Tracey Mann, a right-wing congressman from Kansas, is backing legislation that could directly benefit his own real estate interests in rapidly gentrifying Austin, Texas—a move that could be, in the words of one expert, “a very serious conflict of interest.”

In June 2021, the first-term Republican became one of a handful of co-sponsors of a bill that would extend the tax benefits that investors can receive from so-called “opportunity zones,” a controversial program intended to spur development in underserved areas. As of 2020, according to his most recent congressional financial disclosure, Mann had as much as $515,000 in various ventures that are dependent on opportunity zones. In one case, Mann was more than merely an investor—he was actually the fund manager, according to his financial disclosure covering 2020 and corporate registration records. He had between $100,001 and $250,000 invested in this fund. Mann’s office did not respond to detailed questions from Mother Jones and provided no indication that he divested from his holdings before publicly endorsing the legislation.

Opportunity zones already offer investors like Mann a number of tax advantages, including one that allows them to postpone certain capital gains taxes until 2026. The bill Mann supports would push that date back to 2028, giving investors an additional two years in which they can reinvest a substantial portion of their profits and earn even more money.

Mann is no stranger to controversy. A decade ago, when he first ran for Congress, he caused a firestorm by flirting with the racist birther conspiracy theory, repeatedly demanding that President Barack Obama “come forth with his papers and show everyone that he’s an American citizen.” Mann has since called those comments a “mistake,” but one of his first acts after taking office last year was to embrace yet another false conspiracy theory and vote to overturn the presidential election because of “serious allegations of voter fraud.”

Mann’s opportunity zone investments have experts raising an entirely different set of alarms.

“I think what the congressman is doing is highly problematic,” says Donald Sherman, the vice president and chief counsel at the liberal-leaning Citizens for Responsibility and Ethics in Washington. “It’s reasonable to question why he is the cosponsor of legislation where it seems obvious that he has a significant financial interest.”

Before his time in Congress, Mann worked at the real estate company Newmark Grubb Zimmer. He was also a small-time landlord and invested in real estate in Texas, Kansas, and Missouri, his 2020 financial disclosure shows. And with two other business partners, Mann co-founded a startup, 3 Strands Neighborhoods, that aimed to 3D-print apartment buildings.

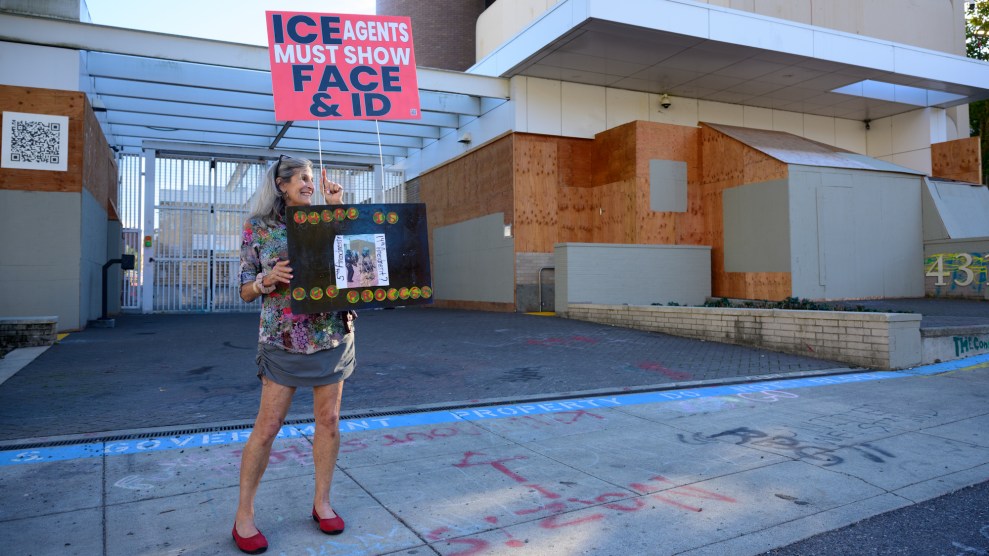

In one case, Mann had an investment in a property that was located within an opportunity zone in Austin, his 2020 financial disclosure shows, although a property merely being located within an opportunity zone does not mean that the property takes advantage of the opportunity zone tax breaks.

Mann’s 2020 financial disclosure also lists investments in three opportunity zone–focused funds. One fund, Del Monte Partners QOZB, is described as a “Qualified Opportunity Zone Business investing in property in Austin, Texas.” The fund owns four properties within an opportunity zone near Del Monte Road in Austin, property records show. Mann had between $100,001 and $250,000 invested in this venture as of 2020.

Two other funds, AMA Austin QOF and Castle Rock QOF, are described in Mann’s financial disclosures as “qualified opportunity fund created to own/invest in QOZB, LLC’s which would then own investment property.” Mann is listed as the manager of Castle Rock QOF on the fund’s corporate registration documents, which were filed with the Texas secretary of state’s office on December 15, 2020—less than three weeks before Mann took office in DC. In 2020, he had up to $250,000 invested in Castle Rock and up to $15,000 in AMA.

Nathan M. Jensen, a professor of government at the University of Texas at Austin and the author of a book on economic development, says that Mann’s investments raise troubling questions. “Particularly problematic in this case is a member of Congress co-sponsoring legislation while managing an opportunity zone fund,” Jensen said in an email. “This fund is 100% dependent on this program and seems to be a very serious conflict of interest.”

The opportunity zone program was originally created by a bipartisan provision included in President Donald Trump’s 2018 tax overhaul. The new bill that Mann supports—HR 970—was introduced in February 2021 by Rep. Tim Burchett (R-Tenn.) and now has 15 co-sponsors. Mann, who does not appear to have been involved in drafting the legislation, signed on to it in June 2021.

Under current law, opportunity zones offer three ways to reduce capital gains taxes. First, when investors take profits from a prior investment and reinvest them into opportunity zones, they can delay paying the capital gains tax on their initial profits until 2026. Second, in some cases, the eventual capital gains tax on that initial investment is reduced. Third, and most importantly, if they hold on to an opportunity zone investment for at least 10 years, they won’t pay any capital gains taxes on profits from that opportunity zone investment.

HR 970 would extend the first benefit, moving back the date at which investors owe taxes on their original profits.

“Extending the due date for paying capital gains taxes on the profits initially invested in opportunity zones from 2026 to 2028 will be a windfall for every OZ investor,” says David Wessel, a senior fellow at the Brookings Institution. “Paying taxes later is always better than paying them sooner.”

Originally, the idea behind opportunity zones was to use capital gains tax breaks to spur development in underserved areas. In total there are now 8,764 opportunity zones spread around the country, including in Mann’s own congressional district.

But the process for selecting opportunity zones has lacked transparency from the start. In theory, governors are supposed to nominate particular census tracts—small geographic areas with several thousand residents—for consideration by the US Treasury Department, which then decides whether to grant final approval. But in practice, Treasury has been accused of rubber-stamping all nominated zones, provided that they meet basic eligibility criteria. In some cases, industry lobbying has led to tracts being redrawn so that specific businesses are placed within opportunity zones after the fact.

In one instance, ProPublica reported, a campaign donor lobbied then–Florida Gov. Rick Scott (R) to nominate a census tract containing a yacht marina development project. The donor, Wayne Huizenga Jr., planned to build apartment complexes adjacent to the marina. Ultimately, Scott selected that tract, but he didn’t nominate lower-income census tracts down the road that had been proposed by the local municipal government. A spokesperson for Huizenga’s company told ProPublica that the firm “never planned the use of any Opportunity Zone tax deferment for its property.”

Moreover, actual investments in opportunity zones have been unequally distributed. One report found that 84 percent of opportunity zone census tracts didn’t receive any opportunity zone-related investments at all. The same report found that the opportunity zones that did receive investments tended to already be better off than the opportunity zones that did not.

Many opportunity zones are located in gentrifying areas that would likely still receive substantial new investment absent the tax incentives. For example, Austin—where Mann invested heavily in opportunity zones—originally asked the governor of Texas to designate four tracts for the program. Ultimately, the city—which is the sixth most gentrified in the United States, according to one report—received 21 tracts.

It’s unclear how much the opportunity zone program will eventually end up costing the federal government. When the program was first proposed, it was advertised as being revenue neutral. But critics say that those estimates were flawed, with one economist describing the projections as based on “magic numbers.”

Legislation like HR 970 would drive the costs even higher by extending provisions that were previously thought to be temporary. That would fit a pattern in Washington, where temporary benefits often prove popular enough to convince Congress to extend them repeatedly.

“What’s to stop at 2028? This could keep getting pushed forward in some form,” says Brett Theodos, a senior fellow at the Urban Institute. “Those could become permanent elements of the incentive, even though they were initially intended to sunset.”

Sherman, the chief counsel at Citizens for Responsibility and Ethics in Washington, says it isn’t clear whether Mann’s financial entanglements actually violate Congress’ relatively weak ethics standards. “The rules definitely aren’t strong enough,” he says. “They’re highly permissive in part because they were made by members [of Congress] for members.”

But “the optics are incredibly bad,” Sherman adds. “If this isn’t something that violates the rules, I think the members should be looking at changing their rules.”