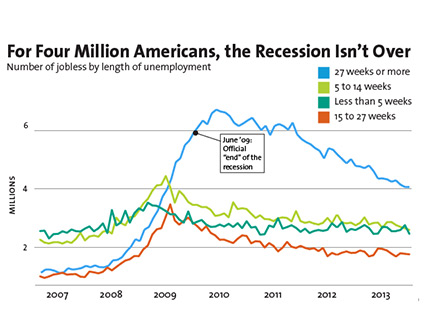

President Obama is expected to put income inequality, unemployment, and economic growth front and center in tonight’s State of the Union address. The speech comes amid continuing congressional intransigence over extending emergency unemployment benefits and food stamps, which has left millions of Americans in financial limbo.

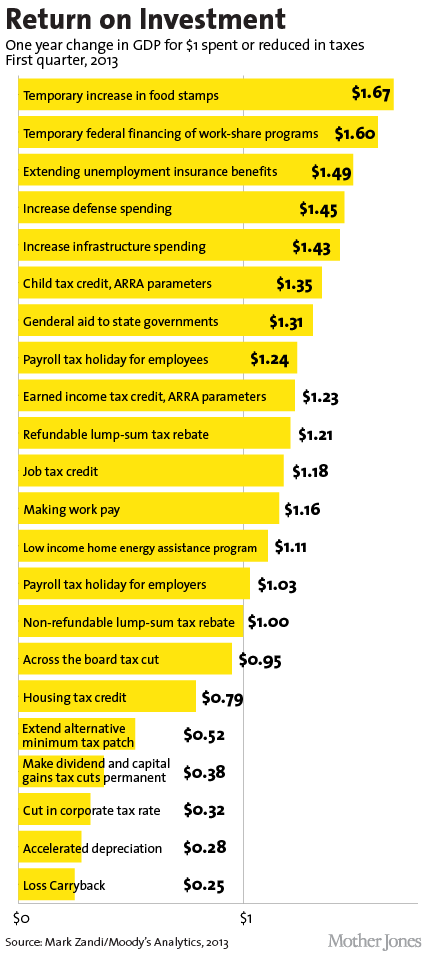

Beyond helping Americans in need, economists say that programs like unemployment insurance and food stamps generate high returns on investment, especially during recessions. According to data from Moody’s Analytics, every dollar spent on a temporary increase in food stamps contributes another $1.67 to the economy. A buck of extended unemployment kicks in $1.49. Compare that with the impact of a corporate tax cut—32 cents on the dollar.

“Using the deficit for something like unemployment insurance—that’s a multiplier—is a good thing,” says Josh Bivens, the director of research and policy at the Economic Policy Institute. “They’re shock absorbers, not bad things.” Unemployment benefits tend to get spent right away on needs like groceries, for example. Chad Stone, the chief economist at the Center on Budget and Policy Priorities, explains that as long as you don’t raise taxes or cut spending from other programs, this type of spending trickles up, giving the overall economy an added boost.

However, that idea has lost currency, Bivens says, because “the politics are more divisive than they’ve been for a long time.” Some Republicans have argued against extending federal benefits programs, citing the deficit. But that argument doesn’t hold up, Bivens explains, because the growth of public spending is at a historic low: “We’re undertaking unprecedented austerity on the budget side.” (More on the austerity effect here.)

To see how spending in emergency unemployment benefits compares to other programs and tax cuts, see the chart below: