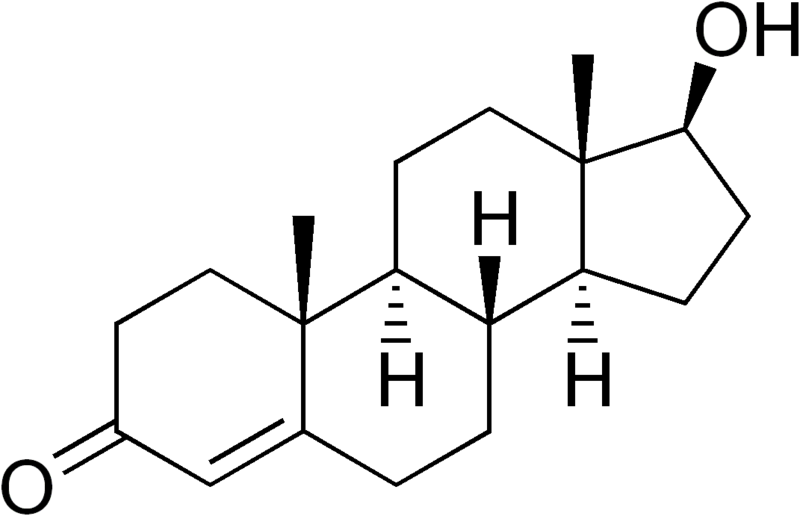

No kidding. A new study finds that higher levels of testosterone correlate with financial risk-taking behavior. A Harvard study assessed men’s testosterone levels before participation in an investment game, and found those whose testosterone levels were more than one standard deviation above the mean invested 12 percent more than the average man in a risky investment.

No kidding. A new study finds that higher levels of testosterone correlate with financial risk-taking behavior. A Harvard study assessed men’s testosterone levels before participation in an investment game, and found those whose testosterone levels were more than one standard deviation above the mean invested 12 percent more than the average man in a risky investment.

A previous study had already proved that men are generally more likely than women to take investment risks. Another demonstrated that male stock market traders experienced greater profits on days their testosterone was above its median level. The Harvard study, forthcoming in Evolution and Human Behavior, was the first study to directly examine, and find a relationship between, testosterone and financial risk-taking.

So, should the Congressional bail-out include estrogen replacement therapy for financially foolish CEOs?

For those interested in the details of the study…

Saliva samples were taken from 98 males aged 18 to 23, before participation in the investment game. The researchers also assessed facial masculinity, associated with testosterone levels at puberty. All players were given $250, and asked to choose an amount between $0 and $250 to invest. The participants kept the money that was not invested. A coin toss determined the investment’s outcome, and if the participant lost the coin toss, the money allocated to the investment was lost. However, if the coin toss was won, the participant would receive two and a half times the amount of their investment. At the end of the study, one person was selected by lottery to receive the cash amount of their investment, which created a monetary incentive for the participants. Men whose testosterone levels were more than one standard deviation above the mean invested 12 percent more than the average man into the risky investment. Men with a facial masculinity score of one standard deviation higher than the mean invested 6 percent more than the average man.

Julia Whitty is Mother Jones’ environmental correspondent, lecturer, and 2008 winner of the Kiriyama Prize and the John Burroughs Medal Award.