Flickr/<a href="http://www.flickr.com/photos/48089670@N00">Tobym</a>

“You’ve done just the right thing,” Colin Honess, a garrulous, pleasant man with a big white beard and matching hair, tells me. “If you’re going to put your money away, you want to make sure it’s in good hands. And this is a very good, safe place to put your money.”

It’s a steamy mid-July morning and we’re sitting in Honess’ office at Jerome E. Pyfrom & Co., a law firm in Nassau, capital of the Bahamas, one of the world’s premier “offshore” financial havens. Pyfrom & Co. specializes in setting up secret bank accounts that allow people to hide their funds—from tax collectors, law enforcement authorities, creditors, or anyone else who might have a claim on their cash. Some experts estimate that more than $5 trillion is now hidden in offshore accounts. I’ve come to the Bahamas to investigate what kind of financial services are available to wealthy Americans eager to bury their riches abroad. Since my own resources are modest, I tell Honess I’ve grown rich as a NASDAQ trader and am sick and tired of being “taxed to death” by the US government. How can Pyfrom & Co. be of assistance? I ask.

I’d initially contacted the firm via email and learned there was no need to actually visit the Bahamas to open my clandestine account; I could submit a few pages of paperwork by mail, and Honess would handle the rest. But now, sitting across from him in his office, I explain to Honess that I felt it prudent to take a firsthand look.

He hands me a packet of information, including a detailed report that lays out the advantages of stashing one’s money in the Bahamas. “Imagine a company which is not required to file any public notice of who its officers and directors are,” it begins. “No need to reveal the identity of its shareholders; no need to file any financial statements or keep any accounts. Imagine that such a company can be incorporated in an economically and politically stable country which is a member of the British Commonwealth and which imposes no income, capital gains, or inheritance tax. ‘Pinch me! I’m dreaming!’ you may be saying if you have never been introduced to the Bahamian International Business Company.”

For the would-be tax evader or money launderer, International Business Companies, or IBCs as they are generally known, are indeed a dream come true. These shell companies often conduct no real business—they are simply used as front operations by people trying to hide their wealth. A 1998 United Nations report says that IBCs “have few commercial or financial justifications, except to conceal the origin and destination of goods in international commerce…and to evade taxes by moving profits and assets out of the reach of the tax collector.”

Not surprisingly, business is booming at Pyfrom & Co. The firm’s clients come mostly from the United States and Europe, but just that morning Honess had fielded a call from Singapore. Setting up an IBC with the company, he explains, is fast and cheap. All that’s required of me is filling out a one-page form and providing a photocopy of my passport and driver’s license. The entire incorporation process—which costs $1,000 plus annual renewable fees of $750—can be completed within 48 hours. I can then open a bank account in the name of my IBC. To help me avoid placing my money in the local offices of a US bank, Honess suggests a branch of Ansbacher, a South African financial firm that is “a little easier to work with.”

The beauty of the whole arrangement, Honess emphasizes, is that Bahamian bank secrecy laws make it virtually impossible to determine who owns an IBC. Incorporation papers filed at the Registrar General’s office, conveniently located just half a block away, disclose only an IBC’s local office—Honess suggests that his home address could serve that purpose—and its agent, who could be another employee of Pyfrom & Co. or another Nassau lawyer or accountant. My paperwork and identification papers, as well as the names of my IBC’s directors and officers, would be securely guarded at his firm’s office. Local law makes it a crime to reveal account information without the owner’s permission, unless under order from Bahamian courts, and Honess can recall the latter happening only a handful of times during the past decade—and only in cases involving notorious drug dealers or other high-profile criminals.

Now we come to a delicate matter. Setting up an offshore account is perfectly legal, but it’s a crime for an account holder not to disclose that information when filing a US tax return. Honess calls the obligation to report hidden wealth a “fine line” and a “question of conscience.” If I fail to do so, he predicts, there will be no negative consequences. “The IRS would need to spend a huge amount of money to pursue the matter and it’s unlikely that they’d succeed,” he says. “You’re no big-time criminal, so it would hardly be worth it. Your NASDAQ investments were probably far riskier than this.”

With that, our conversation comes to a close. In less than an hour, I’ve done everything necessary to set up a secret bank account, short of filling out the one-page application and turning over the $1,000 fee to Jerome E. Pyfrom & Co.

During the early part of this century, American mobsters began buying up legitimate businesses in order to explain the origins of their ill-gotten loot. Laundries and car washes were among the most popular choices; hence, the birth of the term money laundering. At roughly the same time, the Bolshevik Revolution and political instability across Europe caused the continent’s elite to seek a safe haven for their assets. Much of their money poured into Switzerland, which emerged as the first capital of “private banking.” The industry provides specialized financial services to wealthy clients—serving, in many instances, as the legal cousin of money laundering.

Today, the practice of hiding wealth has reached epidemic proportions. Much of the money shipped abroad has its origins in arms dealing and drug trafficking. Another major source is loot plundered by corrupt government leaders, such as former Indonesian president Suharto. A growing portion of offshore money, however, is legal in origin, moved abroad by the super-rich—often through major US banks—in order to evade taxes.

Because private banks and offshore firms work closely with clients to help cover their tracks, no one knows exactly how much money is held in secret accounts. The Organisation for Economic Co-operation and Development tried to come up with a number for a 1998 report it prepared on the subject but gave up, saying only that the use of tax havens was “expanding at an exponential rate.” A US congressional committee estimates that the private banking industry currently manages $15.5 trillion in assets, much of which is hidden offshore.

The boom in secret banking has enormous implications for US taxpayers, as the wealthy increasingly use offshore accounts to evade their contributions to the national treasury. In their new book, The Great American Tax Dodge, Donald Barlett and James Steele estimate that if only 10 percent of the secret wealth belongs to US citizens—a conservative figure—then Americans have squirreled away at least $500 billion overseas. The offshore arrangements, they write, “allow these people to escape payment of income taxes that add up to the equivalent of every tax dollar paid by everyone in New York state and New Jersey who earns less than $200,000 a year.”

The roots of the offshore boom aren’t hard to find. The decade-long bull market in US stocks has produced a big upsurge in the ranks of the super-rich, the most common procurers of tax havens. According to Merrill Lynch and Gemini Consulting, the global assets of all millionaires combined rose by 18 percent last year to $25.5 trillion—including $7.6 trillion held by North Americans. And with banking increasingly digitized, the process of moving cash offshore often involves no more than the click of a computer mouse.

“Whenever there is an unsustainable economic or stock market boom, the early winners move part of their money offshore to make sure they’ll still have it when the crash comes,” says Walker Todd, a former Federal Reserve officer. “It’s likely that the early winners in the dot-com boom took a good bit of their money off of the table by placing it in offshore accounts beyond the reach of US authorities.”

To keep taxes low on so much new wealth, lawyers and accountants here at home have given birth to the emerging field of “asset protection.” One of the foremost practitioners is Barry Engel, a Denver-based attorney who calls his specialty “the process of planning to protect against those risks that threaten accumulated wealth.” Those risks include not only the IRS, but also messy divorces, pesky creditors, and untimely lawsuits. Engel charges $24,500 to set up an offshore trust that he claims is absolutely safe from outside prying—and absolutely legal.

In Las Vegas, the Asset Protection Group headed by William Reed urges potential clients to “Stop Being a Target for Money-Hungry Lawyers and Insatiable Tax Collectors.” Its brochure includes testimonials from happy customers like Dr. W.L., who writes, “I was able to cut my malpractice insurance way down. The first year savings were more than twice your fee.” In addition, the brochure suggests, patients who win lawsuits against their doctors can’t collect if the doctors’ assets can’t be found.

Offshore Finance USA, a bimonthly glossy published in Montreal, is largely a how-to guide to hiding money abroad. The magazine, which bristles with ads from the Bahamas and other nations that serve as tax havens, gives subscribers the option of receiving their issues in plain envelopes. For an additional fee of $3 per issue, the magazine offers to “remove your name from the general mailing and … handle the mailing of your subscription manually from our offices.”

Other strategies that allow people to hide their wealth offshore include “walking trusts,” which shift location to a new tax haven at the first sign of interest from law enforcement or tax authorities. Engel, the Denver attorney, co-authored “walking trust” legislation passed in 1989 by the Cook Islands, a former territory of New Zealand that offers investors a host of protective devices. In the unlikely event that hostile parties discover a Cook Island trust, for example, they are required to bring suit within one year of the trust’s establishment in a local court, since judgments from the rest of the world are not recognized. They are also required to demonstrate fraudulent intent beyond a reasonable doubt—a standard of proof, Engel has pointed out, “that could not be met in the O.J. Simpson criminal case.”

Secret accounts have traditionally been the province of private banks in Switzerland, Austria, and Luxembourg. But those nations have lost favor among depositors in recent years as they have eased bank secrecy laws in response to international pressure. Small states in the Caribbean and the South Pacific, eager to offset declining tourism and lower prices for farm exports, have rushed to fill the void, turning to offshore banking as an easy and effective means of attracting big money from abroad (see “Tropic of Tax Cheats,” this page).

But it’s not just microstates that are profiting from the offshore boom. The world’s largest financial institutions are also growing richer by offering private banking services to their top clients. Big-time American players include Merrill Lynch, Chase Manhattan, J.P. Morgan, Morgan Stanley, and Goldman Sachs. The leading US private banker is Citibank, which administers trusts and shell corporations for some 40,000 clients through its operations in New York, London, the Bahamas, the Cayman Islands, the Isle of Jersey, and Switzerland.

To open an account, private banking clients must generally deposit at least $1 million. According to a report by the Senate Permanent Subcommittee on Investigations, private bankers then assign the client a “relationship manager” who creates offshore trusts, handles all financial transactions—and helps ensure secrecy. “Private banks routinely create shell companies and trusts to shield the identity of the beneficial owner of a bank account,” the report states. “Private banks also open accounts under code names and will, when asked, refer to clients by code names or encode account transactions.”

One former private banker who had more than 30 clients, each with as many as 15 shell companies, told the subcommittee that his own bank prohibited him from keeping any records linking front operations to their owners. In another case, Federal Reserve examiners asked Bankers Trust to create a database identifying the owners of shell companies. The bank complied—by setting up the database on the Isle of Jersey in the English Channel, which requires US investigators to request names on a case-by-case basis from Jersey courts. The effort to create and shelter multiple accounts “complicates regulatory oversight and law enforcement,” the Senate subcommittee concluded, “making it nearly impossible for an outside reviewer to be sure that all private bank accounts belonging to an individual have been identified.”

The secrecy makes it easy for clients of private banks to hide their wealth, whatever its source. Citibank’s clients have included the family of Sani Abacha, the former Nigerian general who plundered billions of dollars from his nation’s treasury, and dictator Omar Bongo of Gabon, for whom Citibank established a Bahamian shell corporation to stash his looted treasure. Citibank also helped Raul Salinas, brother of former Mexican president Carlos Salinas, by transferring tens of millions of dollars out of Mexico and depositing the money in European banks under the names of untraceable companies registered in the Cayman Islands. Citibank never used Salinas’ name in bank communications, referring to him instead as “Confidential Client Number 2,” or “CC-2.”

“CC-1” was the code used to refer to Carlos Hank Rhon, who is currently facing civil charges by the Federal Reserve that he used secret offshore accounts to illegally hide his controlling interest in Laredo National Bank, the third-largest independent bank in Texas. A Mother Jones review of Fed documents reveals that Citibank handled more than $100 million for Hank Rhon, funneling his money through accounts in New York, Mexico, London, Zurich, the Bahamas, and the British Virgin Islands. According to one filing in the case, Citibank not only decided what offshore entities to establish, but designated its own employees as officers, directors, and trustees.

Setting up and managing offshore accounts has become big business for major banks. Federal Reserve officials call private banking a “profit driver” for many financial institutions, providing returns twice as high as other services. In overseeing the Hank Rhon accounts, documents show, Citibank earned $3.2 million in fees in one year alone.

“This is a huge piece of business for them,” says Jack Blum, a Washington, DC attorney and an expert on offshore banking. “There are significant departments at most major banks that cater to this trade. The business of hiding money offshore is one that most banks engage in.”

Nowhere is the dazzling array of offshore banking services more evident than along the sunny streets of Nassau. Financial services are now the second-largest industry in the Bahamas after tourism, accounting for 15 percent of the gross domestic product. More than 400 banks from 36 countries are licensed to conduct business here—compared with only 154 banks chartered to do business in the state of New York, the world’s financial center—and they hold a combined $220 billion in assets, ranking the Bahamas 13th among the world’s top banking nations.

Thanks to the boom in offshore banking, Nassau’s downtown financial district looks positively First World with its gaudy mix of Cartier and McDonald’s, Gucci and Planet Hollywood. Little of the wealth has trickled down to the majority of residents, however, in a country where the richest fifth of the population earns nearly half of all household income. A few miles beyond the center of town, modern shops and offices give way to wooden shacks and ugly concrete-block apartment buildings.

The government heavily promotes the Bahamas as an attractive offshore haven. The country’s official Web site boasts that there’s “no better [place] for your financial investments” and urges interested parties to contact the Bahamian Investment Authority, which operates out of the prime minister’s office and is designed to “cut red tape and lay out the red carpet” for investors.

As a tax haven, the Bahamas is made to order. English is the mother tongue—a former British colony, the Bahamas gained independence in 1973—and six international airports serve the islands. Nassau lies just 180 miles east of Miami, and the US dollar exchanges at par with the Bahamian dollar and is accepted everywhere as legal tender. The Bahamas has refused to sign any international tax treaty that would require it to share information with other countries, and its strict bank secrecy laws extend to attorneys, consultants, and other professionals in the financial sector.

For money launderers and tax cheats, the International Business Companies—first created in 1989—are the Bahamas’ most alluring feature. A tourist guidebook I pick up at my hotel boasts that 80,000 IBCs have been created here, but that figure is already long out-of-date. When I drop by the Registrar General’s office, an official tells me that IBCs now number more than 110,000. I watch as 10 employees tend to a long line of customers—mostly young men and women working for local attorneys and banks—who are requesting information and filing IBC paperwork. Incorporation papers filed in baby blue folders are scattered about in boxes and piled atop desks.

To test the confidentiality of IBCs, I pick the name of a company at random from a logbook kept at the front counter and pay $10 to review its file. All I find for Meridian Holdings International are its memorandum and articles of association, boilerplate documents stating, among other things, that the company’s purpose is “to engage in any act or activity that is not prohibited under any law for the time being in force in The Commonwealth of The Bahamas.” Meridian’s registered agent is a local attorney named Arnold A. Forbes, whose firm has been paid to set up the IBC for its anonymous owner. Forbes’ business address also serves as Meridian’s registered office and two of his employees, Sean Ferguson and Acquilla Rolle, have signed the IBC’s articles of association. No other names associated with Meridian are found in the few dozen pages available for public review. Any law enforcement agency that hopes to discover who owns Meridian Holdings will very quickly run into a brick wall. Before leaving the Registrar General’s office, I pick up a government handbook explaining the ABCs of IBCs and a handy list of local attorneys and agents who can help me set up an offshore account. There are dozens of firms to pick from, ranging from well-known giants like Citibank and Chase Manhattan to small firms run by local entrepreneurs. The former prove to be relatively discreet. The secretary at Chase Manhattan’s local branch tells me to contact its New York or Miami offices to discuss private banking services. At Citibank, an official provides a fact sheet on opening an account with its local office in the name of an IBC. The requirements are not terribly stringent, but I need to submit a letter stating my reason for opening the account and provide information about the source of my income. Citibank will not open an account via the mail or Internet, and a bank officer must personally interview all applicants. Since even a cursory investigation of my finances would quickly reveal that the NASDAQ riches I am so anxious to hide from the IRS are entirely nonexistent, I am nervous about consulting local firms. Will they run a background check before agreeing to meet? Will they ask to see a bank statement or other evidence of my finances?

My fears prove baseless. When I apologize for dropping in unannounced at Alliance Investment Management, one of about a score of offshore firms at Beaumont House on Bay Street, company president Andre White reassures me. “It happens all the time,” he says, escorting me into his comfortable private office. I ask how simple it would be to create an IBC. “It’s the easiest thing in the world,” he replies, promising that everything can be taken care of within 48 hours. And what about creditors back home? I ask, hinting at a darker motive for moving my funds offshore. Might they get their hands on my Bahamian funds? “They can forget about it,” White says confidently.

I also drop by the offices of Offshore Managers Limited, another firm located at Beaumont House. Offshore’s mission, states its corporate brochure, “is to provide the highest standard of professional services to persons wishing to avail themselves of a ‘tax-free’ paradise.” And if the Bahamas doesn’t suit a client’s fancy, the company can also incorporate shell corporations in the Cayman Islands, Liberia, Panama, and other havens. Elizabeth Smith, president of Offshore, is as eager to answer my questions as White. Using a check drawn on a US bank to open my offshore account would defeat the purpose of confidentiality, I tell her. Could I bring cash in? “That’s the best way,” she says enthusiastically, adding that the Bahamas places no limit on the amount of foreign currency visitors can bring into the country. Smith gives me a service agreement to review and urges me to return it promptly so that Offshore can incorporate my IBC.

ITI Management Limited, located in a storefront across the street from a Dunkin’ Donuts, offers the broadest range of services to those eager to hide their money. I stop by at 10 a.m., shortly after the office opens, and find two police constables in smart red-and-black uniforms lounging on a sofa in the reception area. After a brief wait, the secretary, accompanied by a yapping terrier, escorts me to a woman named Renee Lockhart.

For a fee of as little as $3,500 annually, Lockhart tells me, ITI offers a “fully managed” offshore account, which includes creating a local IBC and staffing it with nominee directors. For an added layer of protection, she urges me to create a second IBC in nearby St. Vincent, another tiny tax haven, which would be made the legal owner of my Bahamian IBC. The fully managed account also comes with a bank account in the name of the IBC. ITI had recently chartered its very own bank in St. Vincent for that purpose, but it was not yet fully up and running. In the meantime, Lockhart suggests I set up my account at Suisse Security Bank & Trust, a name that conjures up images of solid Swiss bankers but is in fact a firm chartered in the Bahamas.

Suisse’s glossy catalog promises to “shelter…personal finances from the prying eyes of intrusive governments and bureaucrats.” The brochure states forthrightly that failure to declare ownership of an offshore account on tax returns amounts to tax evasion, but says that Bahamian bank secrecy laws make it “feasible to simply ignore the question and not declare an interest.” The Bahamian courts could conceivably waive secrecy if a foreign government made a direct appeal, but that’s a remote prospect. “Many people are prepared to accept this risk,” says the catalog. “Others are less comfortable with the idea.”

Yet another feature provided to top-of-the-line ITI clients is a gold MasterCard that “provides cardholders with safe and discreet, swipe and ATM connections to a proven offshore fund from anywhere in the world.” The “infiniti Platinum Global Axxess MasterCard,” which comes with a $25,000 credit line, would enable me to deposit additional funds directly into my account. That way I could withdraw my stashed funds from anywhere in the world and leave, as Lockhart puts it, “no paper trail.”

Lockhart offers plenty of other tips about hiding the paper trail, including a means of transferring my money offshore. Her advice: first funnel my money to my attorney or a trusted colleague. That person would in turn send it to a bank account controlled by ITI, from where it would be transferred to my anonymously owned IBC or to my Suisse Security account. “All you have to do is call me and say, ‘Renee, I have a transfer coming in,'” Lockhart tells me. “I’ll take care of everything from there.”

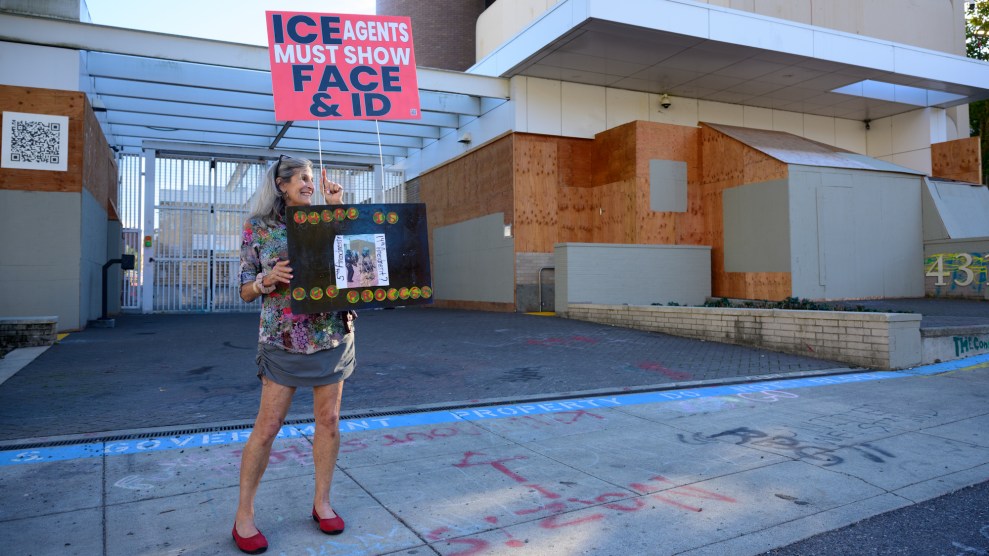

During my brief stay in the Bahamas, the local newspapers carried daily stories about First World nations exerting increasing pressure on the country to ease its bank secrecy laws and crack down on IBCs.

In June, a money laundering task force put together by the G-7 consortium of seven industrialized democracies placed the Bahamas and 14 other countries on a blacklist of nations that are complicit in money laundering and warned that they would be hit with sanctions if they didn’t change their laws. In July, the US Treasury Department issued a warning to American financial institutions to carefully monitor transactions with countries on the list.

Last summer, a bill that would bar foreign financial institutions engaged in money laundering from doing business with US banks passed the House Banking and Financial Services Committee. The measure would also require US banks to disclose the identities of account holders to federal investigators. But even those pushing for reform acknowledge how difficult it will be to stop the flight of money abroad. “No sooner does one jurisdiction commit itself to meaningful countermeasures against money laundering than another pops up in some other corner of the globe to service the business flushed out of the first locale,” said Rep. James Leach (R-Iowa), chairman of the committee and sponsor of the bill.

But while federal officials are quick to denounce money laundering, the IRS has done almost nothing to ferret out offshore tax cheats. “The IRS has known about this problem forever,” says one insider familiar with the agency. “At the rate they’re going, the whole tax base will be gone before they do anything about it.” Tax specialists say the government is reluctant to go after wealthy Americans with offshore accounts because many of them enjoy significant economic and political clout. In addition, the IRS has been demonized by Republicans on Capitol Hill, hampering its enforcement efforts. Phil Gramm of Texas, chairman of the Senate Banking Committee, has blocked the bill requiring banks to fully disclose their offshore customers and has denounced other attempts at regulation. “Hardworking Americans do not deserve this invasion of their private lives,” Gramm wrote to Federal Reserve Chairman Alan Greenspan last year.

Such words provide comfort to those in the business of hiding money for wealthy clients. When I ask Honess at Jerome E. Pyfrom & Co. if he fears a crackdown by the Bahamian government, he remains sanguine. At worst, he predicts, the parliament will make token concessions, such as requiring disclosure of IBC shareholders. Like other offshore firms, Pyfrom & Co is prepared for such an eventuality. It has created a company called Altus Limited to serve as the “shareholder” for its clients’ IBCs. Altus is fully controlled by Pyfrom & Co., but its service contract states explicitly that it will make no claim to my IBC’s assets and will faithfully follow instructions from the corporation’s true owner—me. “This way, if anyone finds out who the shareholders are, it won’t do them any good,” Honess says with a laugh.

For now, he adds, business couldn’t be better. Demand for new IBCs is so great that Honess has taken to reserving corporate names at the Registrar General so that new clients don’t suffer needless delay in setting up their accounts. The only problem, Honess reveals, is that all the obvious names are taken. Before arriving in the Bahamas, I had requested via the Internet that Pyfrom & Co. reserve the name of March Ltd. for my IBC. When Honess submitted the necessary paperwork, the Registrar General informed him that the name was already being used by another local company, as were March Investments Ltd. and March Holdings Ltd. Gone, too, are the other months of the year, as well as names of well-known Bahamian flowers and birds.

Honess is now resorting to selecting IBC names at random. As I sit in his office, he walks over to a small bookshelf, picks out an encyclopedia, and flips through the pages. “Here’s one that worked,” he says, pointing to the word Danegeld — the name of an ancient tax levied by the British crown to finance protection from Danish invasion. “I sent that one this morning and was told that it’s available. Perhaps it will work for you.”