A new report finds that the state of economic inequality in the United States is far more drastic than in other developed countries. The report, published by the German financial services company Allianz, even dubs us the “Unequal States of America.”

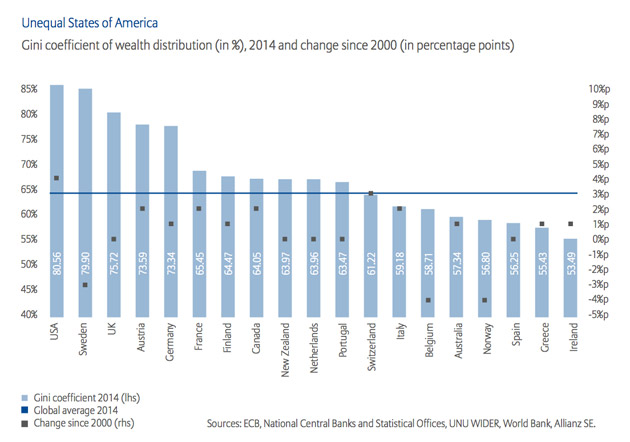

The company’s latest Global Wealth Report calculates 55 countries’ Gini coefficient, a measure of the distribution of wealth in which zero means total equality and 100 means total inequality. The average for all developed countries is 65. The United States’ score is nearly 81.

Michael Heise, the chief economist at Allianz, described the situation in the United States as “worrying.” “Our calculations indicate that developments have not been quite as dramatic in the other countries,” he said. “As usual, the US represents more the exception than the rule among market economies.” The report’s authors note the country’s lackluster recovery from the financial crisis has “caused a dramatic deterioration in wealth distribution.” While the United States amassed nearly 42 percent of the world’s private wealth in 2014 ($63.5 trillion), the top 10 percent of Americans control more than two-thirds of the country’s net wealth.

The United States leads the pack, but it’s not alone. Much of the world’s developed nations saw “exceptionally large gaps” in the wealth gulf between the rich and the poor during since 2000, according to the report. Over the past decade and a half, it found, the number of countries that closed their wealth gaps was roughly the same as the number that grew more unequal.