This popped up in my Twitter feed a few minutes ago:

Let’s find out! Schmitt’s tweet links to an excerpt from Rana Foroohar’s book, Makers and Takers. Here’s the original quote:

If you wonder why most businesses still think of shareholders as their main priority or treat skilled labor as a cost rather than an asset—or why 80 percent of CEOs surveyed in one study said they’d pass up making an investment that would fuel a decade’s worth of innovation if it meant they’d miss a quarter of earnings results—it’s because that’s exactly what they are being educated to do.

Schmitt got the quote right, so he’s off the hook. Now let’s take a look at the book. The survey in question turns out to be from an article titled “Value Destruction and Financial Reporting Decisions” in the December 2006 issue of the Financial Analysts Journal. Right away there’s a problem: the authors surveyed CFOs, not CEOs.

So: did 80 percent of CFOs say they’d pass up a great investment if it meant missing a single quarter’s earnings? The article is only 12 pages long and it takes just a few minutes to read. If there’s anything like that in it, I sure couldn’t find it. Here are the statements that come anywhere close:

- 80 percent of survey participants would decrease discretionary spending (e.g., R&D, advertising, maintenance) to meet an earnings target, “even though many CFOs acknowledge that suboptimal maintenance and other spending can be value destroying.”

- About 78 percent of CFOs say they’d sacrifice some amount of value in order to maintain smooth earnings growth. However, less than 30 percent would sacrifice a moderate amount of value and only a tiny handful would sacrifice a large amount of value.

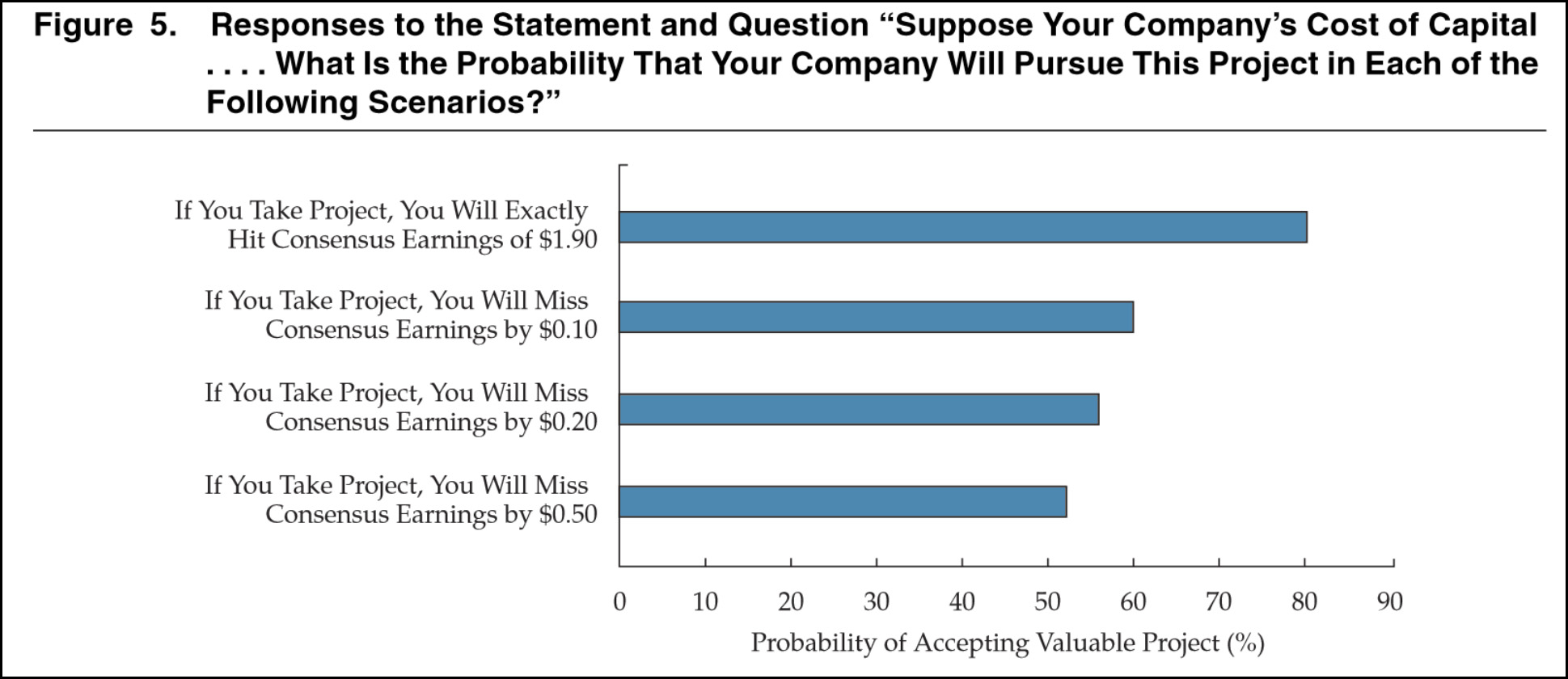

- Given a project with a positive but small future return, 59 percent say they’d accept it even if it meant they’d miss consensus EPS by 10 cents. About 52 percent say they’d accept it even if it meant missing EPS by 50 cents.

So what have we learned by clicking the link? First, it’s a survey of CFOs, not CEOs. Second, nothing in the results is anywhere close to “80 percent” saying they’d pass up an investment that would “fuel a decade’s worth of innovation” if it meant they’d miss an earnings estimate. It’s more like 41 percent saying their company would probably pass up a barely profitable project if it meant missing an earnings target.

Other than that, it was spot on.