The US economy is rebounding for the nation’s top income earners but not for everyone else, according to a new study from the Economic Policy Institute. The study, published Sunday, finds that chief executives at the country’s 350 biggest firms earned an average of $16.3 million in 2014, marking a 54.3 percent increase since 2009. Meanwhile, compensation for typical workers in the same industries as those CEOs fell 1.7 percent over the same time period.

“Those at the top of the income distribution, including many CEOs, are seeing a strong recovery, while the typical worker is still experiencing the detrimental effects of a stagnant labor market,” the study’s authors, Lawrence Mishel and Alyssa Davis, found.

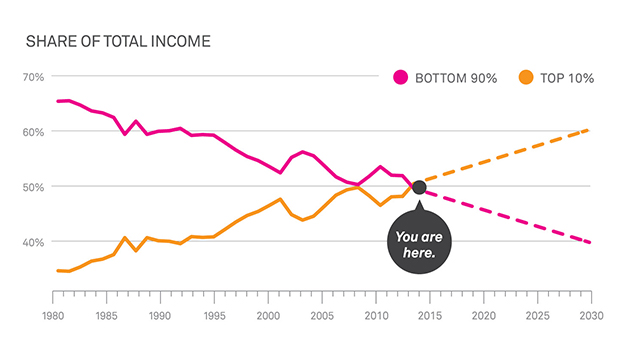

The pay gap between CEOs and the typical worker has widened since 2009, with CEOs now making more than 303 times the earnings of workers in their industries. CEOs have made at least 120 times the earnings of typical workers since 1995. In 2014, Mishel and Davis note, CEOs also made 5.84 times more than others in the top 0.1 percent of wage earners. “As CEO pay has escalated,” the authors found, “it’s directly contributed to growing income inequality by [fueling] the growth of the top 1 percent and 0.1 percent.”

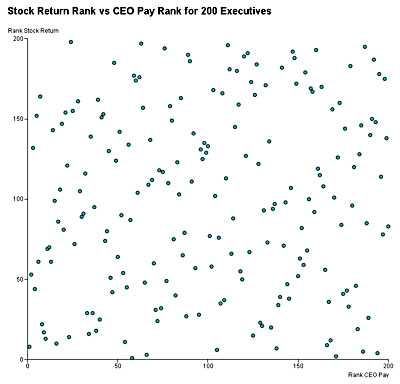

CEO pay soared by 997 percent between 1978 and 2014, after adjusting for inflation. That meteoric rise is double the growth rate of the stock market and makes the increase in the typical worker’s annual compensation seem trivial: The earnings of typical workers grew at a “painfully slow” 10.9 percent over the same period, according to the EPI researchers.

The trends in CEO pay over time, which tracked closely with the ups and downs of the stock market, “casts doubt on any explanation of high and rising CEO pay that relies on the rising individual productivity of executives, either because they head larger firms, have adopted new technology, or other reasons,” Mishel and Davis conclude. “CEO compensation often grows strongly simply when the overall stock market rises and individual firms’ stock values rise along with it.”

Read the full report by the EPI here.