DenisNata/Shutterstock

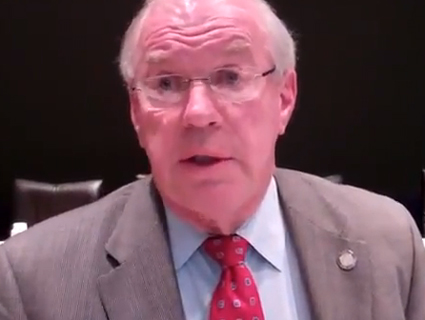

Missouri Rep. Steve Cookson, a Republican, caused a stir last year when he offered a bill to ban any discussion of sexual orientation in public schools outside of traditional sex ed and science instruction. That meant teachers couldn’t talk about gay and lesbian issues during class, and gay-straight alliances couldn’t meet during the school day. Critics called it the “don’t say gay” bill. It died in committee.

Now, Cookson is back in the news for introducing another controversial bill. Children of welfare recipients can’t miss more than 10 percent of their classes—roughly three weeks of school—or their family loses welfare benefits. The bill, which would amend the state’s welfare statute, is a single sentence long:

School age children of welfare recipients must attend public school, unless physically disabled, at least ninety percent of the time in order to receive benefits.

You’d be hard-pressed to find anyone who thinks it’s OK to skip three weeks’ worth class during the school year. But what about an unexpected illness like mono or clinical depression? Cookson has yet to clarify what exactly qualifies for the “physically disabled” exemption in his bill. And so unless mono qualifies as a physical disability, the critics who deride Cookson’s bill the “don’t get sick” bill make a fair point. A entire family could lose its state assistance if their kid got mono from a classmate.

As the Kansas City Star notes, state Republicans, which control the Missouri General Assembly, recently named Cookson the chair of the House education committee. That means his “don’t get sick” bill could get a full airing on the House floor.