Former California controller Steve Westly writes in the LA Times today that he doesn’t favor making gig workers either pure contractors or pure employees. He favors a middle ground called “dependent workers” that’s used in Canada and Spain.

There might be something to this—I’m agnostic about it for now—but I want to point to one specific part of his argument:

It’s important to remember that Uber and many other gig economy companies are not profitable. Uber is currently losing over $1 billion a quarter and is likely to have an extremely difficult time raising future rounds of capital. This is especially true if it is forced to pay higher wages and benefits — and profitability is no longer in sight. If Uber or any of these companies goes out of business, everyone loses. A negotiated compromise could obtain higher wages for workers without putting companies on the hook for full benefits for all.

This is technically true. However, it’s worth pointing out something that few people seem to know:

Uber’s profitability target rests heavily on the success of its ride-hailing service, which brings in three-quarters of the company’s revenue and is its only profitable business unit before interest, taxes, depreciation and amortization.

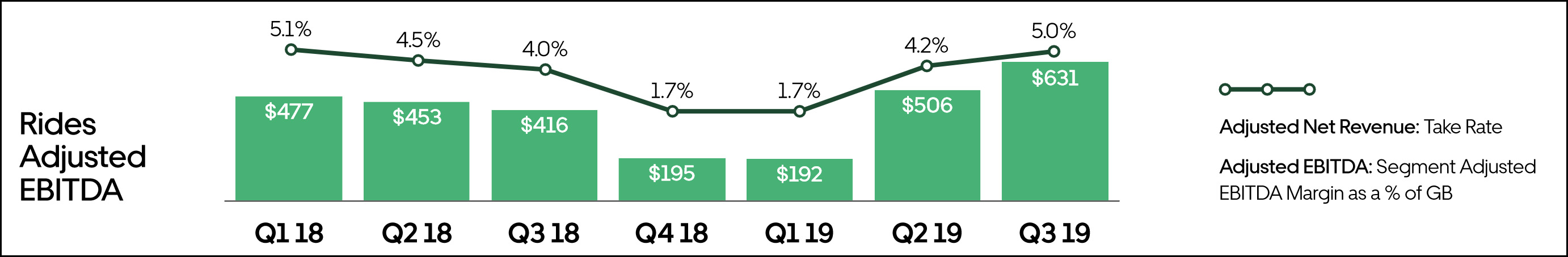

In fact, Uber has reported profitability in its ride-hailing business for the past two years:

Now, it’s true that this is funny-money non-GAAP profitability, so don’t take the exact figures too seriously. Still the profit numbers aren’t generally way different even when they’re reported on a conventional GAAP basis, which suggests that in ride hailing, which is what most people think of as “Uber’s business,” it is profitable. That is, the ride-hailing business would be profitable if Uber simply ran a ride-hailing business.

So why is the company as a whole so massively unprofitable? Because Uber has chosen to plow its profits (and more) into new areas that require enormous spending on both R&D charged to the corporation as well as other corporate expenses. There’s nothing inherently wrong with this—Amazon has done spectacularly well plowing profits into new businesses—but it’s a separate issue for investors, who have to decide what they think about the future of these risky bets. Conversely, if you want to know if the ride-hailing business can afford to pay its workers more, you should look solely at the ride-hailing business. And according to Uber, at least, their ride-hailing biz will earn nearly $2 billion this year. That’s the right metric for evaluating their ability to pay their drivers more.