At first glance, our newfound view into Donald Trump’s finances hasn’t shed a lot of new light on things. In a nutshell, Trump built his first empire by borrowing lots of money and blowing through it; then he inherited lots of money and blew through it; and then he made a lot of money on TV and blew through it. Along the way he employed lots of clever tax avoidance schemes, as rich people do. It’s not clear that any of it was illegal (though there’s good evidence that some of his earlier tax scams were). That said, there’s certainly one odd thing that jumps out at you when you look at Trump’s annual income over the years. First, though, a very brief recap of Trump’s business career:

Phase 1 (1983) — Trump builds Trump Tower. It’s a perfectly good project that remains profitable to this day.

Phase 2 (1984-1991) — Trump goes crazy, borrowing huge sums to overpay for airlines, football teams, the Trump Plaza hotel, and casinos in Atlantic City. It all ends in 1991 when the Trump Organization goes bankrupt.

Phase 3 (1992-1999) — Trump digs his way out of bankruptcy, helped along by hundreds of millions of dollars funneled to him by his father. This is also the phase in which he packages most of his bad casino debt into a single company that he takes public. Trump pays himself millions of dollars for managing this business, but anyone who invested in it loses every penny.

Phase 4 (2000-2004) — After the death of his father, Trump buys a few golf courses.

Phase 5 (2005-2011) — Trump reaps hundreds of millions of dollars from his part ownership in The Apprentice. During this period he goes on a huge buying spree, mostly snapping up golf courses that he overpays for. These transactions are almost all in cash.

Phase 6 (2012-present) — Revenue from The Apprentice and from licensing starts to dry up. He reports negative income on his tax returns. But he continues his buying spree—most of it in cash—overpaying for Scottish and Irish golf courses, pouring money into renovations, and bidding for a lease to turn the Old Post Office into a hotel. His bid for the hotel is widely believed to be far higher than the cash flow from a downtown hotel can ever support.

Here’s the odd thing: In order to stay solvent, Trump has always needed fresh flows of cash from outside his main business. Always. In Phase 2 he borrowed it. In Phase 3 he got it from his father. In Phase 5 he got it from The Apprentice.

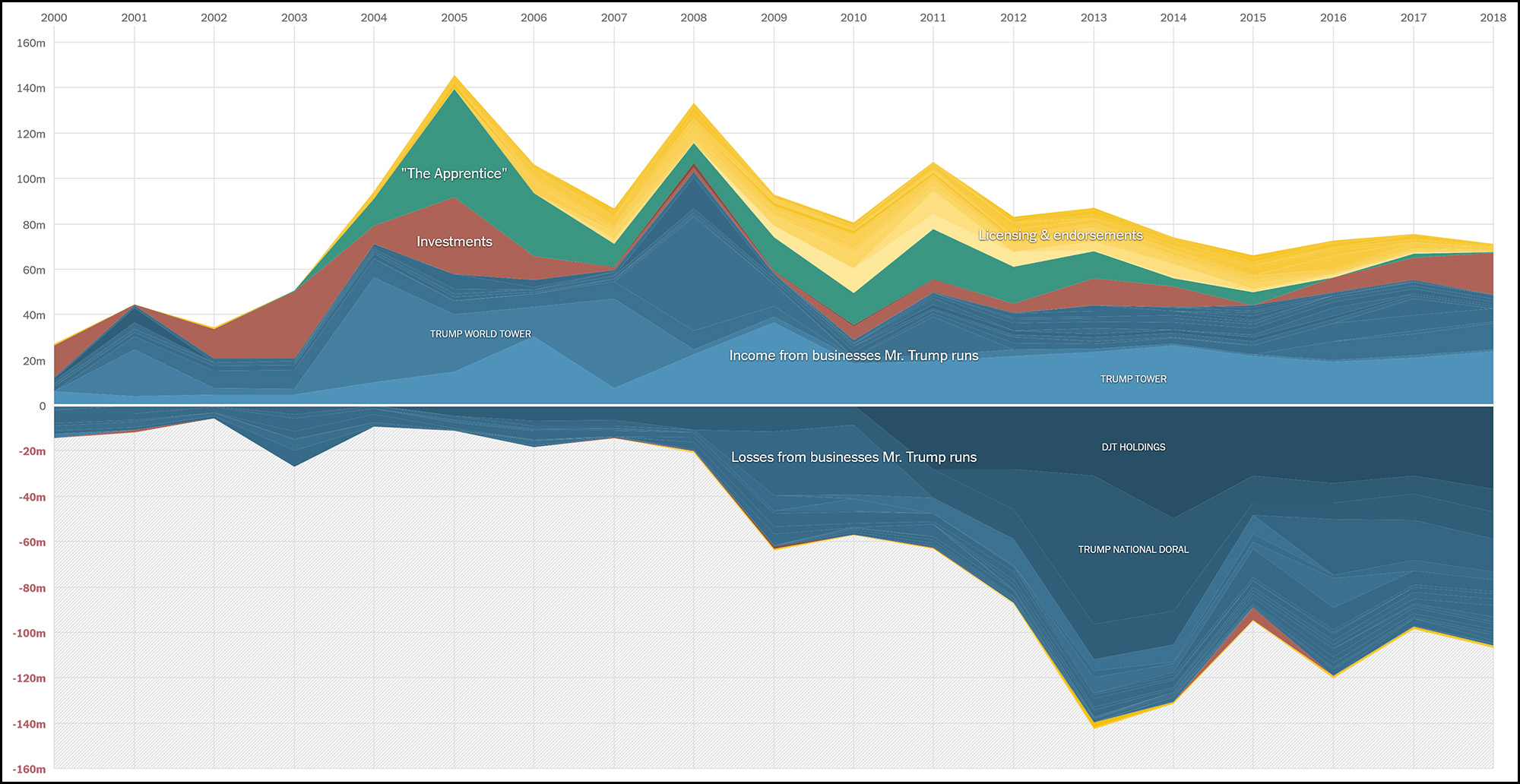

But now we’re in Phase 6. Take a look at the chart of Trump’s finances that the New York Times put together:

In 2009, losses from Trump’s businesses get bigger, but this is likely due to the Great Recession. In 2012, however, with the economy recovering, Trump suddenly starts showing huge losses in his real estate business (DJT Holdings) and in his golf courses. He has kept up these losses to this day. This makes no sense, especially since these losses almost have to be deliberate. Why is Trump dumping boatload after boatload of his own cash into money-losing enterprises?

In the past, Trump has always financed these splurges with outside income streams, but his old income streams have mostly dried up. So what’s his new one? And who controls it? It’s possible that the answer is “no one,” and Trump is just idiotically pouring his fortune down a rat hole. But at this point it’s a legitimate national security question to want to know the answer.