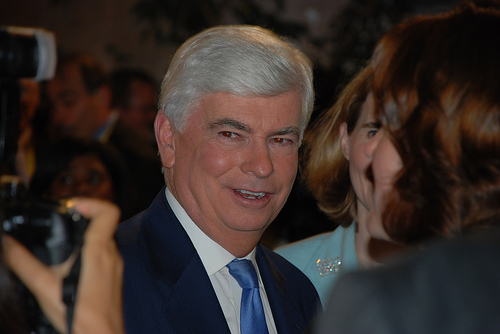

Flickr/<a href="http://www.flickr.com/photos/americanprogressaction/3821293202/">Center for American Progress Action Fund</a>

Despite the glacial pace of financial-reform negotiations in the Senate—the banking committee, led by Sen. Chris Dodd (D-Conn.), was expected to release its bill this week to no avail—the Senate Majority Leader Harry Reid (D-Nev.) remains confident Dodd and his GOP counterparts will still pass comprehensive financial reform. In response to a question on whether Reid feared the window of opportunity was closing to pass financial regulation, a Reid spokeswoman told Mother Jones Reid “is not” worried the chance to reform Wall Street is passing. “Years of reckless actions by Wall Street put our economy on the brink of collapse, and the American people are paying the price,” the Reid spokeswoman added. “It is essential that we bring reform to our financial system to ensure that this does not happen again. We look forward to the Banking Committee completing its work to move this legislation forward.”

While the Majority Leader has largely been trying to round up enough Senate support to pass comprehensive health-care reform, he has voiced support for Dodd’s effort to overhaul Wall Street. Last month, Reid told reporters that he was “comfortable we are going to be able to do a really good financial regulation bill.” Reid’s support comes as outsiders fear the chance to rein in Wall Street and its risky behaviors is slipping away, that the memory of 2008 and 2009’s financial crisis is already fading in public’s memory and the urgency that accompanies every crisis is dwindling with it. “Meaningful regulatory change is urgent now because this is the window of opportunity,” says Simon Johnson, former chief economist at the International Monetary Fund economist. “If that window closes, we’re asking for trouble.”