Photos: Lucy Gray

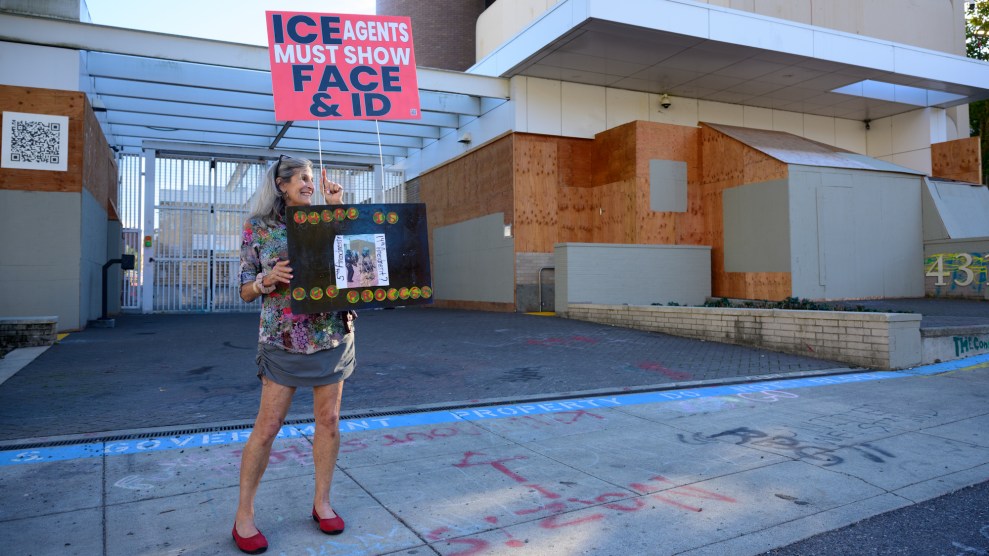

After 18 months and more than 700 sworn testimonies, Congress’ Financial Crisis Inquiry Commission wrapped up its hearings last September with three unscheduled witnesses—a last-minute plea from a lawyer got them included, for five minutes each, at the tail end of the commission’s hearing in Sacramento.

A relative helped 79-year-old Lovie Hollis to the microphone. She testified (pdf) that she and her husband Grafton had raised five daughters in their Sacramento home and had paid off their mortgage but had to sell in 2006 when Grafton could no longer get up the stairs. She did not understand the terms on their new home and was unable to pay when the monthly rate suddenly adjusted upward to nearly three times the original mortgage. She answered an ad offering loan modification help. “Tom” operated out of an office in Hollis’s neighborhood. He told her to stop making loan payments while he worked on her case, took her money (and her car), and fled. Hollis, now a widow, lost her home.

Nia Lavulo, a young Fijian-American, was nervous speaking to a room full of suits. She testified (pdf) that she lost her childhood home when CitiMortgage, Inc. foreclosed without notice. She had signed an agreement with the bank for a trial period of modified loan payments after her partner, Bernard, was laid off. They’d been paying their modified loan on time and in full right up until they were foreclosed, but that didn’t seem to matter to Citi.

Allen Carpenter, a former contractor, marched down the aisle as though on a mission when it was his turn. He testified (pdf) that as the housing market slowed and his income began dropping in 2007, he refinanced his home three times to try and make ends meet. He had not understood the risks involved in taking on an adjustable-rate or interest-only mortgage. First, he went bankrupt. Then he lost his home. He and his wife now live on his social security check and her income as a sales clerk. In a tone of barely controlled anger, he told the commissioners they’d been through a “nightmare.”

“The federal government and the banks are not doing nearly enough to protect consumers like my wife and me,” Carpenter said. “Wells Fargo and other big banks got bailed out even though they are a big reason for the financial mess we are all in.”

The room grew quiet. Chairman Phil Angelides thanked everyone and quickly brought official business to a close. (The commission’s final report—now compromised by Republican members who released their own ‘preliminary findings‘ when Democratic members refused to excise the words “Wall Street,” “shadow banking,” “interconnected,” and “deregulation” from the document—is due to Congress and the president Thursday.) After hearings in 19 hard-hit cities across the nation, these three homeowners were the only actual victims of the mortgage meltdown to be heard.

The numbers are familiar by now. In normal times, banks foreclose on approximately 100,000 homes annually, but from January through September 2010, almost 2.7 million homeowners received foreclosure notices. September alone saw more than 100,000 bank repossessions. According to the Special Inspector General for the Troubled Asset Relief Program, “at that pace, foreclosure notices will have been sent to more than 3.5 million homes” by year end 2010.

California has been hit with more foreclosures than any other state. The 19 counties in its Central Valley region all show up in a bruised-red hue on foreclosure trend-spotter RealtyTrac’s national foreclosure map—indicating high-density home loss.

I wondered what was happening on the ground, to the people who had gone into default or had actually lost their homes. I was also struck by the fact that during the last massive economic crisis to hit this country, this very region was the place to get out of hock and despair.

Back then, drought, farm failures, and foreclosures in the Plains forced hundreds of thousands to move west in search of work. Many of these Dust Bowl migrants followed the harvests in the fertile Central Valley—an odyssey captured by Dorothea Lange, working for the Farm Security Administration, in the 1930s.

Today, when you travel Lange’s 1939 photographic route up Highway 99—as photographer Lucy Gray and I did for four months last spring—you come face to face with the 21st century version of social collapse: Kern County, home to the Weedpatch labor camp made famous in John Steinbeck’s The Grapes of Wrath, has an unemployment rate of 15.4 percent. In Tulare it’s 16.8 percent; and in Merced County, whose largest city, Stockton, was deemed by Forbes the second “most miserable city in the US,” nearly one in five [18.6 percent] can’t find work. The Okies’ promised land has become a wasteland of vacant storefronts and bank-owned homes. The itinerants of Lange and Steinbeck’s day are today’s “chronically unstable.” But unlike their forebears, they have nowhere to go in search of work.

The foreclosure crisis has many causes, from impotent government programs to shadow banking, securitization, predatory lending, borrower overreach, and simple market correction. But the most persistent culprit has been a weak economy that has led to massive job losses and wage cuts. Many families could have survived an ARM in good times but were felled by a pink slip, reduced hours, or unforeseen medical bills.

And, apparently, there’s no point in seeking help from Washington. Early in the 20th century, the Great Depression inflicted enough suffering and stirred up enough of a public outcry that legislation was passed to create a whole string of financial consumer-protection agencies: the Federal Deposit Insurance Corporation to protect individual savings; the Securities and Exchange Commission to regulate investments; the Federal Housing Administration to insure mortgages and home loans. Today, we can’t even get to a bipartisan report on what created the financial collapse, much less the political will to mitigate against a repeat performance.

That no one has been listening, that there is no workable government program to turn to for relief, and that the banks continue to deny permanent loan modifications even after receiving taxpayer bailouts for that very purpose, has frustrated and angered many. The Home Affordable Modification Program (HAMP)—the “socialist” program that set CNBC’s Rick Santelli off on the tear that launched the tea party—was very unpopular among those I talked to in the Central Valley, but for reasons far different than Santelli’s. HAMP was supposed to help between three and four million Americans stay in their homes. The program received $75 billion aimed specifically at incentivizing mortgage companies to lower payments and renegotiate rates for at-risk homeowners. Yet according to the Treasury Department, less than one-third of all temporary modifications through HAMP are made permanent.

Last summer, Sarah Palin passed through the Central Valley to speak at a private fund-raising event at the state university in Turlock. In opening remarks, she gave a shout out to family farmers, many of whom have been slammed by the decline in the price of Stanislaus County’s number-one commodity, milk, saying: “I have great respect for you [and the] business that you want to pass on, generation to generation.” In a 35-minute speech, Palin said “liberty” 18 times and “freedom” 17 times, with nearly as copious references to “threats” to both. But in a county where 1 out of every 99 homeowners has received a foreclosure notice, (the national average is 1 in 492 ), she offered not a peep about the quotidian threats of a mortgage collapse.

In the months I traveled through California’s Central Valley, it was nearly impossible to meet anyone who hadn’t been affected by the foreclosure crisis. One morning I spoke with a HUD-certified mortgage counselor about her clients. She volunteered that her own house in the agricultural town of Visalia was underwater because so many neighbors had been foreclosed and the value of her property had plummeted. She had no plans to walk away from her mortgage, she said. But she understood why many were making a rational economic decision to do just that.

At Wool Growers, a Basque restaurant in Bakersfield that’s been serving pork dip and pink beans in massive family-style helpings for a half-century, our waitress said she was having trouble keeping up with her ARM. Her best friend had just lost her home. Others had gotten caught up in the romance of refinance, using the equity in their home as an ATM. “People actually came to our neighborhood and went door to door asking if folks wanted to fix up their house,” Fresno-area resident Sandra Crump told me. “Everybody jumped on it. Our neighbor down the street lost his house. The people behind us lost their house.” Once hailed as engines of a booming economy, the aspirants to the ownership society now struggled simply to keep a roof over their head.

Here are some of their stories.

Steve Rath, City Manager, Los Banos, California (population 35,000)

Steve Rath, City Manager, Los Banos, California (population 35,000)

Los Banos was a small agricultural town that ballooned when residents of nearby San Jose and the South Bay discovered affordable homes there. “Of course, you know the story. These people were drawn into adjustable rate mortgages and low-interest teaser loans. When the mortgages started to adjust upward, they couldn’t pay,” said City Manager Steve Rath. High-end new homes were the first to default. “I think it’s safe to say that by 2012 at least half of the homes in Los Banos will have gone through foreclosure. Our tax revenues have gone down 90 percent.”

California’s property tax initiative, Proposition 13, guarantees a slow recovery. “Homes that once sold for $400,000—and we would get property tax on $400,000—now sell for $150,000, and the tax base locks in at that level. Even if the economy turns around and in two years that home is back up to $400,000, Prop 13 ensures that property taxes can only increase by a maximum of 2 percent a year.” Today, lush medians that developers keep manicured by city ordinance lead to subdivisions with paved streets but no homes—just tumbleweeds and rusting cable. “I think it will be 10 to 12 years before Los Banos even begins to approach where it was before this crash. We have 2,500 lots on the ground ready for development and they’re not going to be built for years. Even in good times.”

David and Janette Graham, Stockton, California

David and Janette Graham, Stockton, California

Stockton, California—where nearly one in five adults are out of work—holds the dubious honor of making Forbes’ “most miserable cities” list two years running. “We bought a foreclosed house in September 2008 with a 30-year-fixed loan,” said David Graham. “I had a good job at the Stockton Steel plant. I was a shop steward. All those tall buildings in San Francisco? We made them. I had savings. My credit cards were paid down. Everything was fine.”

Then circumstances changed. First, Graham’s wife Janette lost her job at a beauty salon when a degenerative eye disease made it impossible for her to continue working. Then, in October 2009, Graham was laid off. “The company said we’d be back by March 2010. That didn’t happen and they just laid off another 48 guys at the plant.” The Grahams had to decide between health insurance and the mortgage. Savings obliterated and facing foreclosure after the third missed payment, they were forced to sell their house before the bank took it. (After escrow closed, they got a check for $16—their “profit” from the sale of their home.) They now live in a trailer park on the outskirts of town. As he and Janette stood at the threshold of their much diminished circumstances, Graham said, “I kept my nose to the grindstone and did everything a citizen is supposed to do. I bought a foreclosed house. I got a reasonable loan that I could pay off. The bank wanted to give me a bigger loan when they saw how much I made but I said no. We feel like we did something wrong, but we didn’t.”

Gibson Avenue, Clovis, California. Sandra and Jared Crump.

Gibson Avenue, Clovis, California. Sandra and Jared Crump.

Sandra and Jared Crump live in Clovis, a Fresno suburb. Their neighborhood is made up mostly of first-time home owners “trying to get on their feet and get a little bit of the dream,” Sandra said. The Crumps bought their home for $125,000 in 1997, securing a 30-year-fixed. Sandra is 55 and on permanent disability. She opened the door to problems, she said, when she got greedy and insisted they remodel. By 2004, interest rates were low and home improvement shows were proliferating, promoting the idea you could change your life one Kohler faucet, BlueStar oven, or Carrera marble countertop at a time.”We were part of that flood of re-fi’s—people going crazy to get their homes fixed up,” Sandra said. “People actually came to our neighborhood and went door to door asking if folks wanted to fix up their house. Everybody jumped on it. Our neighbor down the street lost his house. The people behind us lost their house.” When the Crumps fell behind on their new adjustable refi, they paid a company nearly $3,000 up front to help them modify their mortgage. (Advance fees like these are now illegal in California.) “We got two months behind and then our lender recommended someone who could help us, supposedly,” Sandra said. “The company took our money and didn’t do a thing. We got six months behind and the bank was getting ready to foreclose. We’re about to lose our home, we’ve been ripped off by this company, and we’re being sued by the credit card company we used to pay for that ‘modification.’ There were times when we did not have food in our house. I had to go to food banks. I borrowed from my mom. My stress level was so high that I was under a doctor’s care. Sometimes I thought I would lose my mind.” According to Stanley Boone, Assistant US Attorney for the district that covers Clovis, the type of mortgage fraud described by the Crumps continues to be widespread. The Crumps eventually found a local nonprofit that helped secure a modification. But, said Sandra, “we’re still struggling because we’re so far behind on everything else. We also discovered that because of the refinance loan we got into, we are going to be paying a million dollars before the house we bought for $125 grand is paid off. And there’s a balloon payment in ten years of about $300,000. We’re sitting on a powder keg.” “For us, the American dream is that every year you should be doing better than you did the year before and you will be able to leave something to your loved ones. That isn’t gonna happen this time.”

Billie Ray Atchely, Bakersfield, California.

Billie Ray Atchely, Bakersfield, California.

Billie Ray Atchely’s father packed their flatbed Model A in 1932 and followed a well-worn track from desiccated land in Oklahoma toward rumors of work and a better life in California’s Central Valley. By seventh grade, Atchely was earning two cents a pound picking cotton in the fields near Bakersfield, California; he’s now retired after 40 successful years with State Farm Insurance and a stint in the Navy. Five generations of Atchelys live within shouting distance in Bakersfield, and the housing-market collapse has not spared them. Billie Ray’s daughter, a registered nurse, has lost two properties to foreclosure. Her twin sons are both policemen in the Bakersfield area, married with two kids apiece and wives who work. One of the twins has already lost his home in a short sale and the other is in foreclosure. “Okies lost their homes back during the Dust Bowl due to the government and the banks,” said Atchely one morning over coffee at the Westchester Lanes bowling alley, where he meets fellow Okies every Thursday at 6:30 a.m. Historian Charles Wollenberg concurs, explaining that misguided federal efforts to alleviate the Dust Bowl’s environmental crisis may have contributed to the California migration recorded by Lange, Steinbeck, and others. Even more damaging, when the government paid the owner to take “surplus” crops out of production or produce less for conservation purposes, “that owner might not need sharecroppers or tenants,” says Wollenberg. “[Okies] were in effect kicked off the land.”

But where will California tenants go if they’re kicked off the land?

“The banks are foreclosing, and they won’t renegotiate with the people who own the house like they’re supposed to,” says Atchely. “That’s what the government said they were supposed to do when it gave the banks those billions of dollars.”

Mary MacNeil and Michael Hurst, Strathmore, California.

Mary MacNeil and Michael Hurst, Strathmore, California.

Mary: “My brother is handicapped and my main job is him and the house. We signed the paperwork with Wachovia and moved in December 2007. It was a 30-year fixed but in May 2009 our payment jumps up. I call the bank and speak to Yolanda. She tells me that happens when the insurance or taxes go up. Well, we had just gotten a notice from the county that our property taxes had gone down—the value of our home had decreased from $159,000 to $140,000—and we had just gotten a renewal on our insurance policies, which are tied in with our house payments, and they were the same. I tell her this.” Michael: “They hadn’t even sent notice that the payments were going up. The only way I knew is that they provide a payment booklet with the monthly fees and when I get the new one my mortgage has increased.” Mary: “Yolanda says, ‘Maybe you need to talk to your loan officer.’ I say, ‘I am talking to her! It’s you!’ I tell her we had a fixed mortgage. I ask if there’s any way she can look it up on the computer and explain what happened. And she says, ‘I can’t help you.’ So we send the increased payments to Wachovia. But in August we get a letter from Wells Fargo that they had taken over the loan and it was behind. It wasn’t behind. The increased payments had gone to Wachovia. The only thing we did differently was send July and August together because it took Michael is little while to pay that increased amount that month. Then in February 2010, we get a letter from some law firm representing Wells Fargo, saying they could restructure our loan. We filled out all the paperwork. We wrote exactly how much our bills are, how much Michael makes, all our personal information, our situation of how it got to where it was. Five weeks later we get a letter from this firm saying ‘we can’t help you.’ And in April, the bank taped a foreclosure notice to our gate.” A recent statewide survey of California mortgage counselors found that 60 percent of them had clients who suffered foreclosure while in the middle of negotiating with their servicer.

Jeannie Gaines, Bakersfield, California (with sons Matthew and US Navy, on leave), daughter-in-law Sheryl Gaines, and granddaughter Savannah, Bakersfield, California.

Jeannie Gaines, Bakersfield, California (with sons Matthew and US Navy, on leave), daughter-in-law Sheryl Gaines, and granddaughter Savannah, Bakersfield, California.

“My son has cerebral palsy. I can’t really punch a clock because I have to go to all his therapies and appointments. About 18 years ago I started doing commission work with different companies to sell their jewelry, purses, and scarves to Longs Drugs. I’ve always worked hard.

This is the first home I’ve owned since my divorce 15 years ago. It was appraised for $235,000 but I got it for $200,000. I can’t just move. My son is totally dependent on me and always will be. I’ve done a lot of modifications so he can get around in his wheelchair.

When Longs was bought by CVS, they discontinued ordering anything from any of the vendors. That took my income away. Before I got behind on any bills, I called lenders and told them, ‘I’m going to have a problem. Is there something we can do to prevent that from happening? Can you give me maybe two or three months?’ They said no. It was frustrating and scary. I worked so hard to get this house, and then for this to happen. I don’t like asking for help. I just wanted the bank to work with me. But no. I got three months behind on my mortgage and didn’t know what else to do so I went to Catholic Charities. They took a special interest, I think, because of my son. I was behind by more than $5,000 and they totally caught me up. I would have lost my house otherwise.

You know, after a divorce you’re eating Cheerios for dinner and three-for-a-dollar Mac and Cheese. Then you work hard and build yourself up to a position where you can buy a home and all of a sudden poof, you’re right back to the bottom.”

Teriann Selby, Bakersfield, California

Teriann Selby, Bakersfield, California

“My husband and I had been renting our house for 14 months, beginning in June, 2008, when we received a notice that the house was going up for auction. We went to the rental agency that was managing the house and asked what was going on. They said ‘don’t worry about it; the guy’s just refinancing and they have to send these notices out.’ On August 13th, 2009 we came home to a note on the door saying the house had been sold at a foreclosure auction and we had three days if we were the owners and ninety days if we were renters to vacate the property. I called the name on the note and told him we’re renters, not owners. I also told him we’d like to continue to rent the house. He says ‘No. This is what we do. We buy foreclosed houses and we sell them.’ I said ‘ok, we’ll be out in 90 days.'” “A week after the house was sold, the guy starts calling me. He’s a real estate agent in town working for the company that bought the house. ‘When you gonna let us into the house? We need to take pictures for insurance purposes.’ Just constantly bugging me. Finally, I looked up renter’s rights and told him I didn’t want him in the house. That’s when he started showing up at the door, telling me he’s going to bring a locksmith and change the locks. This was within the 90 days. I’d been doing more research on our rights and I say, ‘You got a court order?’ He says he doesn’t need one. I say, ‘Yes, you do. Look up California tenant law. You can’t change the lock and you can’t have access to my house.’ My husband is at work and I’m alone with my kids but I’m a tough old gal.” Citing a “pattern of illegal conduct” and tenant harassment, more than 20 housing rights and public interest groups from across California petitioned then-Attorney General Jerry Brown to take action against agents like the one Teriann Selby described. At least 37 percent of homes in foreclosure in California are rentals. Last year alone, more than 200,000 California renters were affected by foreclosures, and most of them were displaced. California law now requires that banks and other post-foreclosure owners inform tenants of their rights and advise them to seek legal help.

Juan (kneeling, picking lock), Stockton, California

Juan (kneeling, picking lock), Stockton, California

We found Juan, who wouldn’t give his last name, as he worked to gain access to a unit in a complex called Le Corbusier Court. He works for five national companies and several local agents trashing out foreclosures—cleaning them up after the family has been evicted and preparing the properties to be shown to real estate agents. “If there are people inside they have options. They don’t lose their stuff like they make it sound on TV, all dramatic,” said Juan. “California is such a liberal state that they give everyone more rights than they should have, I personally think. Evictions aren’t really as bad as they say they are. It just happens. I don’t know where the people go. It’s just not something I ever worry about. It’s not the end of the world because you lose your house.”