A pharmaceutical company that manufactures the prescription painkiller fentanyl repeatedly misrepresented its product and the patients using it in order to boost sales, according to a blistering report released Wednesday by Sen. Claire McCaskill (D-Mo.).

The report, part of the senator’s investigation into opioid manufacturers, focuses on a major pharmaceutical company called Insys, which manufactures a fentanyl spray, Subsys, for cancer patients experiencing extreme pain. The spray is extraordinarily potent stuff—this is the same synthetic compound that is illicitly produced and is now fueling the opioid epidemic. Before covering it, insurers require authorization from a doctor in order to make sure that the patient indeed has an active cancer diagnosis, has extreme pain as a result, and has tried other painkillers and is thus tolerant to opioids.

But this prior authorization process was a barrier to sales: in 2012, Insys found that the medication was covered by insurers in only about 30 percent of cases. So the company created a special unit called the Insys Reimbursement Center (IRC) that would press insurers to cover the drug—in some cases by misleading them to believe they were speaking with representatives from doctor’s offices of prospective patients. To boost the rate of authorizations, executives used sales tactics like quotas and individual bonuses.

IRC representatives deployed all sorts of shady techniques that ultimately led the prescription to get into the hands of patients for whom it was unsafe, according to the investigation. The company reportedly fabricated medical histories of prospective patients, falsely stating that the patients had a cancer diagnosis or extreme pain from it. Insys executives allegedly instructed employees to say they were calling “from” a doctor’s office or “on behalf” of a specific physician. The company set up a 1-800 number so that calls couldn’t be traced back to Insys.

According to a class action lawsuit, Insys management “was aware that only about 10% of prescriptions approved through the Prior Authorization Department were for cancer patients.”

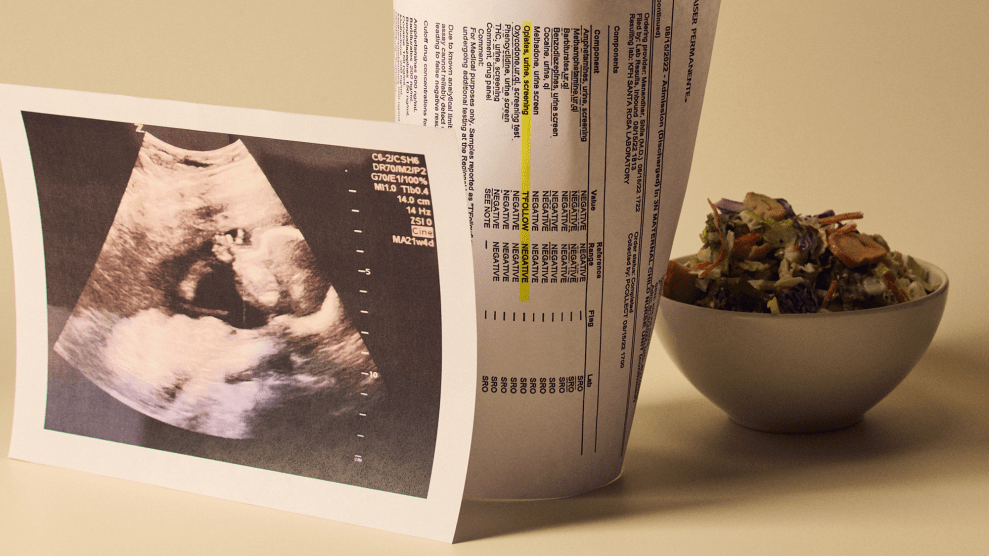

All of this came to a head in the case of Sarah Fuller, a 32-year-old Subsys patient from New Jersey who died in March of 2016 “due to allegedly improper and excessive Subsys use.” Fuller suffered from a number of health conditions, including fibromyalgia and back pain, and had overcome an addiction to opioid painkillers. Despite all this, and despite her lack of a cancer diagnosis, her doctor prescribed Subsys, in addition to a number of other opioid medications. (The investigation notes that the doctor received $600 in payments from Insys in 2015.) But the medication would require Envision, a pharmacy benefits manager, to get prior authorization from the doctor ensuring that they Ms. Fuller met all the requirements for Subsys.

McCaskill’s team uncovered audio, embedded below, from conversations that Insys representatives had with Envision, in which the Insys rep said she was “with” the office of Fuller’s doctor. When asked if Fuller had breakthrough cancer pain, the rep said, “it’s for breakthrough pain”—pointedly declining to mention the lack of cancer.

According to a lawsuit filed by her parents, Fuller died “due to an adverse reaction to prescription medications.” Over 14 months, Medicare paid as much as $24,000 per month for Fuller’s prescription.

Insys president and CEO Saeed Matahari responded to McCaskill’s investigation saying that the company has “invested significant resources in establishing an effective compliance program,” adding that he hopes “to play a positive and productive role in helping our nation overcome the opioid epidemic.”