insurance companies will be in pretty good shape this year. A few people have seen sharp premium increases, but the vast majority haven’t. Uncle Sam is picking up most of the tab. In other words, 2017 is shaping up to be the healthiest year on record for Obamacare.