The Republican tax bill has lots and lots of odd provisions which I’m only now learning about. For example, did you know that it bans tax-free bonds for building sports stadiums? I like that one, actually, though I’m not quite sure what the justification is.

But whatever the reason, it’s small potatoes. How much money does Uncle Sam lose due to tax free stadium bonds? Or tax-free “employee achievement awards”? Or teachers writing off the cost of supplies? Practically nothing. But I can name one thing that costs the Treasury a ton of money: corporate profits held in offshore tax havens. This is from Gabriel Zucman, our reigning expert on such things:

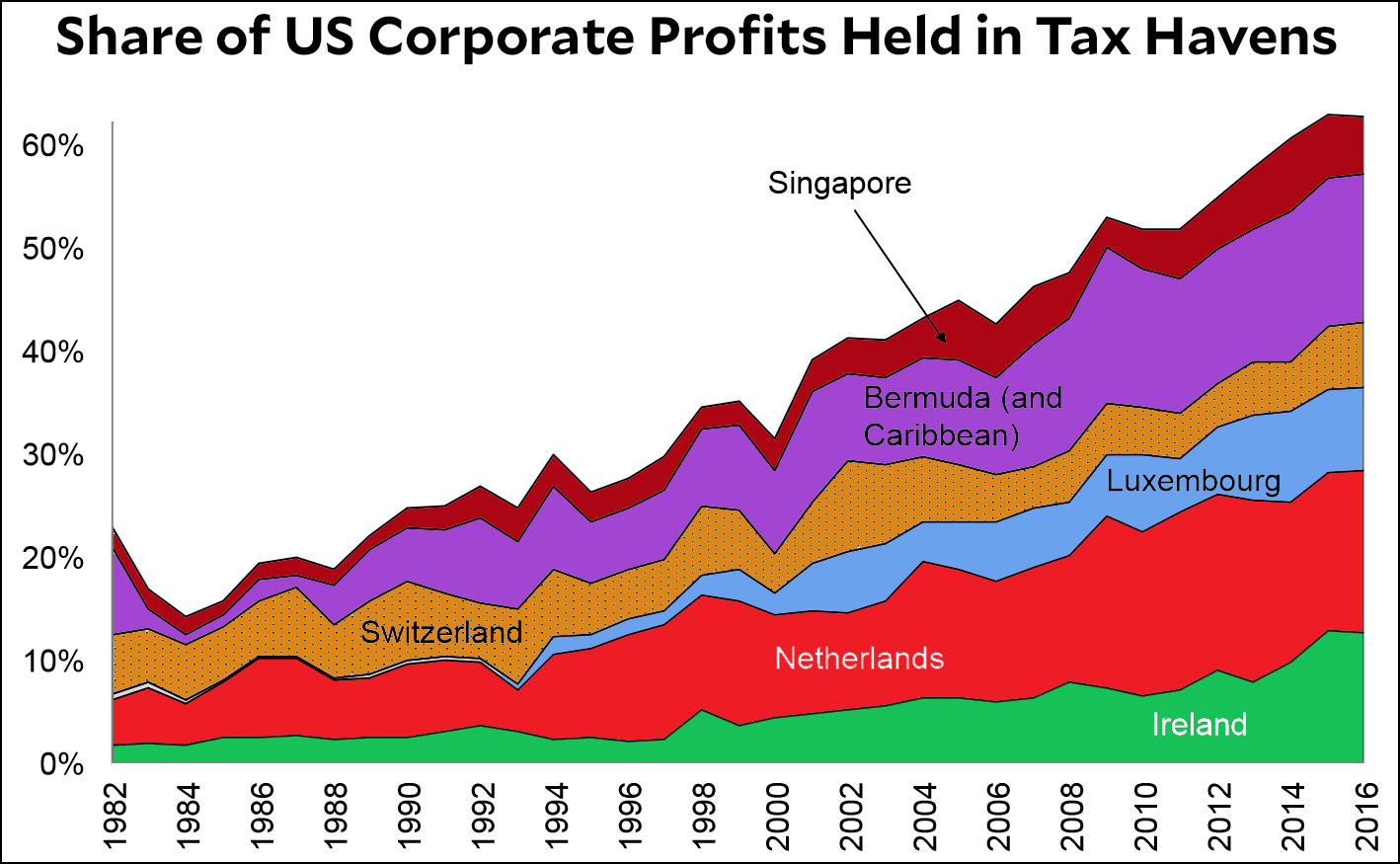

I have taken the liberty of making Zucman’s chart more colorful in hopes that it will eventually attract a mate.¹ But even on its own, it shows that the percentage of corporate profits held in tax havens has steadily risen for decades and now stands at triple the amount of the mid-80s. This would be a great loophole to close as a companion to lowering the corporate tax rate. You know, broadening the base and all that.

But of course the Republican tax bill does nothing of the sort. In fact, the GOP would like to offer a lovely tax holiday that allows corporations to repatriate all this money at a tax rate of 10 percent. Normally they hate amnesties, but for some reason they like this one. I wonder why?

¹Sorry. This joke will become clearer later in the day. Or maybe tomorrow.