Donald Trump’s massive debts—he owes hundreds of millions of dollars—are the subject of continuous congressional and journalistic scrutiny. But for years, one Trump loan has been particularly mystifying: a debt of more than $50 million that Trump claims he owes to one of his own companies. According to tax and financial experts, the loan, which Trump has never fully explained, might be part of a controversial tax avoidance scheme known as debt parking. Yet a Mother Jones investigation has uncovered information that raises questions about the very existence of this loan, presenting the possibility that this debt was concocted as a ploy to evade income taxes—a move that could constitute tax fraud.

Here’s what is publicly known about this mystery debt: On the personal financial disclosure forms that Trump must file each year as president, he has divulged that he owes “over $50 million” to a company called Chicago Unit Acquisition LLC. The forms note that this entity is fully owned by Trump. In other words, Trump owes a large chunk of money to a company he controls.

The disclosures state that this loan is connected to Trump’s hotel and tower in Chicago, and the forms reveal puzzling details about Chicago Unit Acquisition: It earns no revenue—suggesting that Trump was not paying interest or principal on the loan—and Trump assigns virtually no value to Chicago Unit Acquisition. Something doesn’t add up. Under basic accounting principles, a firm that is owed money and has no outstanding debt should be worth at least as much as it is owed. The loan has another odd feature: It is identified as a “springing” loan, a type of loan made to borrowers who are viewed as credit risks. Known sometimes as “bad boy” loans, these agreements allow the lender to impose harsh repayment terms if certain criteria aren’t met. These are not the type of loan terms that someone is likely to impose on himself.

The Trump Organization has consistently refused to answer questions about Chicago Unit Acquisition, a limited liability company it formed in Delaware in 2005, as construction began on the Trump International Hotel and Tower in downtown Chicago. But Trump did tell the New York Times in a 2016 interview that this debt represents a loan he repurchased from a group of lenders. “We don’t assess any value to it because we don’t care,” Trump said. “I have the mortgage. That is all there is. Very simple. I am the bank.” Jason Greenblatt, who was then the Trump Organization’s top lawyer, declined to explain to the Times the reason for the Chicago Unit Acquisition deal. “It’s really personal corporate trade secrets, if you will,” he said. “Neither newsworthy or frankly anybody’s business.”

Trump has not publicly identified the creditors from whom he bought this loan. But a 2008 lawsuit Trump filed in connection with the Chicago project—a case that produced voluminous records detailing the financing of this venture—suggests two possibilities. The majority of the hotel and tower project was bankrolled by Trump’s lender of choice, Deutsche Bank, which gave him a $640 million loan. Fortress Investment Group, a New York City-based hedge fund, provided Trump an additional $130 million in financing. (Two other firms, Cerberus Capital Management and Dune Capital Management, partnered with Fortress on this loan.) According to court records, these were the only loans associated with the construction and development of Trump International Hotel and Tower Chicago.

Trump’s Chicago project quickly became a financial debacle—hence the lawsuit. The 2008 financial crisis struck as the project neared completion, and Trump, saddled with nearly $800 million in debt, was in jeopardy of defaulting on a $330 million payment he owed to Deutsche Bank in November that year.

To fend off his biggest creditor, Trump attempted a brazen legal gambit. He sued Deutsche Bank, accusing the firm of causing the housing crisis and economic meltdown that was supposedly inhibiting his ability to sell units in the Chicago project and repay his debts. Eventually, Trump settled his financial differences with Deutsche by repaying some of the money he owed the bank and refinancing the rest through the bank’s private banking arm, according to records filed with the Cook County Recorder of Deeds. That is, Trump took out a new loan through Deutsche’s private bank to cover his debt to the firm’s commercial lending side. This transaction apparently did not involve purchasing any debt, suggesting the debt that Trump claims to have bought could not be from the Deutsche Bank loan. That leaves the Fortress debt.

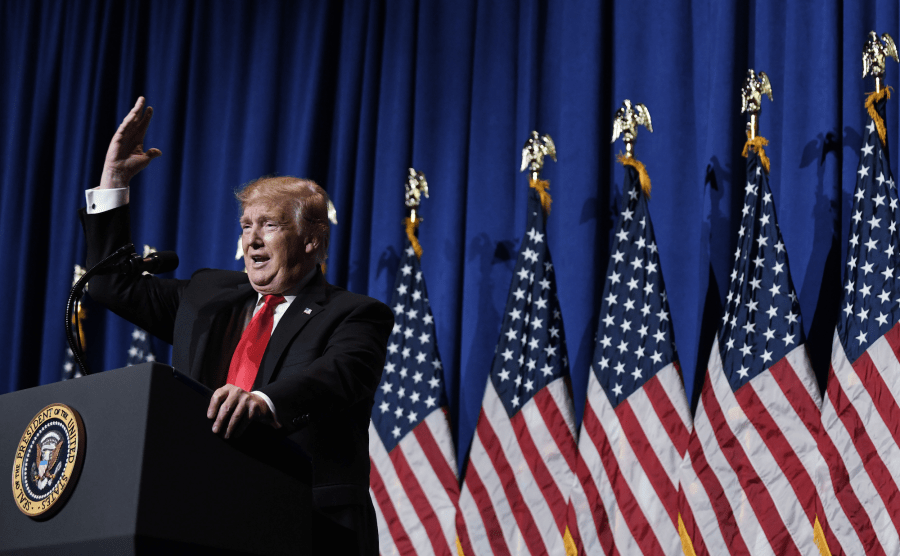

Donald Trump looks at his 92-story Trump International Hotel and Tower with his children—(from left) Eric, Ivanka, and Donald Jr.—in Chicago in 2007.

Charles Rex Arbogast / AP

In March 2012, as Trump resolved his dispute with Deutsche Bank, he finalized a separate deal with Fortress and its partners to clear his debt with them. According to a source with direct knowledge of the deal who spoke to Mother Jones, Fortress ultimately agreed to accept 50 cents on the dollar—or about $48 million—for the outstanding debt (which by that time amounted to just under $100 million). This was a steep loss for the hedge fund and its partners. The question is whether the deal was what’s known as a “discounted payoff”—in which the debt was considered repaid and the loan was canceled by the lender—or whether Trump purchased what remained of the loan. That distinction has enormous implications.

When a lender forgives a portion of a loan, the IRS considers the unpaid portion taxable income. For instance, if a lender accepts $50 million in repayment of a $100 million debt, the borrower, in the eyes of federal tax authorities, has earned $50 million and owes tax on that. The tax could be as high as 39 percent. But big-time borrowers have devised a tactic to forestall paying taxes in cases in which they’re able to buy back their debt at a discount. They purchase the debt through a corporation, parking the loan within this entity to temporarily avoid realizing income. Debt parking falls into a legal gray area. “Maybe there are respectable ways that it could work, but I would call it kind of a scam to pretend you haven’t gotten rid of the debt,” says Daniel Shaviro, a professor of tax law at New York University.

Debt parking can be permissible as long as the borrower intends to repay the loan. Parking debt indefinitely with no intention to repay it, however, violates federal tax law, according to tax experts.

For that reason, Trump’s comment to the Times that “we don’t care” about the loan raised a red flag for several tax experts consulted by Mother Jones. They wondered whether this was an admission that he has no intention of repaying the loan—an implication reinforced by Trump’s disclosures showing Chicago Unit Acquisition generates no revenue and has practically no value. And debt parking that essentially places a loan into suspended animation indefinitely would not be considered legal, according to these tax experts.

But the story of Trump’s mystery loan gets even more complicated. According to two sources with direct knowledge of the disposition of the Fortress loan, Fortress did not sell Trump this loan. Instead, according to these sources, Fortress canceled the debt after Trump paid about half of it. “The transaction that Donald Trump did with the lender was a discounted payoff and not a purchase of the loan—I know that for sure,” a person involved with the deal tells Mother Jones. That means there may have been no loan to buy, no debt to park; Trump might have invented a loan—and then parked it.

Fortress declined to comment on the Trump loan. Representatives of Cerberus Capital Management and Dune Real Estate Partners (which took over the business once run by Dune Capital Management) did not respond to requests for comment.

To recap: Trump claims he bought a debt related to his Chicago venture, but neither of the two loans associated with this property appear to have been purchased. The Deutsche Bank loan was refinanced. The Fortress debt, according to sources with knowledge of the transaction, was canceled. And this raises a question: Did Trump create a bogus loan to evade a whopping tax bill on about $48 million of income?

Several legal and real estate finance experts say it’s possible to fabricate a loan. Doing so would be as easy as creating some paperwork and declaring the debt on your tax returns, though such a scheme would also violate federal tax law.

“When you see it, if you lay all this out, it’s pretty brazen,” says Adam Levitin, a law professor specializing in commercial real estate finance at Georgetown University. “If he didn’t actually buy the loan, this is just garden-variety fraud.”

Most loans are documented in public records, but Mother Jones could locate no documentation of a loan owned by Chicago Unit Acquisition. The Cook County Recorder of Deeds has records concerning the original Deutsche Bank loan for the Chicago project; the Deutsche Bank loan that replaced it; and the Fortress loan. But the Recorder of Deeds has no filings related to Chicago Unit Acquisition.

Trump International Hotel and Tower in downtown Chicago

benkrut / Getty

Not all loans are tied to property and require registration with local authorities. In those cases, a filing called a Uniform Commercial Code financing statement is typically made. This is a publicly available legal form in which a creditor states its interest in the event of a loan default. The $130 million Fortress loan had a UCC statement filed in Delaware in 2005. Fortress filed a notice that this loan agreement was terminated—it does not specify how—in March 2012. A search of records in New York (where the Trump Organization is based), Illinois (where the hotel is located), and Delaware (where Chicago Unit Acquisition is registered) found no UCC records related to Chicago Unit Acquisition.

Levitin and Steven Schwarcz, a law and business professor at Duke University, say it’s not totally unheard of for a company to skip filing a UCC statement in cases where one branch of a firm is loaning money to another. But Levitin says that submitting a UCC statement is standard practice in most scenarios where there is a large amount of collateral at stake.

Could the Chicago Unit Acquisition loan be legitimate? The tax and real estate experts interviewed by Mother Jones had a difficult time explaining what this transaction could be. And the Trump Organization offered no explanations of its own. The company did not respond to a detailed list of questions from Mother Jones regarding Chicago Unit Acquisition and this loan. Nor did the White House.

Trump has a track record of pushing the envelope when it comes to paying—or not paying—taxes. In a Pulitzer Prize–winning investigation examining the origins of the president’s fortune, the New York Times reported in 2018 that “President Trump participated in dubious tax schemes during the 1990s, including instances of outright fraud, that greatly increased the fortune he received from his parents.”

Breaking with a four-decade precedent for presidents, Trump has refused to release his tax returns, which would shed light on the tax strategies he has employed over the years. But the release of Trump’s returns alone would probably not solve the Chicago Unit Acquisition mystery. Nor would a standard IRS audit.

“It would take a forensic audit,” says Martin Lobel, a prominent tax lawyer based in Washington, DC. “It is very labor intensive, and it takes someone who has years of experience to spot the problem areas.” This type of audit would entail combing methodically through every shred of paperwork underpinning Trump’s financial claims. And Lobel and other tax experts Mother Jones interviewed are dubious that the IRS would mount this type of audit on a sitting president. “The IRS is not going to look too closely at Trump’s tax returns,” Lobel says.

But congressional Democrats, if they have their way, intend to do just that. In May, the House Ways and Means Committee subpoenaed the IRS to hand over six years of Trump’s tax returns as part of an investigation into the agency’s presidential audit program. By law, the IRS must annually audit the returns of a serving president and vice president, but, as the panel’s chair, Richard Neal (D-Mass.), wrote in a recent Washington Post op-ed, it’s not clear how much scrutiny these reviews entail. “Neither Congress nor the public knows anything about the scope of those audits and whether the president can exert undue influence on the IRS to affect his or her tax treatment,” Neal wrote. “If, for example, the president is already under audit at the time he or she takes office, what happens to that audit? We don’t know. My committee will consider legislation regarding the mandatory audit program to ensure these audits are conducted fairly and without undue influence from the commander in chief. And, as part of our deliberations, we must review his tax information to better understand the audit program and propose any needed changes.”

Rep. Lloyd Doggett (D-Texas), a senior Democratic member of the committee, says the tax returns could reveal how Trump does business, including if he and his company have employed dubious tax strategies. “Lying and tax avoidance appear to be a way of life for Trump,” he notes. “His tax returns could indicate the role tax-dodging plays in Trump’s overall business strategy. Perhaps this is another reason why Trump and his Republican enablers are so intent on defying the law to keep them hidden.”

Treasury Secretary Steven Mnuchin, who oversees the IRS, has so far rebuffed the Ways and Means Committee’s efforts to obtain Trump’s returns. In July, the panel sued the Treasury Department and the IRS to force them to comply. In a recent court filing, the committee revealed a tantalizing bit of information about its inquiry: A whistleblower had come forward with “credible allegations of ‘evidence of possible misconduct’—specifically, potential ‘inappropriate efforts to influence’ the mandatory audit program.”

Trump’s finances are currently the subject of multiple inquiries in his home state of New York. Following the New York Times investigation of the questionable tax schemes employed by Trump and his family, a spokesperson for the New York Department of Taxation and Finance said the agency was “vigorously pursuing all appropriate avenues of investigation.” New York Attorney General Letitia James has also been scrutinizing the financing of several Trump projects. This investigation was sparked by Michael Cohen, Trump’s former lawyer and fixer, who told Congress earlier this year that Trump had inflated his assets on financial statements used to secure loans. In March, James subpoenaed records from Deutsche Bank concerning multiple Trump ventures, including the Trump Chicago project. Her office declined to comment on whether it had subpoenaed Fortress or planned to do so in the future, but James tells Mother Jones in a statement: “My office takes any allegations of significant tax fraud seriously. No one is above the law—not even the president of the United States.”