Somewhere that looks like the Cayman Islands, home to thousands of US tax cheats.<a href="http://www.shutterstock.com/cat.mhtml?lang=en&search_source=search_form&version=llv1&anyorall=all&safesearch=1&searchterm=cayman+islands&search_group=#id=95270656&src=phb0dJdj01YLB2KgrpsZng-1-12">Candis Davis</a>/Shutterstock

Late Tuesday, Sen. Rand Paul (R-Ky.) introduced a bill that would repeal part of a law aimed at fighting offshore tax evasion.

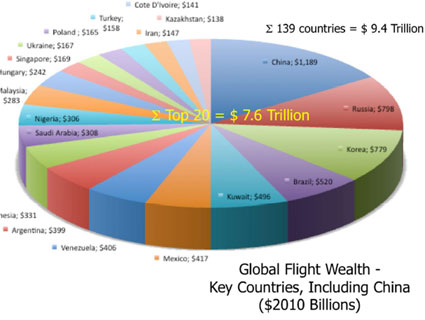

The law, called the Foreign Account Tax Compliance Act, was passed in 2010 and is supposed to go into effect on January 1, 2014. It requires foreign financial institutions to report information about Americans with accounts worth more than $50,000 to the IRS. Firms that don’t comply will be fined.

Tax policy watch dogs say the FATCA is essential to rooting out tax cheats. “The increased bilateral exchange of taxpayer information that…[is] crucial to cleaning up the worldwide shadow financial system,” Heather Lowe, director of government affairs for the advocacy organization Global Financial Integrity told Accounting Today earlier this month. “[F]oreign financial institutions should not harbor the illicit assets of U.S. tax evaders.”

But Paul’s bill to weaken the law was immediately hailed as “heroic” by the biggest independent financial advisory firm in the world. In an email press release from the deVere group, chief executive Nigel Green said, “Senator Paul’s heroic stance against this toxic, economy-damaging tax act is a landmark moment in the mission to have it repealed. He has taken a courageous stand against FATCA, [a law that] will impose unnecessary costs and burdens on foreign financial institutions.”

Paul, generally a die-hard anti-taxer, says the intent of his bill “is not to disrupt legitimate tax enforcement.” Instead, he says he objects to FATCA because it “violates important privacy protections,” by giving foreign governments too much access to US citizens’ tax information. Paul says he is only in favor of repealing those provisions.

But Paul has a long history of fighting the offshore-tax evasion law. Since FATCA was signed, the Treasury Department has been negotiating and signing treaties with over 50 countries to implement the law’s provisions. Paul has put a hold on Senate approval of all tax treaties since he was elected in 2010, and as such has been blamed for trying to block FATCA.

A companion version of Paul’s bill is expected to be introduced in the House soon.