Over at The Corner, Jim Geraghty passes along the results of a survey about the Republican tax cut of 2017:

Kiplinger’s Personal Finance magazine surveyed 852 taxpayers in December about the tax cuts enacted in 2017, and how it affected their income taxes. The results will probably disappoint both fans and critics of the tax cuts. When asked how the 2017 tax changes affected their last return, 59 percent said, “my taxes remained the same,” 22 percent said they owed less, 19 percent said they owed more.

I find this poll useful because none of the questions was about whether the respondent supported the tax cuts or thought they were a good idea, or how the respondent felt about President Trump or Congress….To hear a lot of Republicans tell it, the tax cuts put a lot more money in Americans’ wallets, and to hear a lot of Democrats tell it, the tax cuts were a disastrous giveaway to the rich that socked it to the middle class. Judging from these poll results, most Americans didn’t feel much of an impact either way.

Two things. First, I don’t think liberals ever suggested that the tax cut would “sock it to the middle class.” Our contention was only that it wouldn’t do much of anything for the middle class, and the Kiplinger survey confirms that this is what happened.

Second, a survey like this doesn’t catch the impact of these tax cuts on very high earners. Partly this is because high earners tend not to participate in telephone polls like this, and partly it’s because there aren’t very many of them in the first place. At a guess, the Kiplinger survey reached no more than 30 or 40 high earners at most. Even if every single one of them said that they owed less in taxes, that would affect the overall results by only two or three percentage points. You’d never notice it. However, the CBO provides this projection:

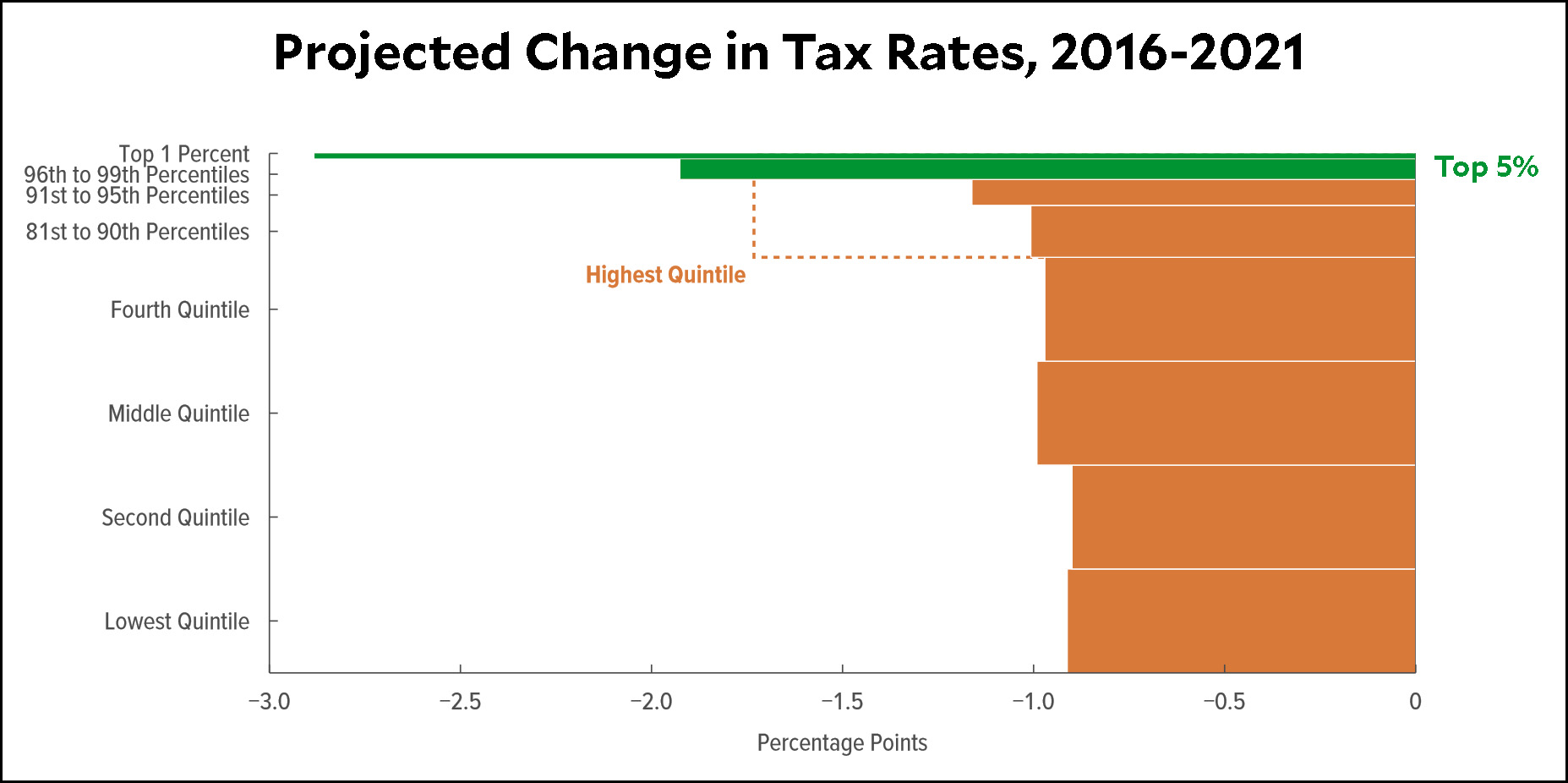

As you can see, the entire bottom 95 percent got a tax cut of less than one percent—and even that’s misleading since it includes the imputed share of the corporate part of the tax cut. For somebody who pays a few thousand dollars in taxes, this amounts to thirty or forty bucks. That’s not enough to take your family out to a movie.

But the affluent did much better. The top one percent may not affect the survey numbers, but that doesn’t mean they didn’t make out pretty well. The average one-percenter earns nearly $2 million, which means that a 3 percent tax cut saves them about $40-50,000. Not bad!

So if you look at the whole picture, it turns out that the Republican tax cut was indeed a huge giveaway to the rich, but did almost nothing for the middle class. And that’s exactly what liberals warned of.