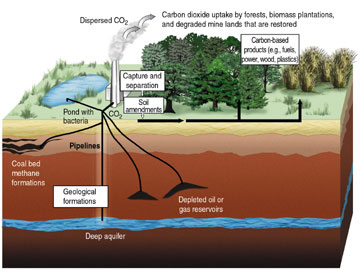

Two new modeling studies are tackling simulations of long-term CO2 storage. The first examines leakage of stored CO2 from abandoned oil wells. The second attempts to simulate the big picture, starting with capture and leading to injection and storage, evaluating costs and risks of potential sites.

Two new modeling studies are tackling simulations of long-term CO2 storage. The first examines leakage of stored CO2 from abandoned oil wells. The second attempts to simulate the big picture, starting with capture and leading to injection and storage, evaluating costs and risks of potential sites.

Both papers are published online at Environmental Science & Technology. Both simulate projects that aim to capture CO2 from power plants and store it underground in aquifers or sedimentary deposits. Pilot carbon capture and storage projects are currently underway in Germany, Norway, Canada, Algeria, and the U.S.

The first paper from the U of Bergen, Norway, and Princeton finds that abandoned wells have created a Swiss-cheese pattern of holes across North America. CO2 can escape from these wells. Undersea storage would avoid the Swiss cheese problem, the authors note. But an ocean solution is more expensive.

The second study from Los Alamos National Laboratory and the National Energy Technology Laboratory created a model to examine a comprehensive approach, including surface injection, leakage, costs and risk analysis. Two sample sites were evaluated, one shallow, one deep. Contrary to expectations, storage was cheaper at the deeper site, despite higher pipeline costs.

Here’s why: In the colder, shallower site, CO2 behaved like a thick liquid. Consequently more wells were needed to absorb the same amount as in the deep well—where CO2 acted like honey, getting more fluid with heat (depth). The greater pressure in the deep site also meant CO2 could be injected at higher pressures without dangerously stressing underground faults and fractures.

These are Faustian bargains, for sure. But we may well find our leaders striking them en route to saving our ass-backwards backsides.

Julia Whitty is Mother Jones’ environmental correspondent, lecturer, and 2008 winner of the PEN USA Literary Award, the Kiriyama Prize and the John Burroughs Medal.