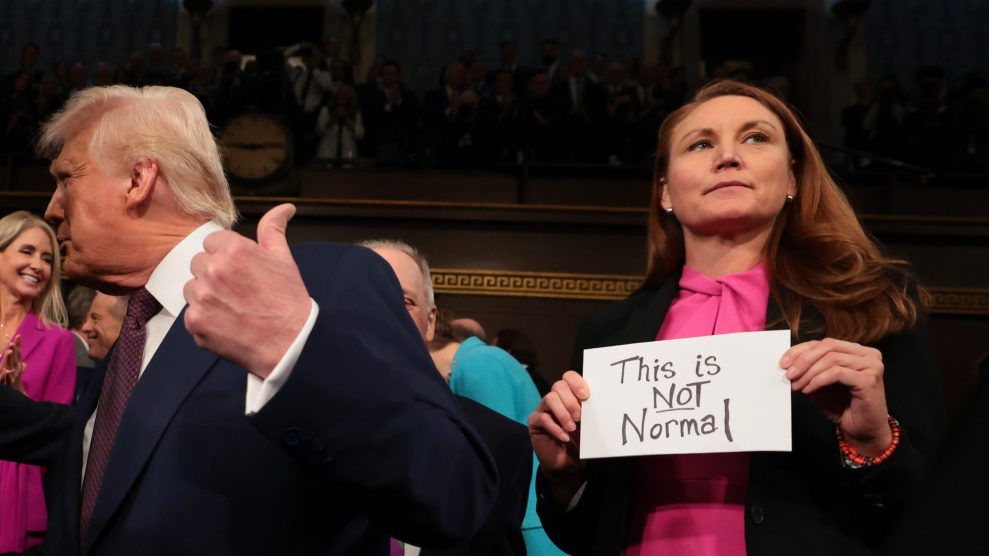

Jamie Dimon, CEO of JP Morgan Chase, testifies before the US Senate Banking, Housing and Urban Affairs Committee.Zhang Jun /Xinhua/Zuma

This story first appeared on the ProPublica website.

This morning, Jamie Dimon, the CEO of JPMorgan Chase, faced a Senate hearing over more than $2 billion in bank losses caused by risky hedges that blew up. Dimon said that the hedges—investments meant to protect the bank—had grown into “complex and hard-to manage risks.” The losses “let a lot of people down, and we are sorry for it.”

Many lawmakers are holding up the losses as evidence of the need for stronger financial regulation. The chairman of the Senate banking committee, Tim Johnson, (D-S.D.) in his opening remarks, asked for “a full accounting” of JPMorgan’s losses.

But through campaign contributions and well-connected staff, JPMorgan appears to have already taken its own accounting of the Banking committee. Here’s a picture of connections between the company and the committee:

Revolving Door

One current staffer on the Senate banking committee, Dwight Fettig, is a former lobbyist for JPMorgan. In 2009, the bank hired him to work on “financial services regulatory reform.” Meanwhile, JPMorgan is stacked thick with former committee staff.

- Naomi Camper: Currently a lobbyist for JPMorgan. Prior to that, from 2001-04, she was an aide to Sen. Johnson.

- Kate Childress: JPMorgan lobbyist since 2008, she is also a former aide to Chuck Schumer (D-N.Y.), who sits on both the Senate banking and finance committees.

- Steven Patterson: A JPMorgan lobbyist and formerly a staff director for economic policy for the banking committee.

- Nate Gatten: A JPMorgan lobbyist based in London who was reportedly called back to Washington recently to help with the company’s damage control. He is a former lobbyist for Fannie Mae, and, in the 1990s, was a banking aide to former Sen. Robert Bennett (R-Utah), who also sat on the committee.

- P. Michael Nielsen: A lobbyist with a firm run by former Sen. Bennett, he has been retained by JPMorgan for help with federal probes, according to Bloomberg. He was also a senior policy adviser to the committee from 2007 to 2010.

American Banker also reported that three other outside lobbyists currently working for JPMorgan were once affiliated with the committee:

- Jason Rosenberg: A lobbyist at the Glover Park Group and formerly an aide to Jon Tester (D-Mont.) who sits on the committee.

- Jenn Fogel-Bublick: A lobbyist at McBee Strategic Consulting and formerly a Democratic counsel on the committee.

- Mike Chappell: A lobbyist for Fierce, Isakowitz & Blalock and a former press assistant to Sen. Roger Wicker (R-Miss.), another committee member.

A former senator on the committee, Mel Martinez (R-Fla.), is also now the JPMorgan exec in charge of Florida, Central America, and the Caribbean. Martinez was elected to the Senate in 2004 and went to the bank in 2010. Bloomberg reported that he was called to Washington after the losses were reported.

Lobbyists for JPMorgan appear to be keeping busy. The bank spent $7.6 million on lobbying last year, according to the Center for Responsive Politics.

Campaign Contributions:

JPMorgan has also been a generous donor to banking committee members, both Republican and Democratic.

- JPMorgan is the second-largest campaign contributor to Johnson, the committee chair, and to the top Republican on the committee, Richard Shelby of Alabama, over the past 20 years, according to a tally from American Banker.

- JPMorgan employees have donated more than $80,000 to Johnson since 1998 and more than $136,000 to Shelby since 1990.

- So far in 2012, Dimon has personally donated to committee members Bob Corker (R-Tenn.) and Mark Warner (D-Va.). In 2008, he gave $2,000 each to Johnson and Shelby.

- Six of the 22 members of the banking committee have not received any money from JPMorgan PACs or employees in recent election cycles. Two of those members are retiring and aren’t collecting campaign funds.

It’s not clear what the committee will do beyond the hearings. Numerous federal agencies are investigating JPMorgan’s losses, including the Commodity Futures Trading Commission, the Office of the Comptroller of the Currency, the Department of Justice, and the Securities and Exchange Commission. Next Tuesday, Dimon will testify in front of the House Committee on Financial Services.