Phil Gramm is in the headlines today–being slammed by Democrats and disavowed by the McCain campaign–for complaining to The Washington Times that “we have sort of become a nation of whiners.” Gramm, who chairs John McCain’s campaign and who advises the presumptive Republican nominee on economic matters, pooh-poohed talk of a recession: “You’ve heard of mental depression; this is a mental recession.” The former Republican Senator and current vice president of Swiss bank UBS dismissed talk of US economic woes and declared, “We’ve never been more dominant; we’ve never had more natural advantages than we have today. We have benefited greatly” from globalization.

Predictably, liberal bloggers and Democrats blasted Gramm for being out of touch with the real world. The McCain camp initially stood by their man but then distanced itself from Gramm’s remarks, with a McCain spokesman saying, “Gramm’s comments are not representative of John McCain’s views.”

But as this tempest was under way, another Gramm story went little noticed: a top McCain aide indirectly implicated Gramm in the current economic mess.

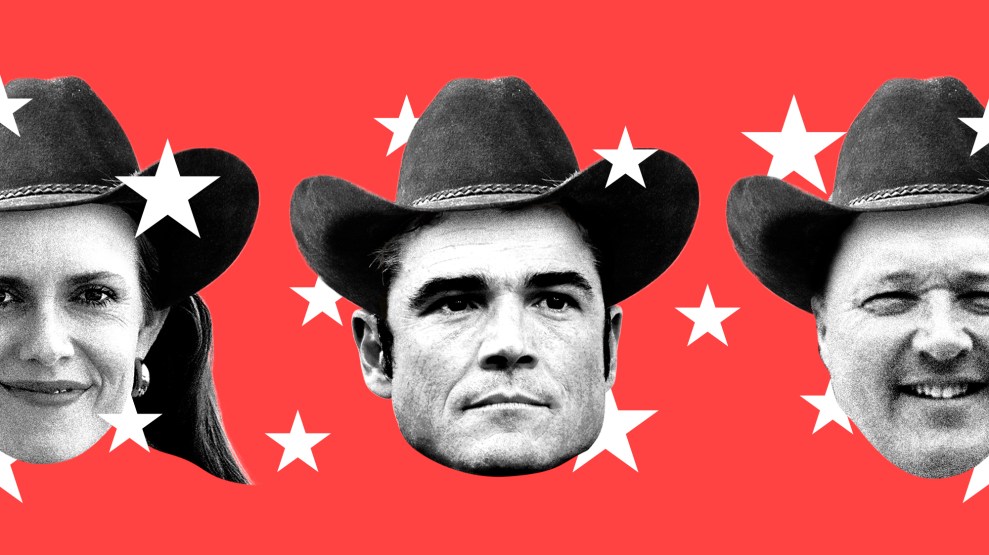

On Thursday, Portfolio magazine released an interview with Carly Fiorina, the former Hewlett-Packard CEO who is now a top adviser and surrogate for McCain. In that article interviewer Lloyd Grove asked Fiorina “who and/or what is to blame for the souring economy?” Her answer:

Well, I think there was a situation where there was greed on Wall Street, there was a lack of transparency around a new set of financial instruments, there were a whole new set of financial instruments, there were a whole new set of financial players who were less regulated than banks, and all that together created a situation, which now is rippling through the economy.

She added: “in this particular case, the financial instruments that were being used, when I say they lacked transparency, people didn’t understand all the connections.”

Today’s economic troubles, Fiorina was saying, were caused in part by insufficient regulation and lack of transparency regarding the latest financial instruments. And who bears some responsibility for that? Phil Gramm.

It was Gramm who used a sly legislative maneuver in late 2000, when he chaired the Senate banking committee, to pass the Commodity Futures Modernization Act–to which practically no one but financial industry lobbyists were paying attention in Washington. This bill prohibited federal agencies from regulating financial products called swaps, which have been used to back up the mortgaged-based securities that caused the subprime crisis. Michael Greenberger, who directed the Commodity Futures Trading Commission’s division of trading and markets in the 1990s, says these unregulated swaps have been at “the heart of the subprime meltdown.” He and others point to Gramm as being chiefly culpable for their deregulation.

So here is one top McCain adviser (touted as a possible running mate for McCain) suggesting that another top McCain adviser (touted as a possible Treasury secretary in a McCain administration) is partly to blame for the current economic downslide, which is not recognized by that second top McCain adviser. Seems as if Fiorina and Gramm need to get on a conference call with McCain and work things out.