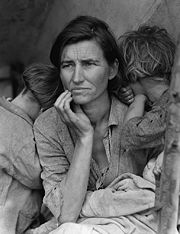

Dorothea Lange

The recession has walloped investment in clean energy. That means we’re no longer on track to avert the worst impacts of climate change, according to a new analysis. (Were we ever on track?)

Anyway… New Energy Finance says that although a depressed global economy will reduce CO2 emissions, funding for energy solutions is decreasing faster and that’s likely to have a worse impact on emissions in the long run.

Here are the stats: Investment in clean energy—make that, renewables, energy efficiency and carbon capture and storage—grew from $34 billion to $150 billion between 2004 and 2008. But investment needs to reach $500 billion a year by 2020. That is if we want CO2 emissions to peak before 2020.

There is currently a generalish consensus that continued growth of emissions beyond 2015 or 2020 at the latest will lead to severe and irreversible climate change (though this will only meet the IPCC‘s relatively generous standard not the 350ppm number that Bill McKibben wrote about recently). The new analysis predicts that a peak before 2020 now looks highly unlikely .

So what do we do? Well, for those who have enough money that they actually do things like make investment decisions, why not move your money to where it’s going to count in more ways than mere money? Invest in clean energy. For those of us who do not have anything resembling spare change, invest in a cleaner energy lifestyle. You know: eat more vegetarian; buy more locally; drive less; kill your clothes dryer; air your clothes more & wash them less (another grandmother solution); buy used; think about the long run more. We’ve talked about these solutions before.

As for why we continue to not do these things, at least on a societal level, Chris Goodall at CarbonCommentary makes some interesting, well, commentary.