Bloomberg reports that foreigners are tripping over themselves to unload their holdings of US treasuries:

In the age of Trump, America’s biggest foreign creditors are suddenly having second thoughts about financing the U.S. government.

….From Tokyo to Beijing and London, the consensus is clear: few overseas investors want to step into the $13.9 trillion U.S. Treasury market right now. Whether it’s the prospect of bigger deficits and more inflation under President Donald Trump or higher interest rates from the Federal Reserve, the world’s safest debt market seems less of a sure thing — particularly after the upswing in yields since November. And then there is Trump’s penchant for saber rattling, which has made staying home that much easier.

….Combined with the unpredictability of Trump’s tweet storms, interest-rate increases in the U.S. could further sap overseas demand….Right now, it’s just “much easier to stay home than go abroad,” said Shyam Rajan, Bank of America’s head of U.S. rates strategy.

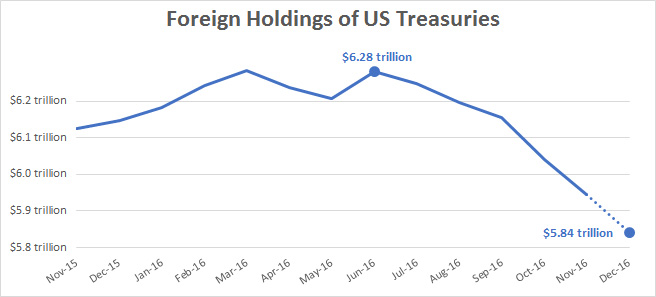

Hmmm. The age of Trump? According to the Treasury Department, the selloff started in June:

Preliminary figures from Japan suggest that December will be much the same as November, which means foreigners will have sold off nearly a half-trillion dollars worth of treasuries in six months. That’s 7 percent of their total holdings. The only other time there’s been a selloff this sustained was at the tail end of the dotcom boom.

But is it Trump’s fault? Nobody thought he had a chance of winning until November, so it’s hard to see how he could have caused uneasiness with federal debt back in June. I don’t imagine Trump has done the US debt market any favors, but on this score, at least, I suspect he’s getting more blame than he deserves.