So how is Obamacare doing? We already know that it ended the 2018 enrollment period with only slightly fewer signups than 2017. That’s not bad considering the relentless campaign of sabotage that Donald Trump engaged in.

But how about insurers? They didn’t abandon the Obamacare exchanges in nearly the numbers some people were afraid of. The Kaiser Family Foundation gives us an idea why:

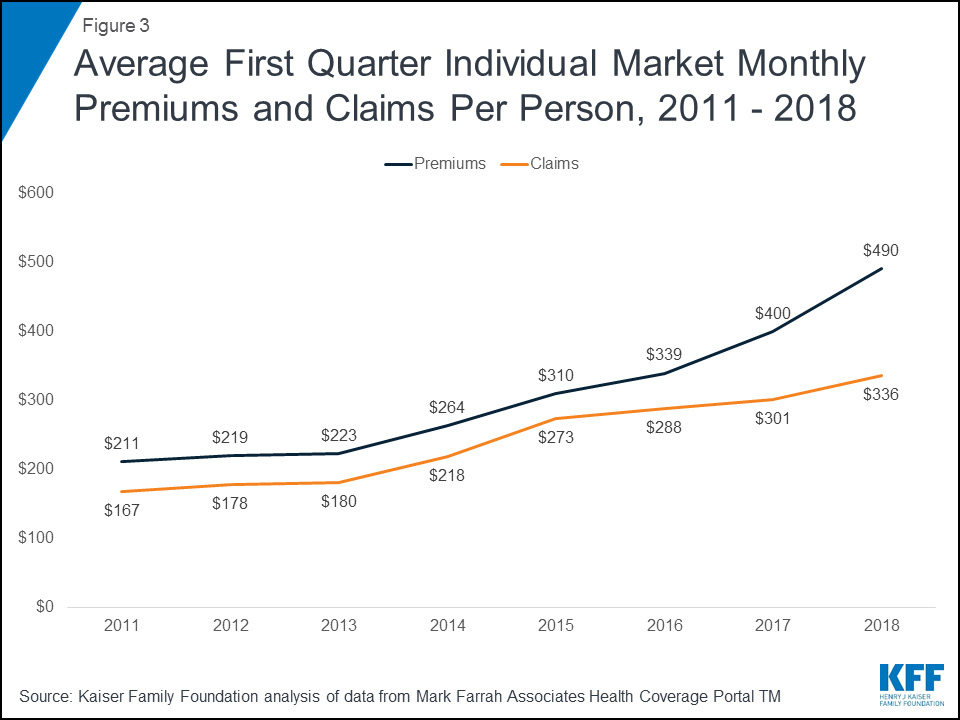

When Obamacare started up, insurers on average charged premiums that were only about $600 per year more than medical claims. That’s not enough for them to stay profitable in a broad market where they’re required to cover anyone who applies.¹ Last year, however, they charged about $1,200 more, and this year they’re charging $1,800 more. That’s plenty to stay in the black:

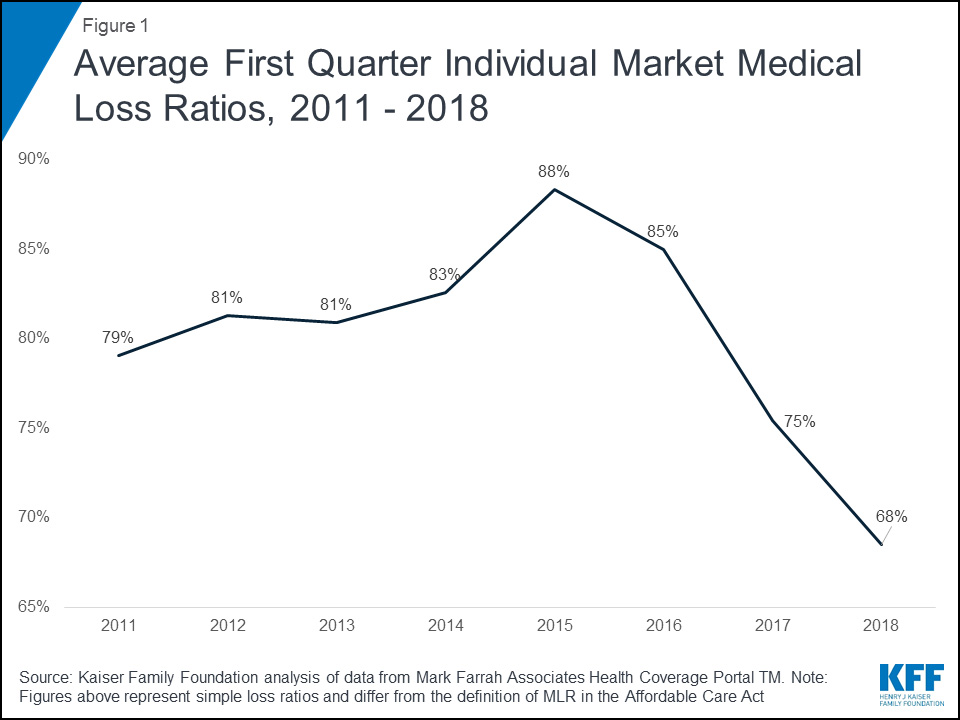

The medical loss ratio is the percentage of premium dollars paid out in claims. For ordinary employer health insurance it’s around 90 percent. The individual market has more overhead, so maintaining profitability requires a lower MLR—somewhere in the range of 80-85 percent, which is what Obamacare mandates.

In its first three years, the MLR for Obamacare insurers was barely in that range, which meant insurers were on rocky ground. Last year, after big premium increases, the MLR dropped to 75 percent, and this year it’s down to 68 percent. That’s plenty to maintain profitability. It’s so good, in fact, that most insurers will be required to rebate some of their premiums in order to maintain the 80-85 percent level required by Obamacare.

In other words, the sabotage isn’t working. Consumers continue to enroll and insurers have enough experience under their belts to do their underwriting more accurately. This means that Obamacare really shouldn’t see big premium increases in most states this year. We’ll see.

¹Though it’s enough in a market where you insure only healthy people and turn down anyone with a pre-existing condition.