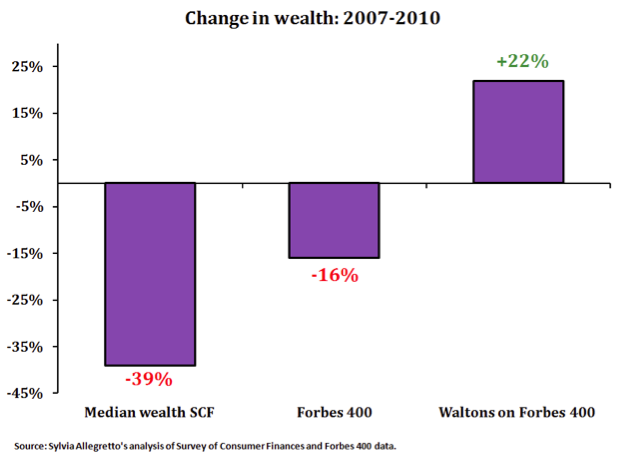

The recession has devastated the finances of many Americans, but it has been very good to the Walton family. Since 2007, Walmart stores have been flooded with millions of folks who’ve lost their shirts in the housing bust, stock market crash, and stalled job market—people who can no longer afford to buy anything that isn’t made in China and sold by someone making close to minimum wage. Using newly released data from the Federal Reserve’s Survey of Consumer Finances (listed as “SCF” below), labor economist Sylvia Allegretto has put together this chart on the diverging fortunes of the Waltons and their customers:

As Josh Bivens of the Economic Policy Insitute points out, the six Walmart heirs now have more wealth than the bottom 42 percent of Americans combined, up from 30 percent in 2007. Between 2007 and 2010, the collective wealth of the six richest Waltons rose from $73 billion to $90 billion, while the wealth of the average American declined from $126,000 to $77,000 (13 million Americans have negative net worth). Here’s a chart of how many average Americans it has taken over time to equal the wealth of the Waltons:

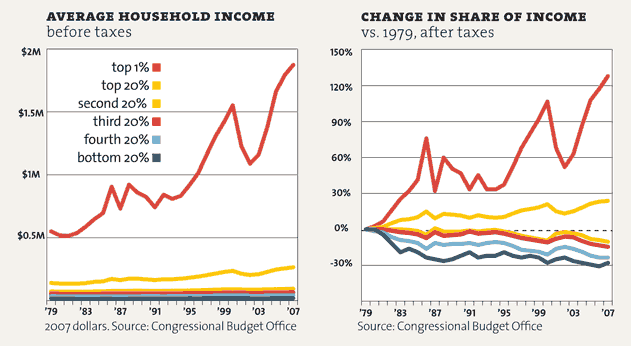

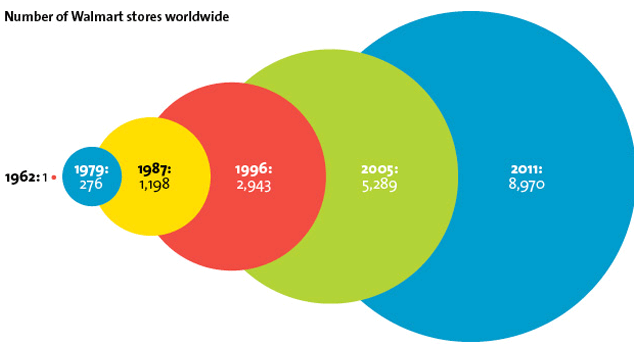

It may be no accident that rising income inequality in America since the 1970s has coincided with Walmart’s meteoric expansion:

For more on how insanely big Walmart has become, see our entire series of Walmart infographics.

For more on how insanely big Walmart has become, see our entire series of Walmart infographics.

And also this: