Till Lauer

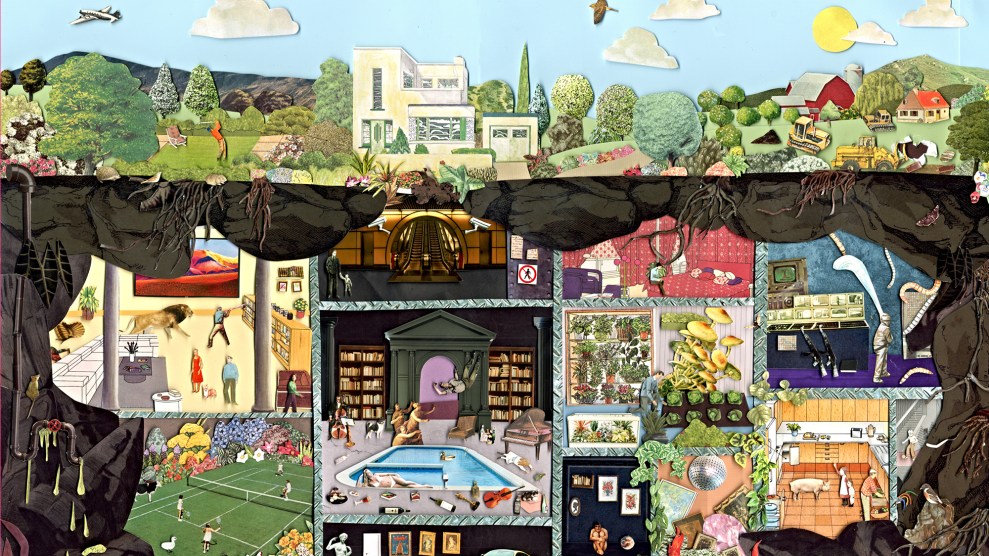

When the US targeted Russia’s oligarchs after the invasion of Ukraine, the trail of assets kept leading to our own backyard. Not only had our nation become a haven for shady foreign money, but we were also incubating a familiar class of yacht-owning, industry-dominating, resource-extracting billionaires. In the January + February 2024 issue of our magazine, we investigate the rise of American Oligarchy—and what it means for the rest of us. You can read all the pieces here.

Governments. Rivals. Ex-wives. When you’re an oligarch, everyone wants a piece of you. But the ultrarich have adapted at pace: They’ve put valuable real estate in their children’s names, allegedly hired captains to steal back a boat that was seized, and used diplomatic immunity to get around visa prohibitions.

Here are some of the ways foreign billionaires and American elites keep all their riches to themselves.

1. Real estate

As of January, the Treasury Department finally started requiring LLCs to disclose the names of their owners. But for years, anyone could buy real estate through a shell company with no disclosure at all. And in a 1 percenter world, penthouses and waterfront mansions can help protect or launder your fortune. A recent Times investigation into one Manhattan property found that more than 200 shell companies had purchased units in the building, including corporate fronts for 17 billionaires—and Tom Brady.

2. Offshore bank account

It’s the simplest formula in the book: Use an anonymous trust to open a bank account in a secrecy jurisdiction. Voila: You can now do business anywhere you want, without anyone being the wiser. “If I walk in and pay cash from a Swiss bank account or a Dubai bank account, and I go buy property in Miami or New York or wherever, then I can do it secretly,” says Gary Kalman, executive director of Transparency International US. “And there’s no requirement that anybody has to do any money laundering check.” The feds say anti-money-laundering rules for real estate are coming…eventually.

3. Art

“High-value art is highly mobile, making it an ideal way to transfer value internationally,” a 2022 Treasury Department study noted. Not only is art easy to transport—it often performs better than the stock market. US auction houses aren’t bound by beneficial ownership requirements or anti-money-laundering statutes such as the Bank Secrecy Act. A 2020 Senate report called the art sector “the largest legal, unregulated market in the United States.”

4. A free port

Remember that giant self-storage complex in the movie Tenet, where Kenneth Branagh hides his Goya? Free ports—tax-free zones near shipping ports or airports—are a real thing, and a preferred tool for the ultrawealthy to move or park an expensive material asset. In Switzerland, nonresidents can store their goods for as long as they want without paying taxes on them, and they can do it virtually anonymously thanks to lax reporting of their beneficial ownership requirements—regulations to identify who controls a company or asset. Free ports are especially popular destinations for expensive art collections; the Geneva Free Port holds three times as much artwork as the Louvre, and 1,000 Picassos alone.

5. Acquire citizenship

To move your assets, it helps to be able to move yourself. Billionaires from Peter Thiel (New Zealand) to Eric Schmidt (Cyprus) to Harlan Crow (St. Kitts and Nevis) have all acquired citizenship in countries with “golden passport” programs. The cost can reach a few million dollars, but the perks are worth it: A golden passport can help 1 percenters circumvent sanctions, protect their nest egg, or—in Thiel’s case—take refuge from the world when shit hits the fan.

6. Renounce citizenship

Gaining a passport elsewhere doesn’t let you off the hook for US taxes. But you can save big if you give up your American one. Carnival Cruise Lines founder Ted Arison decamped to Israel in 1990, largely to avoid estate taxes. Facebook co-founder Eduardo Saverin traded his US passport for citizenship in Singapore prior to the company’s 2012 IPO. Saverin has said that the timing was coincidental—but the new country’s lack of a capital gains or estate tax will make it more than worth his while. And then there’s Oleg Tinkov, who renounced his US citizenship in 2013 and moved to Russia to avoid paying hundreds of millions of dollars in taxes on a billion-dollar investment windfall. The feds went after him for tax evasion anyway. Nine years and $509 million in restitution later, Tinkov renounced his Russian citizenship following the invasion of Ukraine. At least he still has Cyprus.

7. Wealth managers

To get the best returns from trusts and LLCs, oligarchs and ultrawealthy families turn to boutique specialty firms. In a 2023 study, a team of Dartmouth researchers argued that the most efficient way to sanction oligarchs would be to go after trusted lawyers, accountants, and bankers who actually manage and move their riches under the aegis of the “wealth management” industry.

8. Literally hide the asset

Italian authorities seized sanctioned Russian businessman Alexey Mordashov’s 215-foot yacht, Lady M, just days after the invasion of Ukraine. But Mordashov didn’t make the same mistake with his larger, $500 million yacht, Nord. The ship turned off its transponder and escaped to Vladivostok, Russia. Then, after docking for a period in Hong Kong, the ship turned off its transponder again for nearly eight months, during which time it continued to travel the globe. When it next turned the tracking signal on, it was in the Maldives.